A well-functioning portfolio isn’t necessarily one with a large number of holdings and investors who can only afford two funds shouldn’t be put off.

There are several ways to achieve diversification with just two funds. Previously, we covered core/satellite and multi-asset approaches and today we look at a traditional stocks and bonds portfolio.

Trustnet asked experts to pick an equity and a fixed-income fund that not only go well together, but are well suited for investors who don’t have the money, time or propensity to pick additional funds.

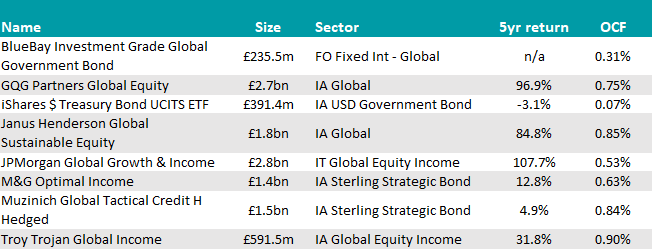

JPM Global Growth and Income and M&G Optimal Income

Quilter Cheviot head of investment fund research Nick Wood chose JPM Global Growth and Income and M&G Optimal Income, which he described as broad-based funds covering most of the market, with a consistent history of steady performance.

Performance of portfolio with 60/40 equity/bond split against index over 5yrs

Source: FE Analytics

JPMorgan Asset Management’s trust is a high-conviction portfolio, collating the firm’s favourite 50-90 companies on the basis of quality earnings that are growing faster than the market. Wood likes the 4% dividend, the very strong track record and the consistent team.

Conversely, M&G Investments’ fund, managed by FE fundinfo Alpha Manager Richard Woolnough, invests in a combination of government bonds and high-yield debt, while also holding up to 20% in equities, providing investors both income and capital growth.

“The portfolio is backed by M&G’s extremely experienced research team who enhance the manager's macroeconomics views through bottom-up credit analysis,” Wood said.

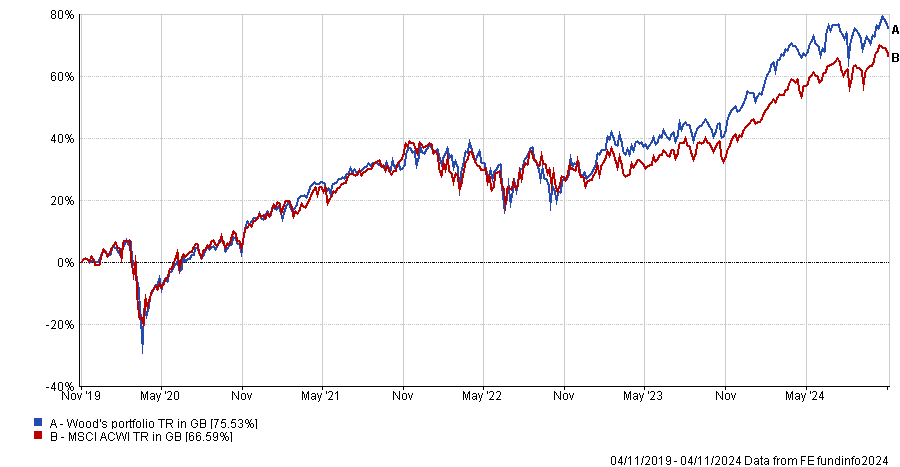

Trojan Global Income and a US government bond ETF

Fairview Investing director Ben Yearsley prioritised keeping costs low, which he achieved through an active and a passive fund.

“The way investors conceive fixed interest – whether as a diversifier or a return-seeking element – determines what sort of fixed interest vehicle to invest in,” he said.

“Normally I eschew passive bond funds in all but one specific area – US government bonds, which don’t offer a huge return but act as a good diversification tool.”

His choice here was the iShares USD Treasury Bonds exchange-traded fund (ETF), which provides broad exposure and is hedged back to sterling.

To sit alongside it, he suggested the quality-income strategy Trojan Global Income.

Performance of portfolio with 60/40 equity/bond split against index over 5yrs

Source: FE Analytics

He said: “The good thing about quality income as opposed to value-based income is that you should be able to hold through a cycle, especially when you consider that Troy’s approach focuses a lot of attention on capital perseveration.”

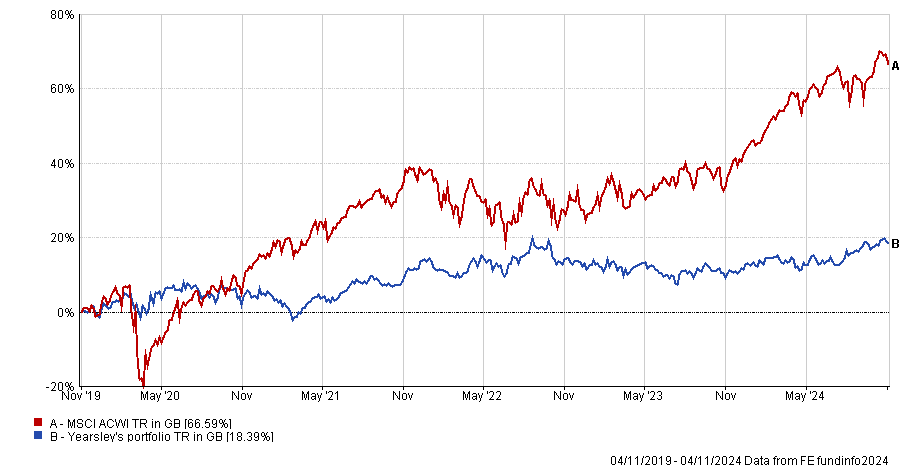

Janus Henderson Global Sustainable Equity and Muzinich Global Tactical Credit

Parmenion fund research manager James Clark would choose a sustainable global equity fund for the long to medium term, paired with a strategic bond fund that has a good degree of flexibility within global fixed income markets.

