Growth funds have been outperforming their value peers so far in 2024 and two formerly popular options are on the rise once again.

Alexis Deladerriere, Nathan Lin and Jennifer Sullivan’s GS Global Millennials Equity Portfolio invests in companies that play into what younger generations enjoy, such as social media and the internet, with top holdings including Apple, Meta and Amazon.

WS Blue Whale Growth, meanwhile, is managed by FE fundinfo Alpha Manager Stephen Yiu and is a concentrated portfolio of 26 companies that he believes are “high-quality businesses”. Examples in its top 10 include Flutter, Nvidia and Visa.

Despite their different methods, they have had similar trajectories. Both have made top-quartile returns so far in 2024 and were above the average IA Global fund in 2023, but struggled in 2022, sitting in the fourth quartile with 31% and 27.6% losses respectively.

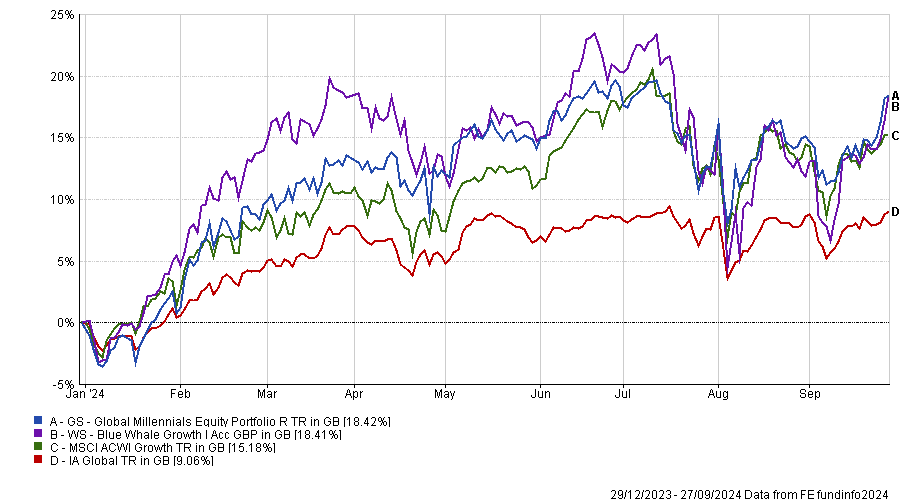

Performance of funds vs sector and benchmark over YTD

Source: FE Analytics

They have a correlation over the past six months of 0.99 (a score of 1 means they have moved identically) and 0.9 over the past year. This widens slightly over longer periods to 0.83 and 0.84 over three and five years, although both have a correlation of 0.9 to the MSCI All Countries World index over the past half a decade.

The funds have around £1bn in assets under management and more than 50% of their portfolios in their top 10 positions, but for Tom Sparke, portfolio manager at Progeny Asset Management, Blue Whale could provide greater diversification.

While both have delivered “very good returns for their long-term supporters” and are “true to their remits”, containing “exactly the kind of stocks that one might expect to see”, he noted that the Global Millennials fund encompasses more of the most familiar mega-cap names in typical US and global funds so overall.

“Looking at these top holdings, the Global Millennials fund encompasses many more of the most familiar mega-cap names in typical US and global funds so overall, if you are looking to diversify your holdings, then Blue Whale would provide greater diversification,” he said.

Ben Yearsley, director at Fairview Investing, agreed that Blue Whale was the preferred choice, noting he generally likes boutiques over the large fund management groups.

“Purity of process and clarity of decision making makes boutiques compelling in my mind,” he said. In the case of Blue Whale, it has one product that has delivered “decent results” over its life and the team are focused solely on this.

While 2022 was “tough” as the high-growth stocks that had boomed during the era of low interest rates tumbled, Yearsley said Yiu “took that as an opportunity to re-look at the process to see if it was fit for purpose”.

“Largely it was, he concluded, but he made some tweaks that meant going forward he wasn’t so reliant on the uber-high growth stocks. I like this kind of honest appraisal.”

Not all agreed, however. Jason Hollands, managing director of Bestinvest, said Blue Whale can be more opaque than its peers. For example, although it lists the top 10 holdings in its monthly factsheets, it omits the position sizing.

“This isn’t helpful,” said Hollands. However, investors can see that 45% of the concentrated 26 stock portfolio is in technology positions and a further 7.8% in communication services, which “probably explains the strong performance over the past couple of years”.

The Goldman Sachs fund also has big positions in tech (26%) and communication services (26%), but another notable theme is 24% in consumer discretionary stocks.

Its top 10 includes big positions in a number of the artificial intelligence (AI) related darlings, including Nvidia, TSMC, Meta, Alphabet, Amazon and Apple and is a slightly more globally diversified with 61% in the US, versus Blue Whale Growth which is 75% invested in US stocks.

“Personally, I wouldn’t buy funds with heavy positioning in tech and AI names given currently frothy valuations, but If I had to invest in one of these two I would have a marginal preference for the Goldman Sachs product given better disclosure and slightly more diversification,” he said.

However, he recommended investors interested in these funds look at Brown Advisory Global Leaders, a 30-40 stock portfolio of mostly large-cap companies.

“Its investment philosophy is focused on high-quality, cash-generating businesses delivering positive and sustainable returns on capital and holding them for the long term. Diversification across sectors and geographies is important, with the portfolio typically having 40% outside of the US. Currently US exposure is 43%,” said Hollands.

It sits in the second quartile of the IA Global sector so far this year but its drawdowns in 2022 were far less severe.

Performance of funds vs sector and benchmark over 5yrs

Source: FE Analytics

It is a better performer than both over three years although lags the Blue Whale fund over five years, as the above chart shows.