UK investors added £1.4bn to global equity funds in June, according to data from Calastone, making it the most popular category last month.

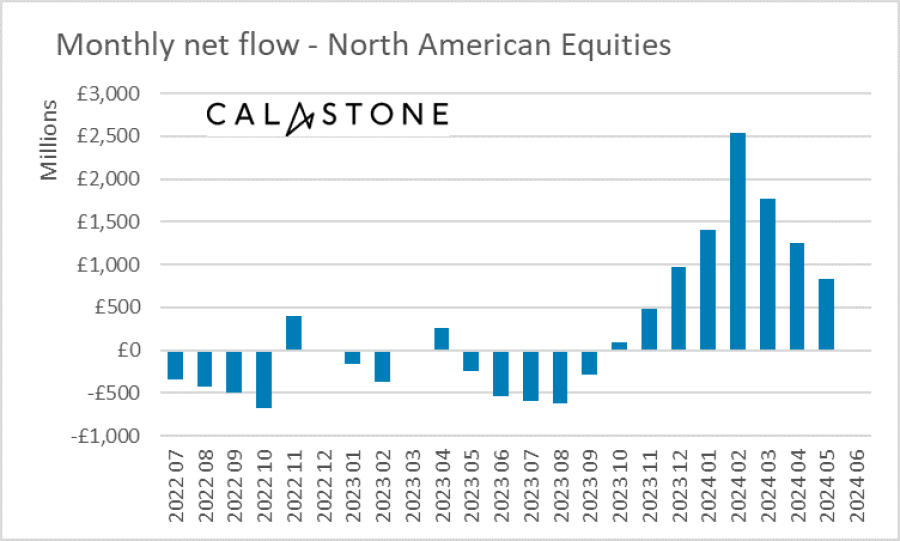

Since the beginning of the year, investors have added a total of £7.6bn into global funds, with only North American funds doing better, having attracted a total of £7.8bn since 1 January.

However, investors shunned North America in June, with very slight withdrawals of £0.6m from the sector despite the strong performance of the US equity market.

This lack of interest in US equities impacted funds with an environmental, social and governance (ESG) mandate, which are typically heavily weighted toward big technology names such as Microsoft and Nvidia.

As a result, ESG funds shed £179m, marking the first month of outflows for the category since December 2023. Indeed, UK investors added £5.1bn into ESG funds between January and May.

Edward Glyn, head of global markets at Calastone said: “The US market valuation is not cheap, and this means investors are hoping that earnings growth will deliver, as the prospect for multiples to expand further is surely limited at present.”

Source: Calastone

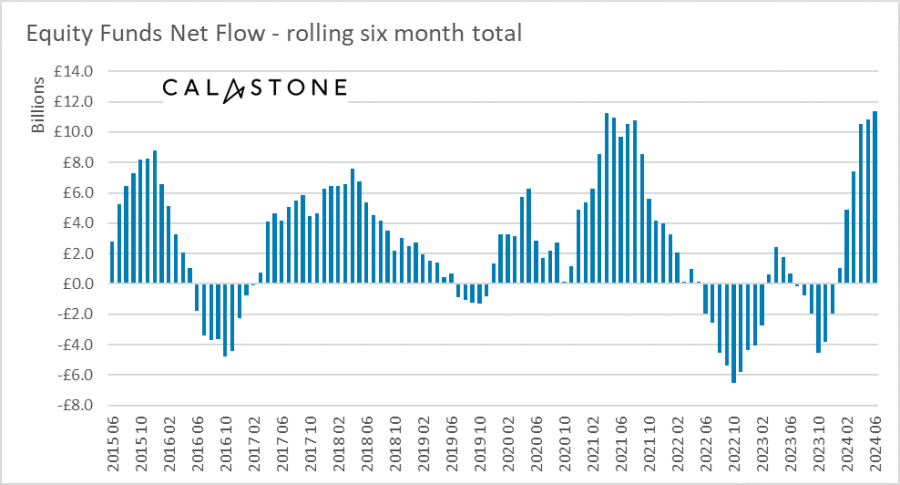

In total, UK investors poured £11.4bn into equity in the first half of the year, with £1.7bn added in June alone. This marks the best six months for equity funds on Calastone’s 10-year record.

Glyn added: “Hopes for cheaper money after the painful rate squeeze of the past two-and-a-half years are the clear driver of record flows into equity funds so far this year.”

European equities and emerging markets were also popular with investors, as inflows reached £714m and £269m, respectively in June. These inflows ended two months of net selling for emerging markets funds.

Outflows from UK equity funds slowed, with investors cashing in £522m over the month. As such, June was the least bad month so far in 2024 for funds focusing on the domestic equity market. Since the beginning of the year, investors have withdrawn £3.8bn from UK equity funds.

“Large markets such as the UK and Europe are trading on less challenging valuations, while many emerging markets are set to benefit from the weaker dollar and a nascent commodity boom,” Glyn said.

Source: Calastone

In spite of hopes for interest rate cuts, bond funds also experienced outflows amounting to £471m as investors favoured equities. Over the past two months, investors have withdrawn £1.1bn from bond funds.

Glyn said: “The outflows from fixed income funds in the past two months are harder to understand. If investors truly believe rates are coming down and will stay low, then there are capital gains to be made in the bond markets. Perhaps the allure of equities simply looks too strong at present.”

Since the beginning of 2022, inflows into bond funds have reached £8.3bn, which is more than twice that of equity funds, which only received £4bn over the same period.

“The current picture may simply reflect a rebalancing of investor appetite,” Glyn added.

Investors also fled property funds, with £48m leaving the sector in June. A beneficiary of those withdrawals has been money-market funds, which have attracted inflows each month since January, with April 2024 being the only exception. In June, investors added £247m to money-market funds.