Two-thirds of Premium Bond holders have never received a penny, a Freedom of Information request obtained by AJ Bell has revealed.

Different to typical investments that generate returns or pay dividends, Premium Bonds offer savers the chance to win monthly prizes valued between £25 and £1m tax-free.

Offered by the government-backed savings bank National Savings & Investments (NS&I), around 22.5 million people have bought into Premium Bonds, amounting to a whopping £126bn.

Their popularity skyrocketed last summer when NS&I smashed its £7.5bn fundraising target for 2023/24 in just six months and rowed back on its formerly generous rate.

At £9bn, the financing target is higher this financial year, as Myron Jobson, senior personal finance analyst at interactive investor, noted. But, with a £22bn “black hole in public finances to fill, the government might lean on the NS&I even more to raise enough money for the Treasury”, he said.

While the lure of winning big is high (the highest prize in the draw is £1m), experts don’t seem to fathom why this product is as loved as it is, especially as 64% of Premium Bond holders – approximately two-thirds – have never won anything.

While NS&I quotes a current variable prize fund rate (currently 4.4%), Laura Suter, director of personal finance at AJ Bell, said there is “no guarantee of any return on your cash”.

The average overall Premium Bonds pot is £5,185, but there is a massive difference between the amount held by last year’s winners, which sits at £23,047, and by those who did not win, who owned £175 worth of the bonds on average, showing that those with very small balances are unlikely to win.

What these figures make clear, according to Suter, is that savers will often be better off exploring the various inflation-beating cash rates on offer elsewhere in the market rather than leaving it to chance in a Premium Bonds account.

“It paints a disappointing picture for hopeful bondholders who could have otherwise stuck their money elsewhere for a more reliable and sometimes guaranteed return,” Suter said.

“When you factor in that many people will have been holding Premium Bonds for decades, that means they may have missed out on significant returns in a higher paying cash account or by investing.”

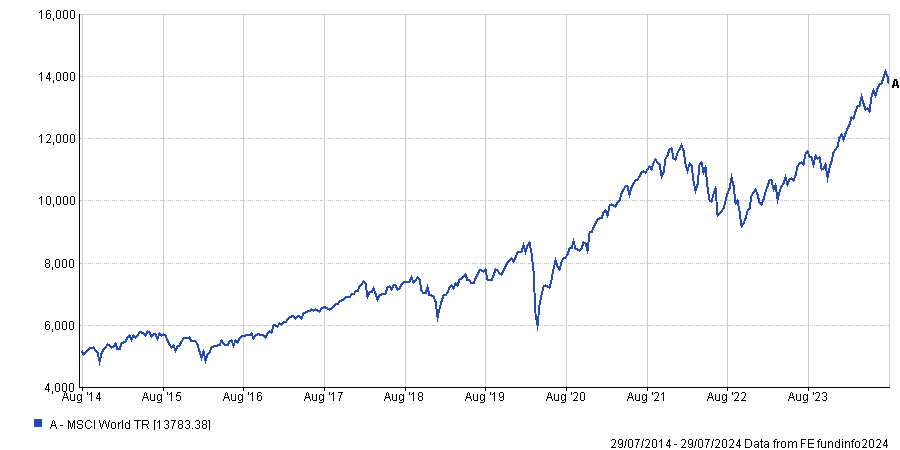

A £5,185 lump sum invested in the MSCI World index 10 years ago would be worth £13,783 today, as the chart below shows.

Value of lump sum invested in the MSCI World index over 10yrs

Source: FE Analytics

Jobson agreed with Suter and suggested investing over cash.

“With a cut in the base rate a question of when, not if, the best savings rates are on borrowed time,” he said.

“Those who can afford to put money away for at least five years or more should consider investing for the potential of long-term, inflation-beating returns that far outstrip savings rates."

Even people who are unsure about investing would still be better off choosing a regular savings account over a Premium Bond, as they could be raking in interest in excess of 5% if they were to shop around for other cash products on the market.