Investments focussing on environmental, social and governance factors are a bubble and are best avoided, according to Jason Pidcock, manager of the £1.9bn Jupiter Asian Income fund.

Sustainable investing has been in the doldrums in recent years and asset managers have been getting more vocal about maximising performance above all other goals.

Areas that were previously considered problematic, such as oil, defence and tobacco, have come back with a bang as a result of geopolitical conflicts, wars and tariffs, with managers gorging on the returns.

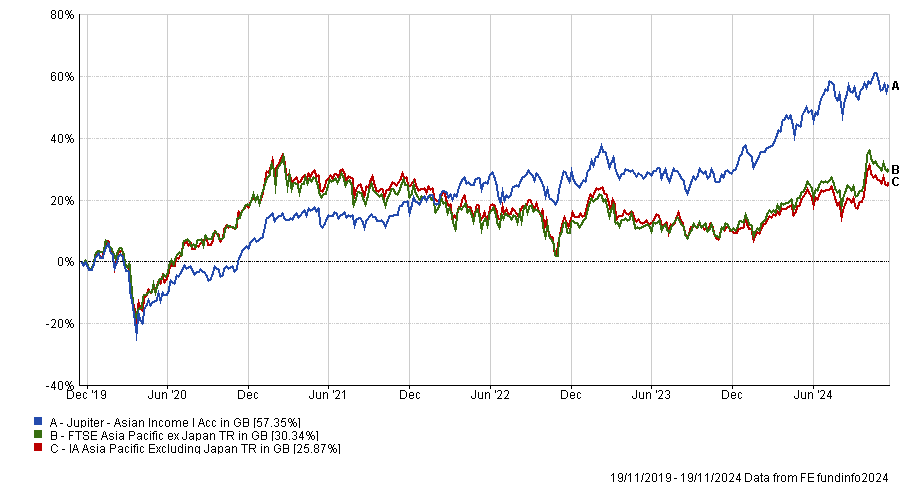

Jupiter Asian Income has had a good run during the past five years, as the chart below shows, and has achieved an FE fundinfo Crown Rating of five, the maximum score.

Pidcock attributed this outperformance to his underweight in China and overweight in technology. “But also, we avoided the ESG bubble, and it was certainly a bubble by the end of 2021,” he said.

“We didn't get caught up in that and went into 2022 owning stocks in sectors that many other people had decided they wanted to avoid, which did very well in 2022, particularly after Russia invaded Ukraine.”

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Many of these investments the manager still owns, including defence, tobacco and mining companies.

However, he hasn’t written off the ESG trifecta altogether, with the governance component being “very important” to him during stock selection.

Pidcock isn’t the only manager who believes ESG to be a bubble.

Django Davidson, portfolio manager at Hosking Partners, told Trustnet earlier this year that the green capital deployment cycle has been driven by predictions of future demand, government regulation and diktats, fitting the definition of bubble, and Barry Norris, FE fundinfo Alpha Manager of VT Argonaut Absolute Return, has also explained the reasons why he has been shorting green energy companies.

Opposing arguments have emerged from James Smith of the Premier Miton Global Renewables Trust, who highlighted all the economic arguments behind green investments, and Peter Michaelis, who runs the Sustainable Future and Ethical fund ranges at Liontrust.

