Multi-asset managers have had to navigate a myriad of risks and events during the past three years, from rapidly rising interest rates to international warfare and this year’s tumult of elections.

They have also had to contend with outflows. Statistics from the Investment Association indicate that nearly £4.2bn was pulled from multi-asset funds globally in 2022 and 2023.

And yet, despite these developments, several multi-asset funds have managed to revitalise their track records, achieving impressive three-year returns despite laggard long-term results.

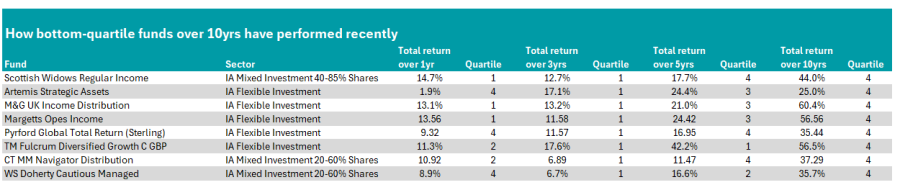

As part of an ongoing series, Trustnet looks at the funds which have rallied from bottom-quartile performance over 10 years to top-quartile over three. Below, we look at multi-asset funds across the IA Flexible and the various IA Mixed Investment sectors.

How bottom quartile funds over 10yrs have performed recently

Source: FE Analytics

First up is the IA Flexible Investment sector, with the $441.3m M&G UK Income Distribution fund, co-managed by Elina Symon and Michael Stiasny.

Under their leadership, the fund has moved from a bottom-quartile portfolio over 10 years to a top-quartile effort of 13.2% over the past three years. It has continued this strong performance since, with first-quartile returns of 13.1% over the past year.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

This consistency is the result of an impressive 2022 and 2024, in which the fund ranked as one of the top 15 performing funds in the wider sector.

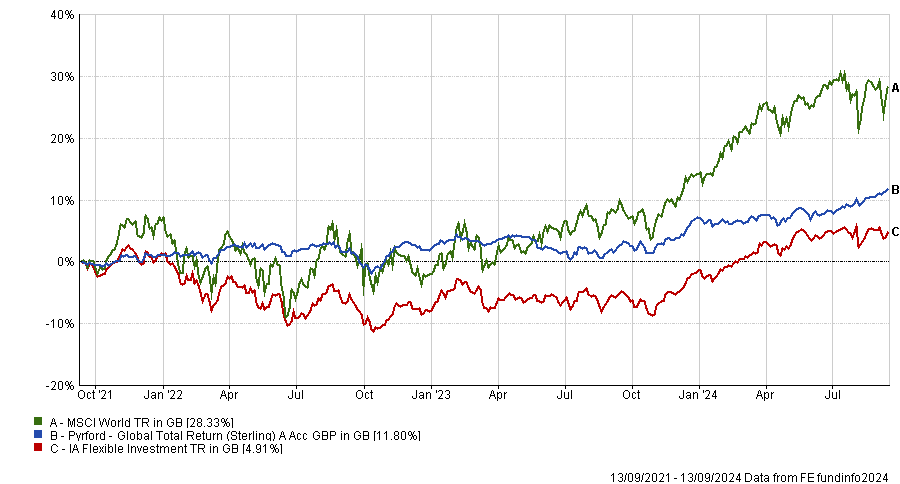

Also in the Flexible Investment sector, the £781.5m Pyrford Global Total Return fund has experienced a remarkable turnaround, rising from bottom-decile 10-year returns to top-quartile performance of 11.8% over the three years.

Some of its other metrics have been similarly respectable, with the portfolio having the lowest maximum drawdown in the peer group at just -4.35%. Managed by Tony Cousins, the fund has an FE fundinfo Crown Rating of four.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Analysts at Square Mile said: “In an industry which has increasingly become overly concerned with short-term returns, the team's long-term approach differentiates it from many peers.”

Nevertheless, the portfolio has gone through a rough patch recently, with returns over the past year falling to the bottom quartile.

Several other funds in the Flexible Investment sector have managed to turn their performance in recent years, including the £8.9m Margetts Opes Income fund, the £190.4m Artemis Strategic Assets fund and the £10.4m TM Fulcrum Diversified Growth fund.

