Microsoft, Alphabet and Amazon are "staples of the modern world" and deserve their dominant places in the global stock market, according to Gerrit Smit, who runs the $2.4bn Stonehage Fleming Global Best Ideas fund. All three companies have products that people use in their daily lives and would not want to be without.

However, all the Magnificent Seven are not created equal and Smit was sceptical about Nvidia and Tesla’s long-term growth potential. This is a critical issue for investors who have piled into these stocks. “One of the biggest behavioural issues with investors is a tendency to run with the herd. There are a lot of herd investors in Tesla and a lot of herd investors in Nvidia,” the FE fundinfo Alpha Manager said.

Smit believes the world’s best companies must have sustainable growth potential, a unique management culture, efficient balance sheets and free cash flow generation. However, he admitted that achieving all of these “quality pillars” was difficult, even for some of the Magnificent Seven.

“You can have fantastic growth with good management, but that does not mean you have a profitable business,” he explained.

Smit argued that Tesla was an example of this. Despite a leading management structure and good top-line growth, with its stock price up by more than 36% year-to-date, it lacks bottom-line efficiency and free cash flow.

Tesla share price performance YTD

Source: Google Finance

Nvidia faces a similar set of challenges. The semiconductor company has seemingly gone from strength to strength, with its share price up by 194% year-to-date. However, Smit is not certain that this growth is sustainable in the long-term.

With the rest of the Magnificent Seven already allocating around £200bn to capital expenditure this year, which is likely to rise even further next year, Smit believes Nvidia is a riskier asset that many investors may believe.

Nvidia share price performance YTD

Source: Google Finance

He argued: “I do hope we can one day develop more certainty, but the uncertainty around Nvidia is that when the big tech companies have spent their money on buying chips for data centres, how does it keep growing at its current pace?

“We’ve seen this situation before. Once [the tech companies] have built the capacity they need and start being careful with their expenditure, that’s when it may become dangerous for Nvidia shareholders.”

The staples of the modern world

By contrast, Smit believes Microsoft and Alphabet have become ubiquitous, with further runway for growth ahead.

Microsoft dominates the business landscape. “I don’t have a cake every day, but I use Microsoft every day,” he commented.

Additionally, the company has historically demonstrated enormous growth potential and remains at the forefront of technological megatrends. For example, Smit believes Microsoft's acquisition of Activision Blizzard, which makes the Call of Duty computer game, and its investment in OpenAI have led to it being a world leader in trends such as the metaverse and artificial intelligence (AI).

“AI has been around for a while, we just did not talk about it until Microsoft bought OpenAI,” Smit argued.

Despite this growth potential and market dominance, Microsoft trades at a 34x price-to-earnings (P/E) ratio, which he said was a reasonable valuation relative to its offering, whereas Nvidia trades at 56x.

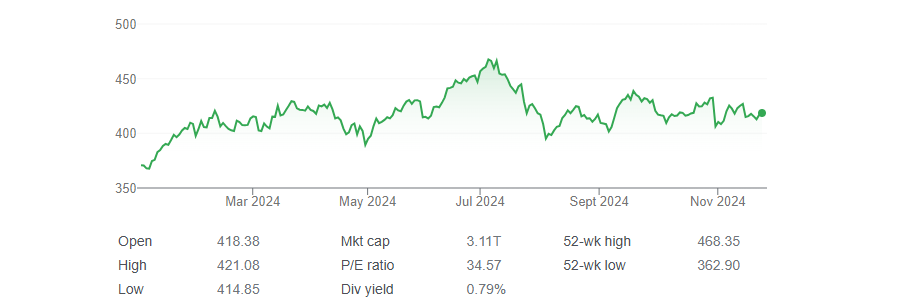

Microsoft’s share price performance YTD

Source: Google Finance

Smit believes that one of Microsoft's most underappreciated aspects is its income potential. “I find it fascinating that we never talk about the dividends of big tech companies,” he said.

Despite Microsoft having a dividend yield of just 0.8%, Smit argues that it is compounding at around 9% per annum. “The discipline is in trying to have some patience. But if you do, that compounding rate will eventually become quite effective.”

Google is another staple of the modern world and currently enjoys a 90% search engine market share.

Its parent company Alphabet has an entrepreneurial management culture, which Smit said was one of its most crucial characteristics.

“It sounds elementary, but you can have two businesses with the same assets, and the one with the better management will succeed,” he commented.

Alphabet’s entrepreneurial management has allowed it to develop several offshoot businesses and products, such as Chrome, or acquire others such as YouTube, he explained. As a result, it makes a compelling holding that gives investors easy access to several individually strong businesses.

Alphabet share price performance YTD

Source: Google Finance

Smit argued that YouTube is underappreciated, despite being a free challenger to streaming services such as Netflix.

Even recent decisions by regulators to target Google for blocking innovation have not dented Smit’s confidence in the stock, because even its sub-ventures are attractive opportunities.

“If you asked me if I would like to own a YouTube or a Chrome, the answer would be absolutely. Even if you value them individually, they are worth far more than their stock prices would suggest,” Smit said. “Holding Google was one of the best decisions we’ve ever made.”