It is rare for fund managers to admit they were completely wrong about big calls, but Talib Sheikh, multi-asset income portfolio manager at Fidelity, admits his backing of European equities in May was an incorrect call.

A few months ago he said the region was poised for a surge in value. At the time, he felt that “the next leg of the equity market move has to be driven by earnings” and had adjusted his portfolios accordingly to favour cheap European equities, expecting that Germany would recover and prompt a much more positive picture for Europe.

Fast forward to this month, however, and Sheikh’s attitude had changed significantly. “I’m laughing because that [Europe] was a bet that didn’t work out”, he admitted.

Earlier this year, he predicted slowing US growth would lead to a broadening in the global economy. He had expected the era of multiple expansion and US exceptionalism was at an end with cheaper, more cyclical, assets becoming more in demand. “That didn’t really happen,” he noted.

Betting on Europe therefore failed to pay off as the US declined less than expected and a surge of geopolitical tensions caused market volatility in the region, particularly in France.

From the US perspective, fears over an economic slowdown or recession proved to be somewhat overemphasised. Between April and June, US GDP growth accelerated to 2.8%, above initial predictions.

Moreover, despite a fall in performance for some of the ‘Magnificent Seven’ stocks, others such as Nvidia have gone from strength to strength, rising by 194% over the past 12 months.

He added: “What you saw in this period was growth slope, not fall beneath trend, so what happened was that everyone just ran back to the US.”

Meanwhile, in Europe, France’s snap election resulted in a hung parliament, prompting a wave of political uncertainty. This caused a spike in volatility for Europe’s second largest economy.

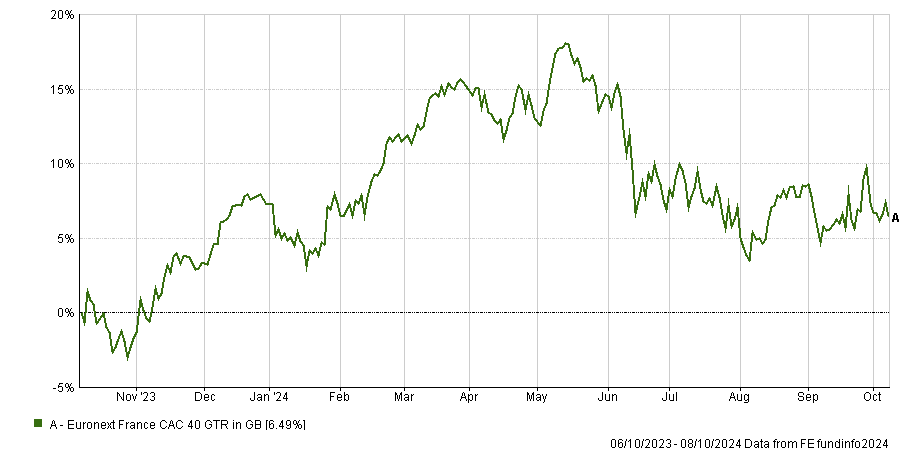

While the CAC40 has still enjoyed an overall rise this year, between the announcement of the election in June and the appointment of a prime minister in September, the index slid 11.5%.

Performance of the index over the past year

Source: FE Analytics

Source: FE Analytics

“The French have now appointed a prime minister, but that political uncertainty meant that the trade didn’t really work”, he said. “As often happens in Europe, that optimism was cruelly snubbed out”.

Consequently, while European holdings are still a large part of his portfolios, Sheikh admitted that “Europe was not a great call, although it wasn’t a disastrous one either”.

With optimism around Europe failing to manifest, where does Sheikh see opportunities for the rest of the year? The big area of interest is in Asia, where markets started to do quite well.

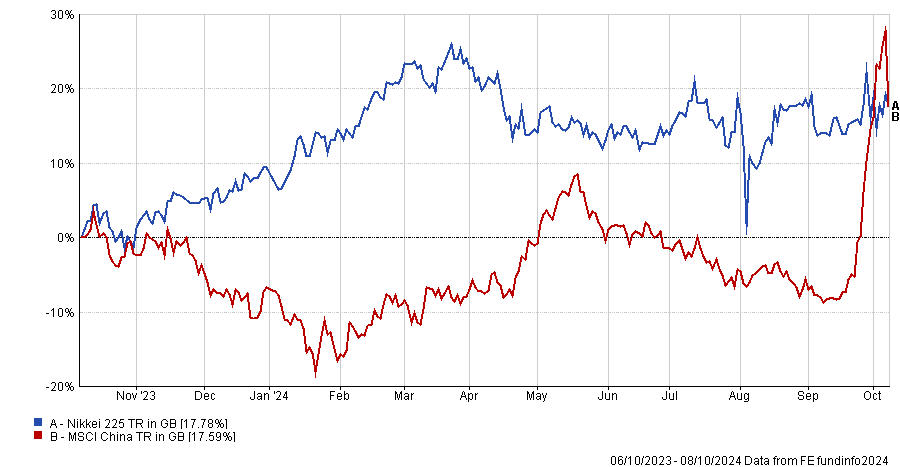

For example, he has been optimistic about Japan this year, noting that investment in the region generated good results for Fidelity’s portfolios. Despite a spike in volatility due to the Bank of Japan’s decision to hike interest rates, the Nikkei 225 has enjoyed a rise of 17.8% over the past year.

Performance of China and Japan market indexes over 12 months

Source: FE Analytics

Additionally, eyes have increasingly turned towards China, which shot up by about 30% in one week following the promise of a new stimulus package from the government. While optimism around Europe was snubbed this year, Sheikh said that this new wave of interest in China had more of a “leg to stand on”.

Sheikh said: “The million-dollar question for us is, does the move we’ve seen in China mean that emerging market equities, which have been out of favour for years, come back to the fore?”

For Sheikh, the recent stimulus reflects a more proactive approach from the Chinese government and signals that they have become more willing to address the current market slowdown.

With new catalysts for growth, cheap valuations and momentum for further development, there is now more debate about whether it is time to be more optimistic about emerging markets.

“Is this round of stimulus the last? No, we don’t think so. If it doesn’t work, they’ll do some more, and then at some point, there will probably be fiscal support, so we do think this is a big change,” Sheikh added.

Nevertheless, Sheikh remains cautious on the emerging markets, with the region still facing several economic challenges. The most notable, Sheikh said, was the poor balance sheets and the massive inventory backlog, which he compared to the situation during the great financial crisis.

Additionally, excitement around the market has somewhat cooled in the past week as Beijing officials have held off on promising further stimulus. Consequently, the MSCI China fell in value to 15.6%, a decline of roughly 12% in just two days.