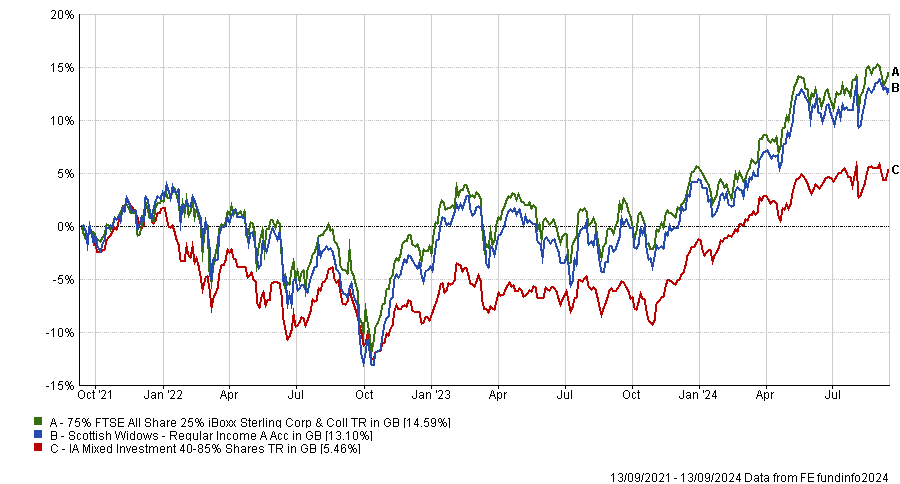

Turning to the IA Mixed Investment 40-85% Shares sector, just one fund matches our criteria. This was the four Crown-rated, £189.2m Scottish Widows Regular Income fund, led by Philipp Chandler since 2020.

With average returns of 12.7% over the past three years, this has been a top-quartile effort and a rise from the fund’s position as the sixth-worst performer over 10 years.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Impressively, it has maintained this positive performance more recently, with top-quartile returns over the past year, six-month and three-month periods, with total returns peaking at 13% over the past year.

This consistency owed to first quartile efforts in 2022 and 2024, with second-quartile performance in 2023 and 2021 enabling it to maintain momentum when competitors struggled.

In 2022 the fund lost 6.7% but was nonetheless a first-quartile performer. This reflects the fact that 2022 was a challenging year, with geopolitical conflict, rising interest rates and recession leading to a large-scale sell-off from global equity and bonds.

This led to difficulties for many multi-asset portfolios; just four funds in the 40-85% shares sector achieved positive returns that year.

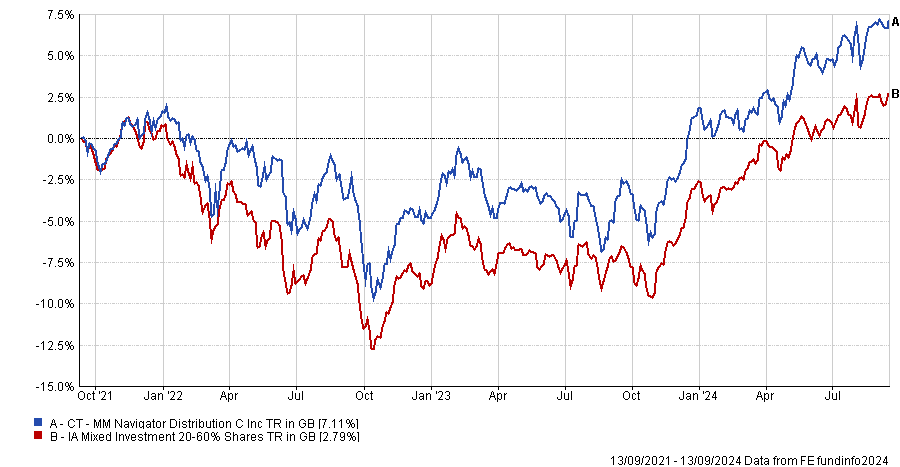

Finally, in the IA Mixed Investment 20-60% Shares peer group, just two funds meet our criteria, most notably the four-Crown rated CT MM Navigator Distribution fund.

The £313.2m portfolio, led by Columbia Threadneedle’s multi-manager team, has rebounded from bottom-quartile long-term performance to a first-quartile effort over three years, returning 7.1%.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

This owed to a particularly strong 2021, where it was one of the top 20 performers in the whole peer group, having risen by 11.2%. Impressively, despite returns falling by 6.4% in 2022, the fund maintained top-quartile performance.

Notably, it ranked within the first quartile for maximum losses and maximum gains in this period, suggesting that it handled the volatile years much better than many competitors.

However, it has not all been plain sailing for the portfolio. Strong three-year results were followed by third-quartile efforts in 2023 and 2024, with returns of just 6.9% and 5.2% respectively.

The only other fund to fit our criteria in this period was the £25.2m WS Doherty Cautious Managed fund, managed by Gavin Curran.

Previously in this series, we have looked at the IA North America and North American Smaller Companies, Europe Excluding UK, UK Smaller Companies, UK Equity Income, emerging markets, IA Global and Global Equity Income, and the UK All Companies sectors.