The merger of Witan and Alliance Trust, which was completed last week, was executed as cheaply as possible, according to manager Craig Baker. The merger will bring additional benefits to investors, such as increased scale and liquidity, he said, although experts had mixed feelings about it.

One thing that made the transition much easier is that Witan’s multi-manager approach was “quite similar in many ways” to the approach at Alliance Trust, and the two vehicles had some of the same underlying managers.

“Witan had two of the same emerging market managers as Alliance – Veritas [Asset Management] and GQG [Partners] – so those can just come across with no cost,” said Baker.

Furthermore, the newly-created Alliance Witan has awarded a mandate to Jennison Associates, a growth manager that was part of Witan’s stable. “Jennison is a manager that we've rated highly and was already in some of our institutional portfolios,” he explained.

As for the costs of bringing the rest of the Witan portfolio across, Baker promised they will be “incredibly low”.

“We don’t have lots of UK equities that trade on stamp duty and those kinds of things drive costs up,” he said.

On top of that, Baker is using BlackRock as a transition manager, as he did in 2017 when the legacy Alliance portfolio transitioned to the current multi-manager approach.

“Back then, we managed to keep the costs at an absolute minimum, much less than half a percent, probably about 0.1% or 0.2%,” he said.

The enlarged scale of the new £5bn trust also allowed the board to lower the ongoing cost ratio (OCR) to a figure in the “high 50s” (i.e. above 0.55%) and also means that the trust might qualify for inclusion in the FTSE 100, which would “increase liquidity, open up the trust to investors who only invest in large funds and potentially also close the discount even further” from the current 5.45%.

“We are getting an increasing dividend through this process and we have done it in a way where there is no net asset value dilution for shareholders,” Baker continued.

“The merger is going to ultimately lead to a higher profile, allowing us to spend more on marketing and get more people on board.”

Baker will continue to run the new portfolio with the same investment philosophy he deployed at Alliance Trust – asking stock pickers such as Dalton Investments and Sands Capital to manage concentrated portfolios of their 20 best ideas.

Besides Jennison, the most recent addition to the 11-strong line-up is ARGA Investment Management, a global value manager that came on board in April.

Baker believes that bottom-up, high conviction stock selection is “the only way” to invest and that in today’s uncertain environment, any aggressive macro positioning or style bets will fail.

“The economic and market backdrop is highly uncertain, as it always is. Today, however, it’s even more so,” he said.

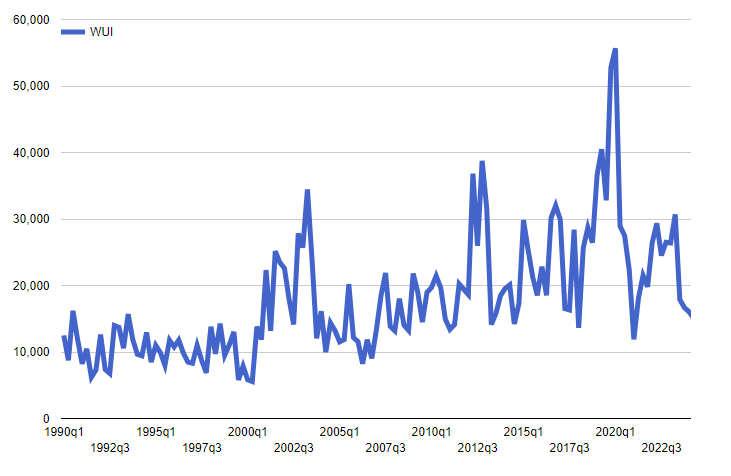

Global World Uncertainty Index

Source: World Uncertainty Index

The World Uncertainty Index, shown above, is computed by counting how often the word “uncertain” or its variants appear in the Economist Intelligence Unit’s global country reports. Here, a higher number means greater uncertainty and vice versa.

“There's always uncertainty, you just jump from one crisis to the next through time, but the number of those [crises] seems to have increased in recent times,” the manager said.

Greater uncertainly would usually be paired with lower equity returns, but equities have gone “on a massive march up, climbing that wall of worry constantly”.

In fact, the 2% drop in the S&P 500 on 24 July as the Japanese carry trade unwound was the first significant fall in 356 trading days. “That's the longest continued outperformance for almost 20 years,” he observed.

The sustained bull run was driven by the Magnificent Seven, but Baker does not think it is sustainable. “Looking at the list of the top 10 stocks at the end of each decade, very rarely do they look the same as the 10 names in the next decade”.

“That's not because they've ceased to exist or they've absolutely crashed – they just aren't the biggest anymore. If history is anything to go by, a couple of those Magnificent Seven stocks will absolutely be in the top 10, but probably quite a few of them won't. That is why stock picking is essential,” he concluded.