Global markets have experienced a turbulent five years, facing challenges such as a global pandemic, recession, and various geo-political conflicts. During times like this it can pay off to take some risks, but can also go catastrophically wrong.

As such, getting the best returns for the risk taken can become a key factor for investors when deciding which funds to buy.

In the first part of a new series, Trustnet looks at the funds in different sectors that have made the best risk-adjusted returns over the past five years using the Sharpe ratio, which factors in volatility and total return.

We do this by looking at funds ranking within the top 10% for five-year returns and Sharpe ratio – which measures the amount of excess return generated by a fund per unit of risk.

There are two ways funds can achieve a strong Sharpe ratio – either by taking less risk for reasonable returns, or by taking on more risk for supranormal gains.

Below, we look at the best funds for risk-adjusted returns over five years in the 412-strong IA Global peer group.

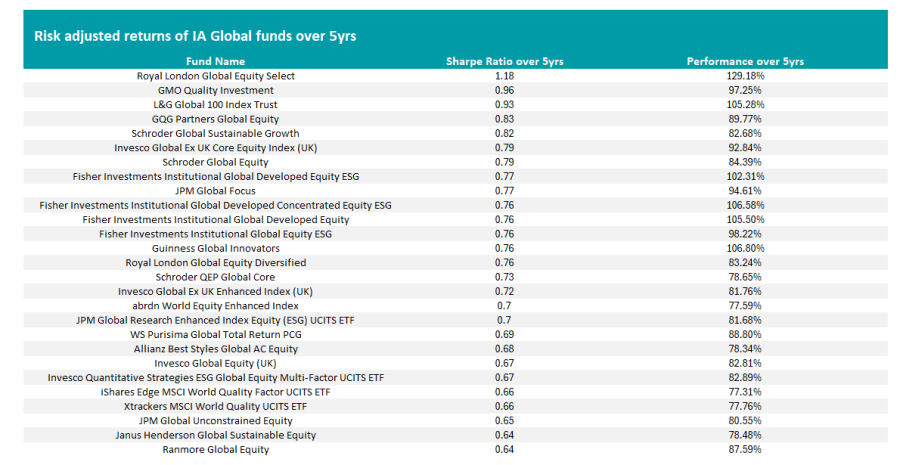

Risk-adjusted returns of IA Global funds over 5yrs

Source: FE Analytics. Total return in Sterling. Figures accurate up to 31 August 2024.

Heading the table is the £621m Royal London Global Equity Select fund, led by FE Fundinfo Alpha Manager Mike Fox. Over five years, it has achieved the best five-year returns among its peers of 129.2% with third-decile volatility of 12.3%. This has led to it achieving one of the highest Sharpe scores in the sector at 1.2.

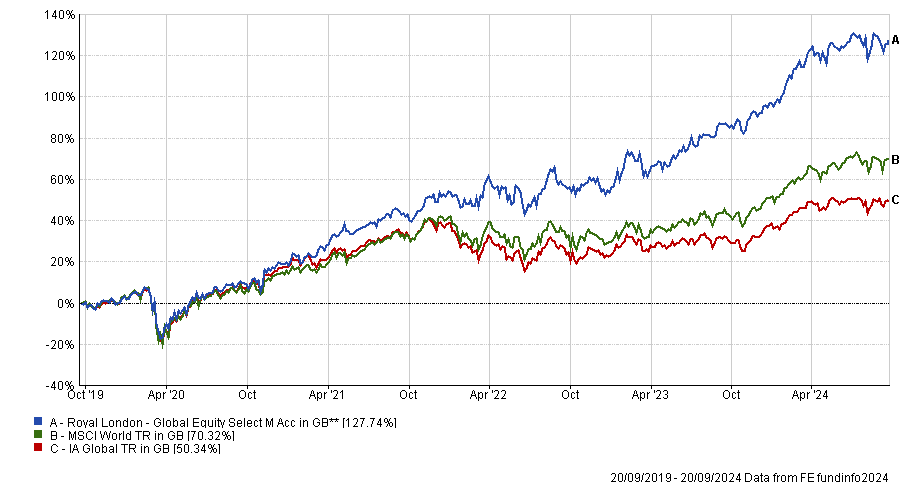

Performance of fund vs the sector and benchmark over 5yrs

Source: FE Analytics

However, the fund is currently hard closed to new investors. Additionally, Royal London’s head of equities Peter Ruffer departed the firm earlier this year, which may affect the fund’s future performance.

Next up is the £833m Guinness Global Innovators portfolio, managed by Ian Mortimer and Matthew Page, which enjoyed the second-highest five-year returns of 106.8%.

It was however, a comparatively more aggressive strategy than Royal London’s portfolio, with the fund ranking in the eighth decile for volatility over the past five years.

This combination of high risks and high returns means the fund achieved a total Sharpe ratio of 0.76 over five years.