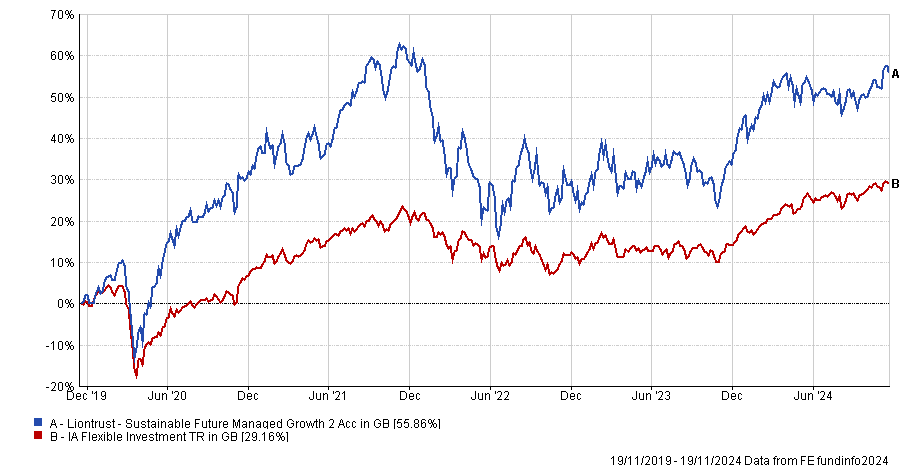

With £884.7m of assets under management, the Liontrust Sustainable Future Managed Growth fund has beaten the IA Flexible Investment sector over 10, five and one year (despite dropping from the first to the fourth performance quartile over three years). It was in line with the returns of non-ESG funds, including Pidcock’s strategy, as the chart below shows.

Performance of fund against sector and index over 5yrs Source: FE Analytics

Source: FE Analytics

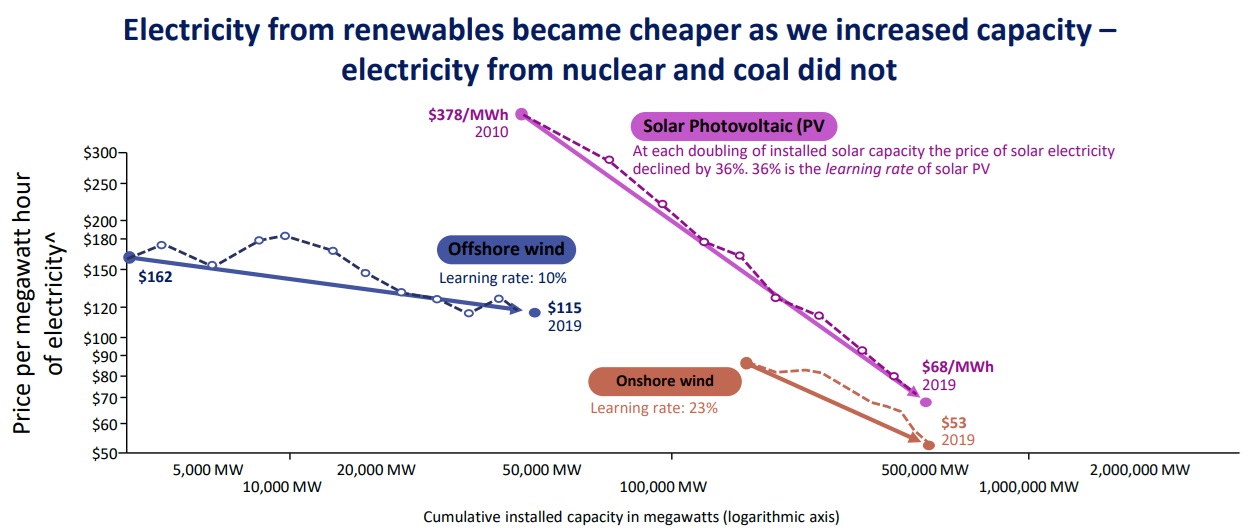

Michaelis attributed part of the success to the sharply dropping prices of renewables, which are the key to spurring the energy transition now and in the future.

Since 1976, the price of solar modules declined by 99.6% and between 2010 to 2019, solar-powered electricity got 36% cheaper. Similar dynamics are in place for wind energy (both offshore and onshore, as the chart below shows) and lithium ion batteries, whose prices declined an average of 18.9% for every doubling in cumulative capacity, according to Liontrust data.

These dynamics get even more powerful by looking at fossil fuels, where cost curves are going in a different direction. For nuclear, costs shot up 60% between 2010 and 2019 (from $96 to $155), while in the same period, coal remained stable at approximately $110/MWh.

Cost curves: Wind and solar get cheaper

Source: Liontrust

“These very different dynamics mean that, for us, the genie is out of the bottle for renewables and they will continue to displace other forms of energy at pace,” Michaelis said. “It is very unwise to bet against cost curves.”

“The energy transition will have a very material impact on investment returns and you shouldn't underestimate the difference between the winners and losers from this long-term trend.”

One potential winner is Danish wind turbine manufacturer Vestas, the manager said. Although it is “having its travails” at the moment, “the value of this company has gone up more than tenfold since it launched in 1999 and it's going to be very successful in the future as demand grows”.

Another company he highlighted was UK National Grid, which is investing £60bn in the UK and the US to modernise electricity grids.