US tech mega-caps have been under the spotlight this year as they have dominated the market, thanks to the enthusiasm around artificial intelligence (AI). Some fund managers think we are at the start of a multi-year boom in AI while others feel valuations look toppy. Either way, next year is unlikely to be a repetition of 2023, as the market outlook remains complex.

Although inflation has been softening in recent times and the Federal Reserve hinted it might start cutting rates next year, a recession or a stagflation are not unrealistic scenarios.

Sheridan Admans, head of fund selection at TILLIT, said: “According to the Bank of England, it usually takes up to two years for the effect to be fully felt from rate increases. Interest rates are a blunt tool, and it can be difficult to know whether the actions taken by central banks are too much, too little or just right.

“Balancing slowing economies, persistent inflation, and the repercussions of unprecedented rate hikes creates a delicate situation for central banks to navigate financial stability and inflation concerns.”

Considering this uncertain outlook, Admans suggested that investors consider Ruffer Investment Company and Trojan Ethical, two defensive multi-asset portfolios.

The first one primarily focuses on capital preservation, but also aims to generate capital growth, while taking top-down views to deliver on those objectives. As a result, the trust invests in equities for the growth aspect of the portfolio as well as in bonds, currencies and commodities for the protection side.

Admans said: “The trust has a consistent approach managed by an experienced team specialising in capital preservation and total return style strategies.

“This is a defensive, all-weather fund with balance across asset classes and investment styles alike. If your primary goal is capital preservation with a growth kicker, this could be a good option.”

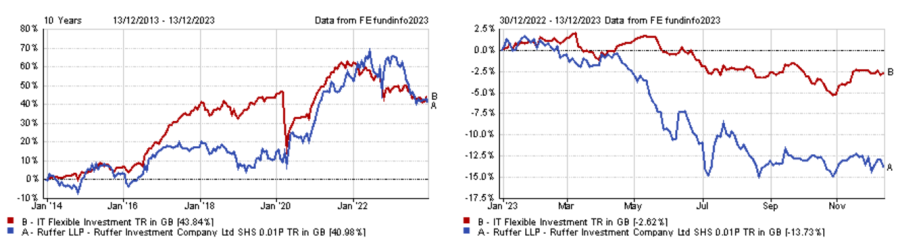

Performance of trust over 10yrs and YTD vs sector

Source: FE Analytics

Admans’ second pick also focuses on capital preservation but with an added ethical screen. Trojan Ethical invests across developed market equities with an emphasis on quality, developed market government bonds, gold (via physically backed exchange-traded commodities) and cash.

There is no fixed asset allocation; instead, the exposure to any single area is based on the manager’s top-down views.

Admans added: “Compared to other multi-asset funds, this one is particularly concentrated, yet it has proven resilient through periods of market turmoil.”

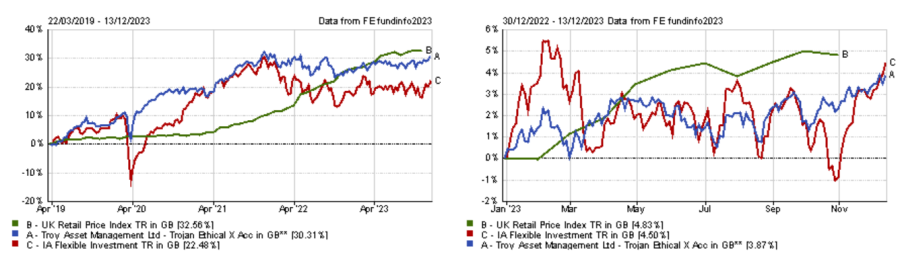

Performance of fund since launch and YTD vs sector and benchmark

Source: FE Analytics

For investors looking for something racier, experts believe they should give UK small-caps a chance.

Nick Wood, head of investment fund research at Quilter Cheviot, said: “Other than at extreme times, it is hard to remember UK small-caps being so out of favour, with concerns over the country entering a recession, the rising cost of living and investor focus shifting elsewhere.

“That said, the market is trading on a much lower price to earnings (P/E) multiple than the long-term average, implying a fair amount of bad news is already being priced in and that low valuations, combined with a tailwind of an improving outlook, will help rerate UK small-caps."

To play this theme, he suggested Henderson Smaller Companies due to its “excellent” long-term track record, combined with a growth and quality bias portfolio. As the trust is trading at a 10% discount to net asset value, Wood said that now could prove to be an attractive entry point.

