European equities are cheap, rate cuts are imminent and Germany’s prospects are improving. For all these reasons, Fidelity Multi Asset Income manager Talib Sheikh and Legal & General Investment Management chief investment officer Sonja Laud both prefer European equities to the more expensive US stock market and are adjusting their portfolios accordingly.

In the past 18 months or so, global equity markets have been driven by multiple expansion with mega-cap technology giants leading the way, Sheikh said. But he added: “Multiple expansion is probably coming to an end and the next leg of the equity market move has to be driven by earnings. I think that will be positive for dividends – so equity-income-orientated blocks in our portfolio are quite high at the moment.”

Sheikh has been increasing exposure to core developed market equities where growth is expanding, with an emphasis on continental Europe and, to a lesser extent, the UK. “We’re trying to buy more value plays where there is a cushion, where we can see the earnings start to increase from here,” he explained.

He is implementing this tilt towards Europe by investing in Dan Roberts’ Fidelity Global Dividend fund, which is overweight Europe and the UK given American companies’ preference for share buybacks over dividends. Sheikh has also used Euro Stoxx equity futures to quickly and efficiently increase his exposure.

Germany has been Europe’s laggard given its exposure to elevated gas prices but they are coming down, he explained. Germany’s business cycle is more tied into China than other countries but both Germany and China are starting to recover.

Spanish and Italian economic data are looking strong, so if Germany can join the pack, then Europe “goes from having six horses driving the European recovery to having them all go in the right direction”, he said.

Europe is the only regional equity market where Legal & General Investment Management (LGIM) is currently overweight. Laud agreed with Sheik that European equity valuations are attractive and that it would be a tailwind if the European Central Bank cuts rates in June.

European industrials have suffered from increased energy input costs but any uptick in global manufacturing would be supportive.

Furthermore, if China has hit its nadir and starts to recover, that will help Germany, which is geared into the global economic cycle. “China alone can’t turn Germany around but it will at least give us a slice of hope that we are moving in the right direction,” she said.

Baylee Wakefield, a multi-asset fund manager at Aviva Investors, also has a positive view on European equities. "Europe is at a cyclical low point; earnings revisions are becoming more positive after being a beneficiary of low earnings expectations and valuations are attractive," she said.

"In addition, we're seeing buybacks increase in Europe so now buyback yields are essentially in line with the US. Finally, the ECB has provided a tailwind to the equities story by providing more certainty that it will be cutting in June."

The US equity market, by comparison, has been dominated by the ‘Magnificent Seven’ tech stocks, Laud observed. “As investors do you really want all your eggs in seven stocks?”

The Magnificent Seven are “incredibly high quality companies” with “no equivalents elsewhere in the world”, but expectations are elevated and disappointments – such as a decline in iPhone sales – will not be well received by markets, she argued.

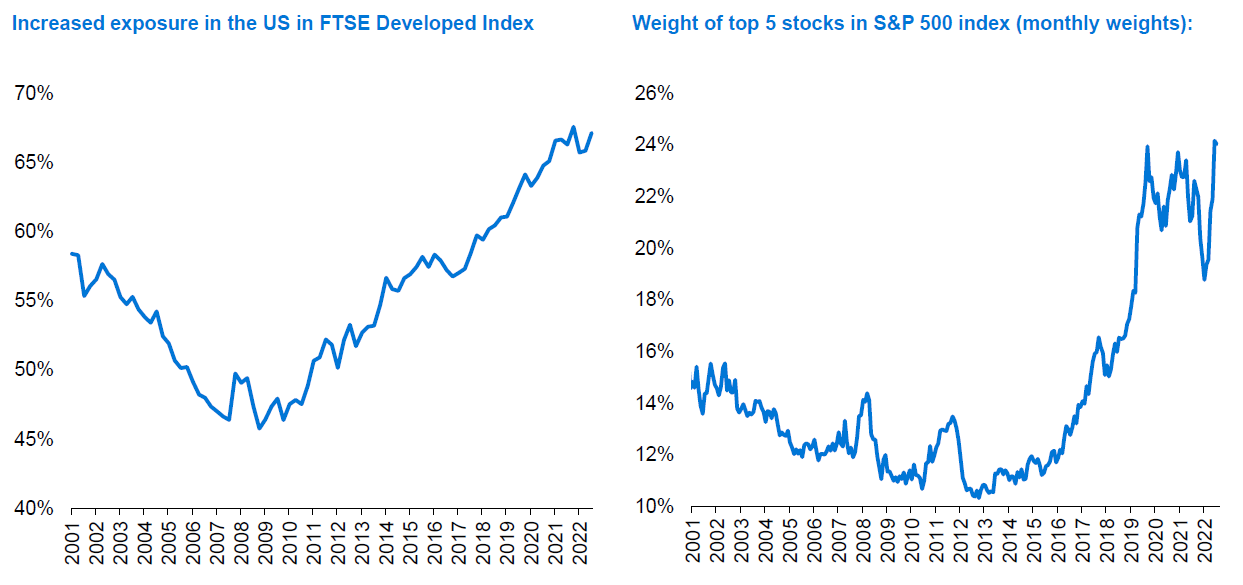

Her views have significant implications for investors in passive funds tracking global equity indices, given that the MSCI World has 71% in the US, the MSCI All Country World index has 63% in the US and the FTSE All World has 62% in the US. “Concentration risk is what clients are worried about”, Laud said, adding “rightly so”.

Sources: LGIM, Bloomberg, Thomson Reuters, FTSE

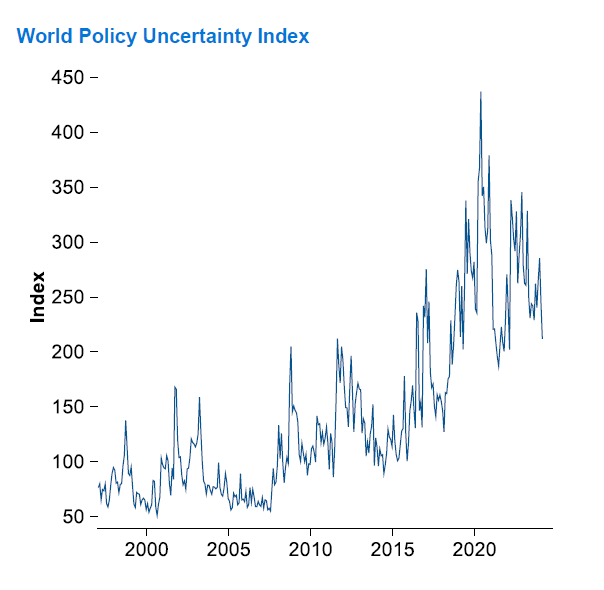

With geopolitical tensions on the rise, LGIM expects volatility to increase and has gone underweight risk assets including global equities.

Sources: LGIM, Macrobond

Passive investors in US and global equities have experienced “powerful” returns over the past decade, she acknowledged, but going forward she expects gains to be more muted, not least because inflation and rates are likely to remain reasonably elevated. “Your expectations might have to be quite a lot lower than they were before,” she warned.

Whether investors should stick with their passive equity allocations depends on their time horizons. With a 10-year view or longer, investors who have made strong gains are probably in a position to ride out short-term volatility in anticipation of future growth, she said. “Long-term, those [Magnificent Seven] companies will do well and you can happily ignore the volatility in between.”