He picked Janus Henderson Global Sustainable Equity, a multi-cap strategy with a large-cap bias and a growth style, with a circa 90% active share against the MSCI World index.

“This is a core holding amongst our sustainable global equity funds at Parmenion,” Clark said.

“We like its highly-regarded manager Hamish Chamberlayne and its investment process centred on investing in companies with at least 50% revenue alignment with one of 10 positive themes (five environmental and five social), combined with a very robust exclusion criteria in place.”

His second choice was Muzinich Global Tactical Credit, a flexible global bond fund spanning sovereign bonds, investment grade and high-yield credit, as well as emerging market debt.

Performance of portfolio with 60/40 equity/bond split against index over 5yrs

Source: FE Analytics

Its mandate is designed to be very flexible, to achieve an absolute return over the market cycle.

“The fund’s portfolio is very well-diversified and its managers are able to employ some hedging techniques, aiding downside capital protection,” Clark said.

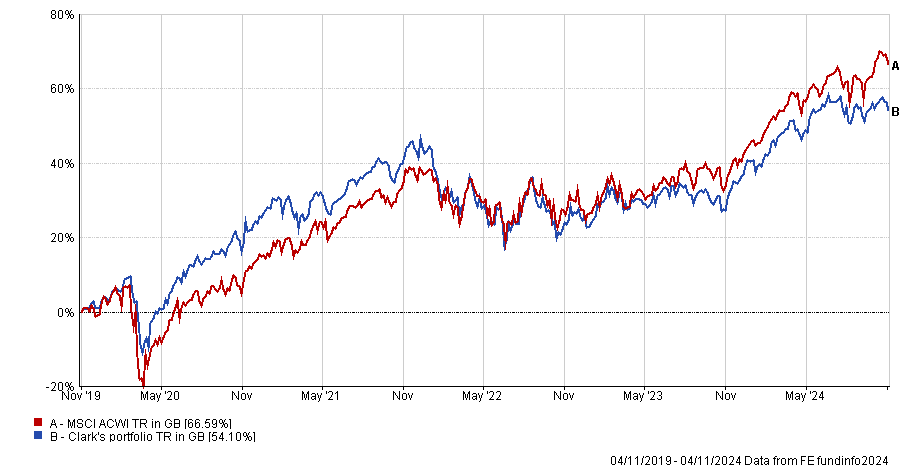

GQG Partners Global Equity and BlueBay Invetsment Grade Global Government Bond

Finally, Darius McDermott, managing director at FundCalibre, chose a pair that should provide “a balanced blend of growth and stability”.

The equity component was taken up by GQG Partners Global Equity, a concentrated portfolio of high-quality companies with strong growth potential.

It is managed by three FE fundinfo Alpha Managers: Rajiv Jain, Sudarshan Murthy and Brian Kersmanc.

McDermott was convinced by how forward-looking the fund is, focusing on companies with resilient, future-ready earnings, rather than those which have simply done well historically.

He favoured it as a nimble, growth-oriented fund, offering a solid foundation for a portfolio.

A “reliable anchor” to complement GQG is the BlueBay Investment Grade Global Government Bond fund.

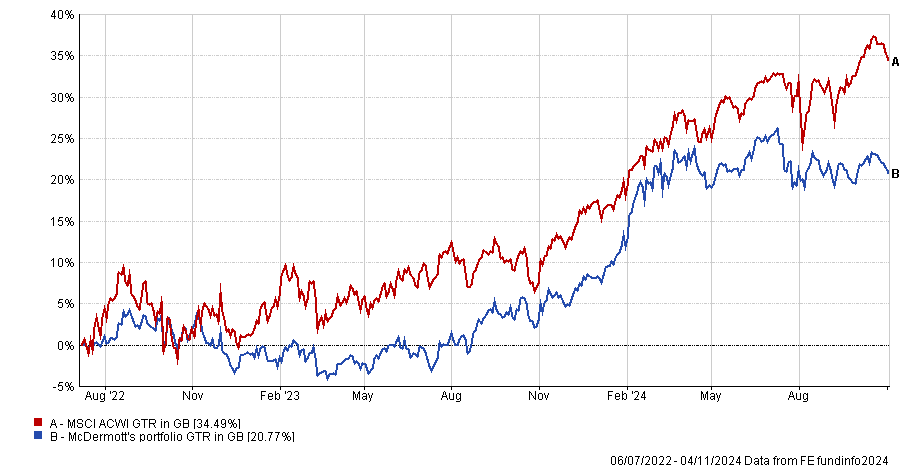

Performance of portfolio with 60/40 equity/bond split against index over 5yrs

Source: FE Analytics

Its low-cost structure, close to that of a passive fund, makes it more feasible to achieve net outperformance after fees, according to the director.

“Government bonds offer steady income and serve as stabilisers during market downturns, given their typically negative correlation with equities. Now is a good time to take advantage of the generous yields available on these low risk assets – with yields on 10-year UK gilts and US treasuries currently exceeding 4%,” he said.

“While government bonds are often seen as a challenging area for active management to add significant value, this fund’s initial outperformance has suggested otherwise.”