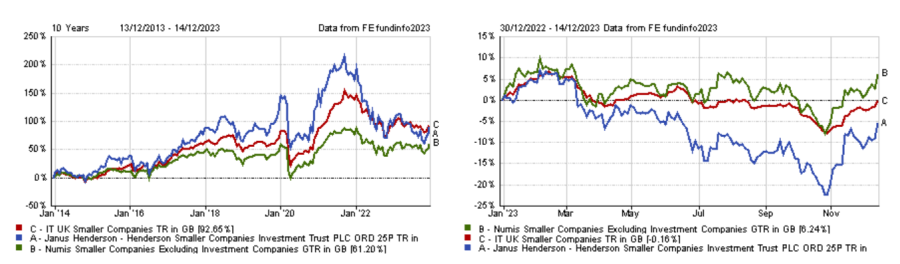

Performance of trust over 10yrs and YTD vs sector and benchmark

Source: FE Analytics

Ben Yearsley, director at Fairview Investing, also believes UK small-caps could prove a rewarding bet for investors, stressing that their cheapness can’t simply be ignored. Yet, he warned that there is no obvious catalyst that could lead them to rerate positively at the moment.

He selected Montanaro UK Smaller Companies IT, which has a focus on quality growth companies, although this investment style has been out of favour for the past 18 months.

Yearsley said: “These companies tend to prosper in slower growth tougher environments, which 2024 could very well be. If there is the odd rate cut and some takeover activity it could be a good year.”

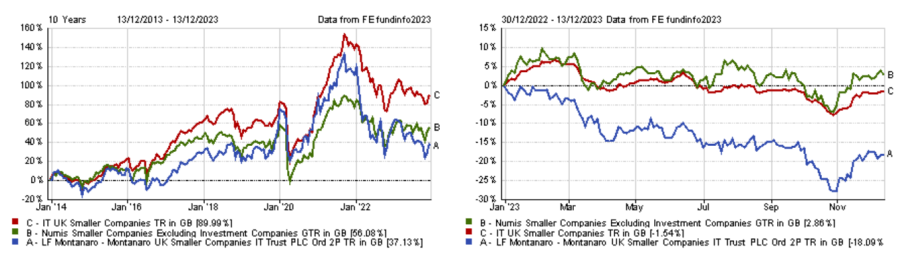

Performance of trust over 10yrs and YTD vs sector and benchmark

Source: FE Analytics

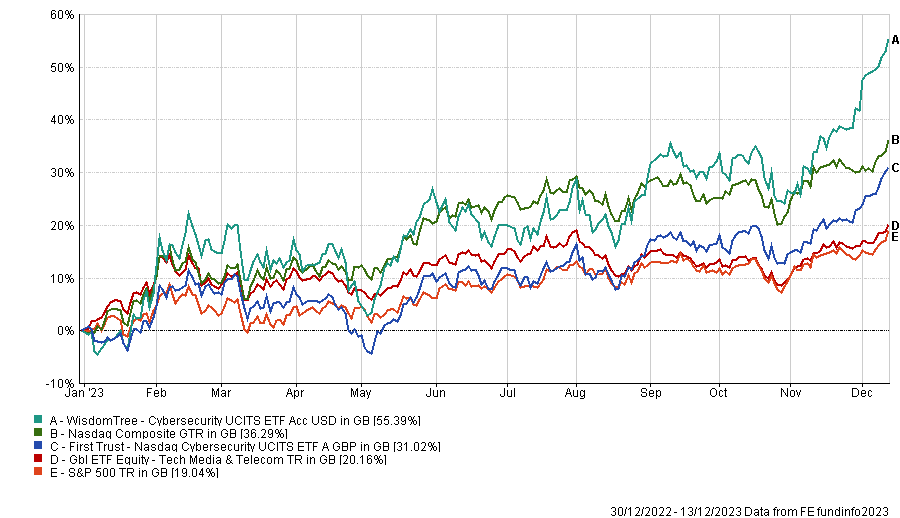

For thematic investors, Andy Merricks, co-manager of the IDAD Future Wealth fund, recommended looking into the cybersecurity sector.

His rationale is that cybersecurity is well positioned to capitalise from the ever-increasing need for protection across private and public exposure, amid global digital transformation and acute geopolitical tensions.

Merricks said: “2023 saw AI become an ‘overnight sensation’ after years of building up to its catalyst. I think cybersecurity could be another overnight sensation that’s been a couple of decades in the making with the growth of cloud computing and elections in 2024 ranging from Taiwan to Russia, the EU to the US (with possibly the UK sneaking in as well).

“I’ve invested in this sector for many years now, and the need for cybersecurity continues to grow. As an investment, having a ‘must have’ element to a fast growing technology sector appears to tick all the boxes for longer term returns.”

To play the cybersecurity theme, Merricks invests in First Trust Nasdaq Cybersecurity UCITS ETF but also mentioned Wisdom Tree Cybersecurity UCITS ETF as a strong alternative.

Performance of ETFs YTD vs sector and indices

Source: FE Analytics