Investors’ flirtation with money market funds has started to abate as looming interest rate cuts prompt a look towards riskier assets, analysis of Trustnet fund research trends suggests.

With millions of pageviews a year, the research trends of the Trustnet audience can offer useful insights into what both professional and retail investors are interested in as well as an indicator of shifts in sentiment.

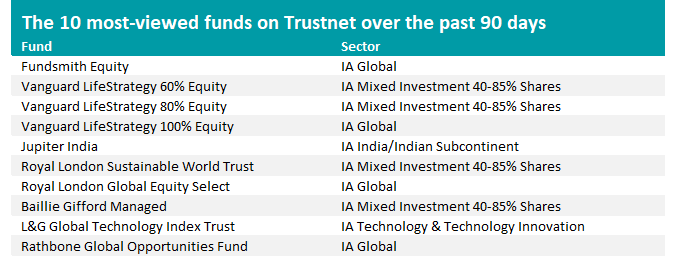

A look at the 10 most read fund factsheets on Trustnet over the past 90 days shows there continues to be plenty of interest in familiar names – Fundsmith Equity, Vanguard’s LifeStrategy range, Baillie Gifford Managed and Rathbone Global Opportunities consistently attract the most views.

Source: Trustnet

However, a more interesting exercise is to examine the changes in funds’ popularity over time. To do this, we have compared each fund’s share of pageviews over the past 90 days with a baseline of the preceding 12 months to determine which are garnering more or less interest among investors.

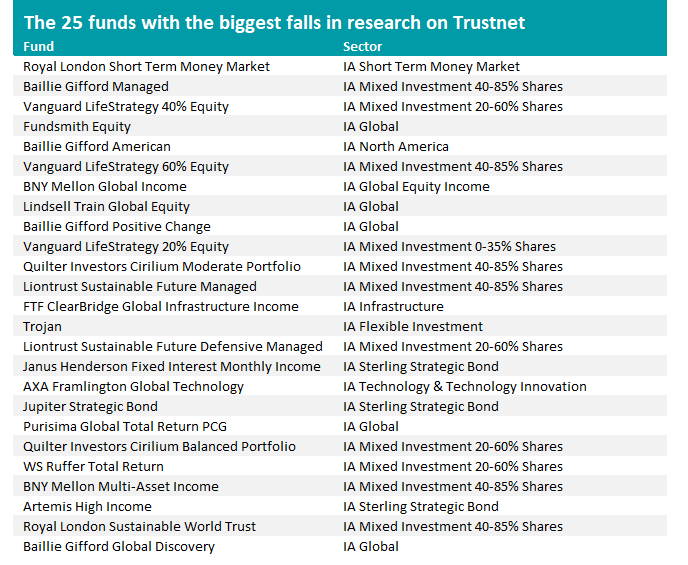

The fund with the biggest fall in research activity between the two periods is Royal London Short Term Money Market, which has the 25th most-viewed factsheet for the past 90 days – down from 16th place over the preceding 12 months.

This 16th place ranking was in itself a bit of anomaly as investors had largely ignored money market funds when interest rates were at record lows and only became interested in them when central banks started to hike rates.

More recently, investors have started to price in rate cuts from the world’s central banks – with the Bank of England among those expected to move first – which would reduce the appeal of cash while boosting the attractiveness of bonds and some parts of the stock market.

Source: Trustnet

Other signs that investors are looking further up the risk scale include a fall in research into more cautious strategies, such as Trojan, Vanguard LifeStrategy 20% Equity and Liontrust Sustainable Future Defensive Managed.

Meanwhile, investors seem to have been spending less time researching some of their favourite funds – such as Fundsmith Equity, Baillie Gifford Managed, Vanguard LifeStrategy 60% Equity and Baillie Gifford American – suggesting they are looking to other parts of the market.

This is backed up by examining the funds that have benefitted from the largest increase in Trustnet pageviews over the past 90 days.

At the top of the table is the £1.5bn Jupiter India fund, which has become the fifth most popular fund on Trustnet; over the previous 12 months, it held 15th place. This came as the Indian stock market surged to new highs, thanks to a business-friendly reforms and a robust economy.

The fund, which is managed by Avinash Vazirani, has been the IA India/Indian Subcontinent sector’s best performer over the past 12 months with a 58.8% total return (its average peer is up 29.7% while the MSCI India index gained 32.8%).

However, this is not the only Indian equity that has been getting researched more with Liontrust India, Ashoka WhiteOak India Opportunities, FSSA Indian Subcontinent All-Cap, Franklin FTSE India UCITS ETF, Nomura India Equity and Franklin India being among those attracting more interest (none to the extent of Jupiter India, however).

Source: Trustnet

A similar trend has been noticed over at interactive investor, with the platform reporting a 21-fold increase in trading volumes (by value) into India-centric funds, investment trusts and exchange traded funds over the past year.

Alex Watts, fund analyst at interactive investor, said: “India has cemented its status as one of the largest and fastest growing economies in the world, bolstered by a suite of business-friendly reforms enacted by president Narendra Modi from an investment standpoint.

“The re-election of president Modi, something the market believes is a forgone conclusion, could serve to strengthen the nation’s long-term investment story. His victory would mark one of the longest periods of political stability since the nation’s independence and his election pledges, including growing India’s GDP to $5trn (from $3.7trn) by 2027 and making further investment in infrastructure, bodes well from an investment standpoint.”

However, Watts noted that the strong recent returns of the Indian stock market mean some valuations are looking expensive. The 12-month price-earnings ratio for MSCI India are above the 10-year average and by far exceed valuations of other emerging market regions, he said.

A few other trends are apparent from the above table.

Global equities remain in favour. While investors might have been researching the likes of Fundsmith Equity and Lindsell Train Global Equity less, they have been looking more at the Trustnet factsheets of Fidelity Index World, GQG Partners Global Equity and Royal London Global Equity Diversified than they were.

The appearance of Artemis Income, Artemis Global Income, Royal London Global Equity Income, Aviva Investors Global Equity Income, Artemis Monthly Distribution, Man GLG Income and Fidelity Sustainable Global Equity Income shows investors continue to research income, as they seek ways to make their money work harder.

Meanwhile, value funds continue to attract more interest as evidenced by the rising pageviews of Man GLG Income, Ninety One UK Special Situations and Artemis UK Select.

Finally, BlackRock Gold & General and Jupiter Gold And Silver reflects high precious metal prices while Janus Henderson Global Technology Leaders and L&G Global Technology Index Trust show tech stocks remain attractive.