Four in 10 UK investors intend to tweak their portfolios following the UK general election, according to research from St. James’s Place (SJP).

Experience is an important factor in how investors plan to react to the elections. For instance, 62% of investors who began investing in the past year are likely to modify their portfolios, while only 19% of those who have been investing for more than a decade are looking to make changes.

Age also plays a role. Most young people (81% of 25 to 34-year-olds) plan to adjust their portfolios and only 12% intend to do nothing. In contrast, 74% of the 45-54 age group and 85% of investors over 55 won’t take any action at all.

Among investors planning to make changes, a quarter intend to increase their exposure to equities, while 22% will add more bonds. In terms of geographies, 24% of investors want to reduce their UK investments to diversify internationally, while 13% are considering topping up their allocation to the domestic equity market.

SJP’s research also shows that investors planning to make changes are twice as likely to add contributions rather than withdraw funds.

Joe Wiggins, investment research director at SJP, said: "It is encouraging to see that very few respondents were looking to react to current events by withdrawing their investments, but it is important to remember that timing the market also applies to adjusting our asset allocation. High profile events can often tempt us into injudicious trading decisions, and this is something we should look to guard against.

“Successful long-term investing is founded upon building a diversified portfolio spread across asset classes and geographies and tailored to meet our return and risk objectives. If we get this right, we should be well-positioned to meet our goals irrespective of short-term events.”

Meanwhile, 19% of UK investors reported waning confidence in the domestic equity market, while 13% said their confidence in their own investments had decreased due to the election.

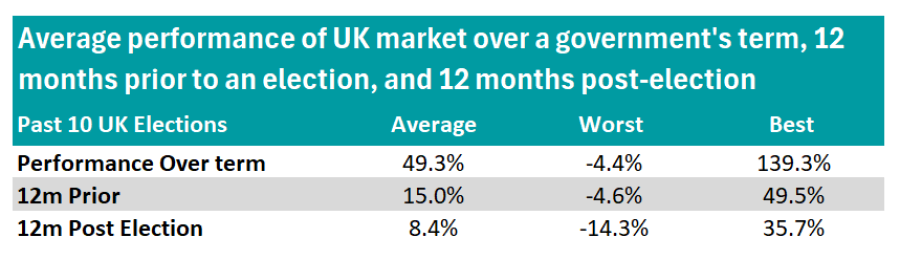

Yet, SJP’s analysis of UK market performance data spanning the past 10 UK elections, going back to 1987, shows there is no clear trend between election outcomes and market performance.

Source: SJP

On average, the performance prior to, immediately post, and over the duration of each government’s term was positive, though with a very wide range. Only one government had a negative absolute return over its term, which coincided with the dotcom crash.

In fact, SJP’s research suggests that major external shocks such as the 1987 stock market crash, the bursting of the dot-com bubble in 2000, and the financial crisis in 2007 have more of an impact in the short term than any political party.

“Our research into market behaviour shows that political events such as general elections have limited impact over the long-term. Therefore, while any period of political change can cause investors to worry, it is important not to become overly distracted by short-term noise,” Wiggins concluded.