A decade of ultra-low interest rates and inflation, supercharged market returns and anaemic yields have warped what investors have come to expect as normal.

Now it feels as though we are “returning to normal”, according to Charles Montanaro, chairman of Montanaro Asset Management, who explained why in his latest annual letter to investors.

He highlighted cash deposits and bonds offering around 5%; inflation at 2%-3%; GDP growth of 1%-3% (depending on the country); large-cap stocks delivering real returns of 6% and small-caps around 9% as signs the world is returning to long-run averages.

“This is how it has been ‘normally’ on average throughout my career. Sentiment will turn positive when no one expects (as in March 2003 when all the Irish banks were predicted to go bust and didn’t; and in March 2009, when another Lehman Brothers bankruptcy was expected and never materialised),” the veteran investor said.

“The days of free money and negative interest rates are over. [Quantitative easing] QE had to be reversed. The ‘magic money tree’ we all loved has been chopped down. Fairy tales do not last forever. It is time to go back to the real world.”

Below he looks at what normal looks like in a number of areas including inflation, recessions, cash rates and the long run returns from UK equities.

Inflation

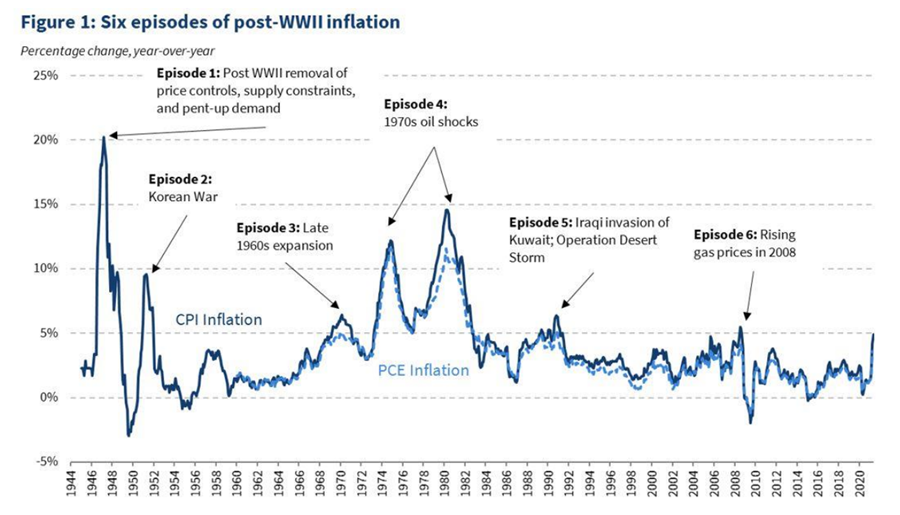

There have been six periods after the Second World War when CPI in the US was 5% or higher, according to a White House paper from July 2021 called Historical Parallels to Today’s inflationary Episode.

Source: Montanaro Asset Management

Oil shocks (like the one experienced in recent years following Russia’s invasion of Ukraine and the sanctions imposed on the exports of Russian oil and gas) caused the three most recent periods of inflation, including in July 2008, when the price of crude doubled to $140.

But this is not the only cause of inflation. Indeed, Montanaro pointed out that the first (1946-48) was caused by the elimination of price controls after rationing.

“During the second world war, the government rationed consumer goods such as sugar, coffee, meat and cheese as well as durable goods like cars, tyres and shoes. All recovered strongly,” he said.

“Wind the clock forward, Covid caused businesses to shut down and forced people to stay at home. Spending on restaurants, travel and entertainment collapsed. Unsurprisingly, pent-up demand led to a boom in retail sales as the economy opened up once again.”

However, five years after the second world war, inflation had normalised. It has been an even more rapid return this time around. Since US consumer prices index (CPI) hit a 40-year high in 2021, it has fallen back down to 3.3%, a “more normal level”. Indeed, since 1980, US CPI has averaged around 4%.

Cash returns

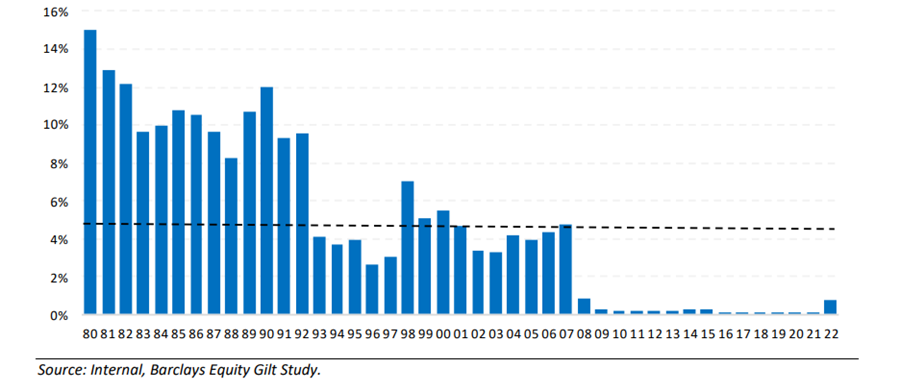

One benefit to the rapid rise in interest rates to combat rampant inflation has been the rise in the amount paid out by savings accounts. Data from Barclays shows since 1980 the average return on cash has been 4.8%, as the below chart shows.

Average interest on a cash account with a UK building society

Source: Montanaro Asset Management

“Today, the average UK bank offers a return of around 4% on cash deposits. We are pretty much back to ‘normal’,” Montanaro said.

The economic cycle and recessions

Montanaro said his “impression” was that the UK would fall into recession every six to seven years, arguing that they used to be viewed as a good thing and a “necessary way of cleansing the system to eliminate excess”.

“People get worried about recessions due to the negative impact on company earnings and share prices. In reality, the average ‘normal’ US recession has lasted just 17 months leading to an average real fall in earnings of 28%,” he said.

“Not much fun, but for long-term investors, no reason to jump out of a window. And since the second world war, recessions have lasted only 10 months and have become less frequent.”

Stock market returns

Investors enjoyed a boom post the financial crisis, albeit a slow one. From the end of 2009 to the start of 2020 the MSCI World index rose 201.2%. The FTSE All Share meanwhile made 118.3%.

Total return of indices from 2009-2020

Source: FE Analytics

Since 1899, the annual real return of UK equities stripping out inflation has been 4.8% per year, with only two decades out of the 11 registering a loss in real terms (1912-1922 and 1972-1982).

“UK-quoted smaller companies have delivered higher returns over the long term, reflecting better earnings growth. The so called ‘small-cap effect’, which has averaged around 3% per annum over the past 68 years, is the reason that we established Montanaro way back in 1991,” he added.

Investor allocations to the UK

Over the years the amount investors have allocated to their home market has changed dramatically in favour of more global equities. Fixed income, real estate and alternatives have also eaten into this though, he noted.

“Exposure to UK equities is now at the lowest weighting that I can recall,” said Montanaro. The average UK investor has almost halved their allocation to UK stocks over the past decade or so, down from 56% in 2009 to 30% today.

“Just when the UK may be at the most attractive level in decades relative to other equity markets, investors have the lowest weighting. You couldn’t make it up,” he said.