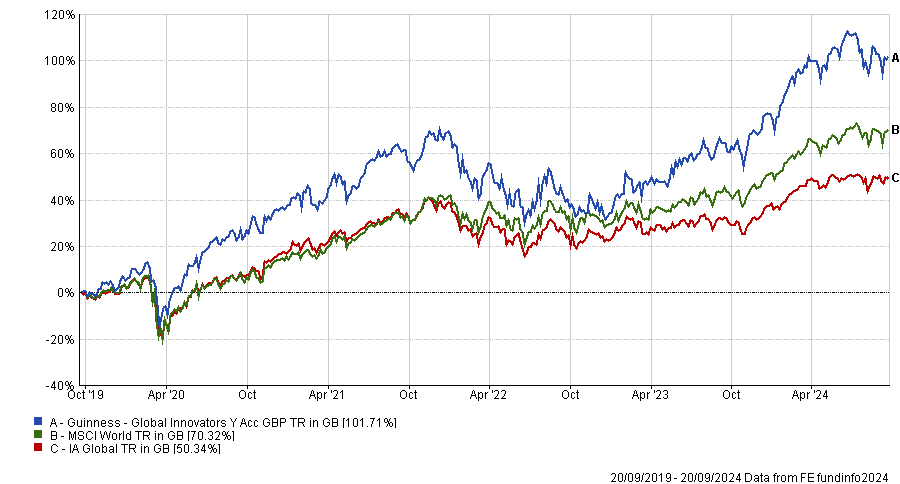

Performance of fund vs sector and benchmark 5yrs

Source: FE Analytics

The portfolio’s broader performance has also been impressive, with top 25% results over 10 years, and the past year. It did, however, drop into the second quartile over three years.

Several other funds achieved returns of above 100%, while also ranking in the top decile for Sharpe ratio across the past five years.

These included the £51.7m Fisher Investments Institutional Global Developed Equity ESG, the £1.7bn L&G Global 100 Index Trust, and the £5.9m Fisher Investments Institutional Global Developed Concentrated Equity ESG.

Another popular portfolio in the IA Global sector that achieved top-decile risk-adjusted returns was the £2.9bn GMO Quality Investment fund, which has an FE fundinfo Crown Rating of five.

With the second-highest five-year Sharpe ratio of 0.93 and top-decile returns of 97.3%, it is one of the consistently best-performing portfolios in the sector, with strong 10-, five-, three- and one-year records.

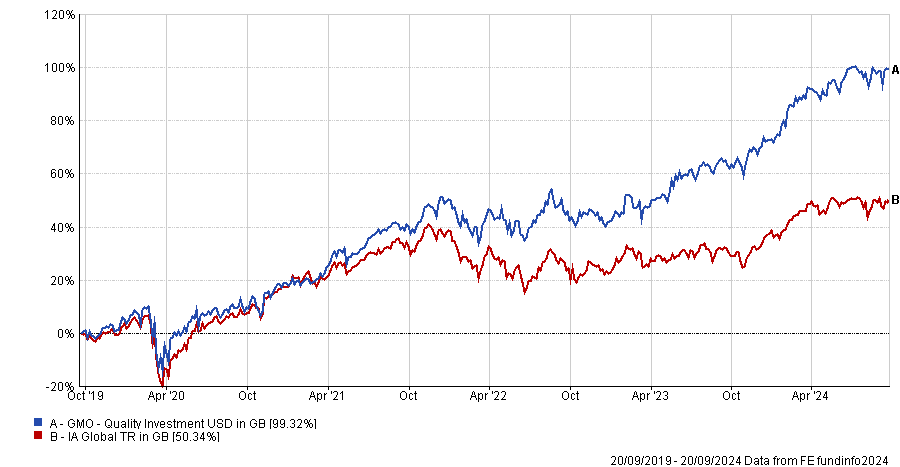

Performance of fund vs the sector over 5yrs

Source: FE Analytics

Its 10-year record was particularly exceptional, with the fund up by 347.2%, a second-place performance in the peer group overall, 37 percentage points better than the third-place portfolio.

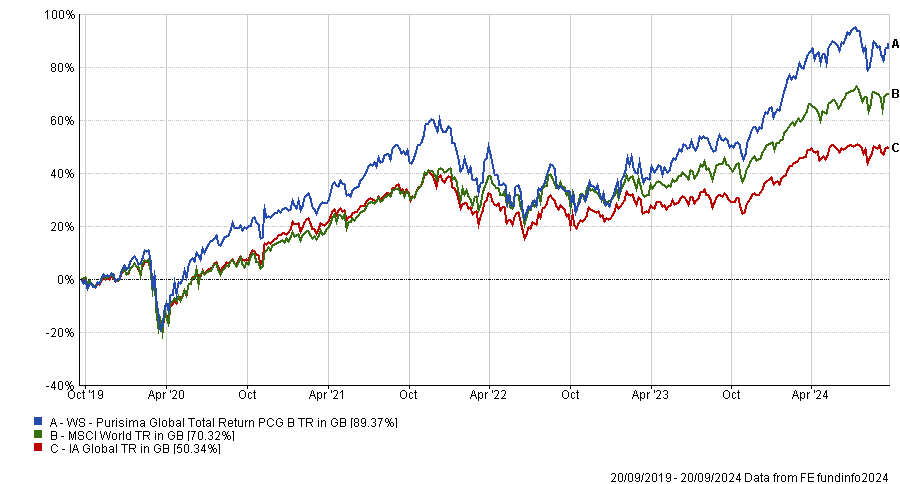

Many other larger funds secured top-decile risk-adjusted returns over five years, most notably the £10bn WS Purisima Global Total Return fund.

The aggressive strategy paired top-decile performance of 88.8% with seventh-quartile volatility, which indicates that, despite taking on more risks than average, it made smart use of those risks. This higher risk strategy resulted in a five-year Sharpe ratio for the fund of 0.69.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

More broadly, it has enjoyed top-quartile performances over both one-, three- and 10-year periods. It’s 10-year performance was particularly notable, with the portfolio up by 247.7%, the 12th best result sector.

Other large funds to gain top-decile Sharpe ratios and returns over the past five years include the £5.9bn Royal London Global Equity Diversified and the £5.6bn JPM Global Focus portfolios.