Having closed the book on a busy year for global markets, even the most experienced investors had something to learn from 2024.

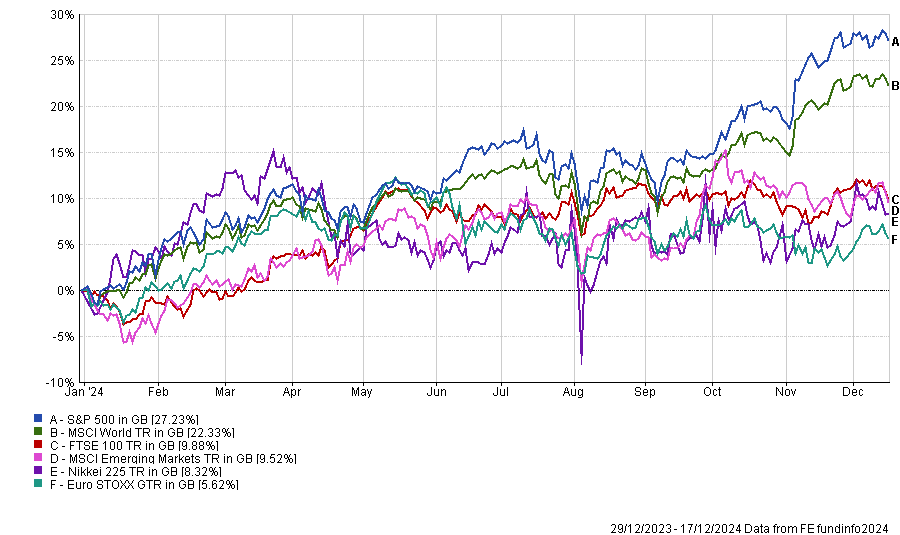

Around 2 billion eligible voters are estimated to have gone to the polls in 2024, while geopolitical tensions continued to cast long shadows. Moreover, the market demonstrated its capacity for unexpected swings, best seen in the global market sell-off in early August following poor US employment data.

Performance of indices in 2024

Source: FE Analytics

Below, Trustnet asked fund and wealth managers for the biggest lesson they learnt in 2024.

Artemis’ Jacob de Tusch-Lec – Be curious

For Jacob de Tusch-Lec, co-manager of the Artemis Global Income fund, 2024 ended on a high note.

“The big lesson of 2024 has been to be curious,” he said.

While he acknowledged that the most significant conversations this year have been around US tech names, he reminded investors that these were hardly the only games in town. He explained that 2024 was a fantastic year for the more adventurous stocks in his portfolio.

He argued that being nimble and flexible in the fund’s allocations allowed his team to tap into a wider variety of long-term trends, reflected in another top-quartile performance for the fund in 2024.

De Tusch-Lec added: “We have made money in gold stocks, in defence stocks globally and in European banks – all from being inquisitive rather than dismissive.”

AllianceBernstein’s Karen Watkin – Flexibility remains key

Karen Watkin, manager of the AB All Market Income fund, said 2024 was another year where market resilience proved surprising.

While she noted that US outperformance was expected, the extent of it proved surprising. Indeed, she argued that equity markets generally remained below the long-term average for volatility in 2024, except for the spike in August.

By contrast, Watkin concluded that 2024 demonstrated that bond markets were a “poor predictor of interest rates”. This time last year, the market expected almost seven cuts from the Federal Reserve, but only about three to four failed to manifest.

Consequently, Watkin hoped investors would learn one big lesson from bond and equity performance: the importance of flexibility in your portfolio, particularly ahead of a potential for further market broadening.

Downing’s Simon Evan-Cook – The irrationality of markets

For Simon Evan-Cook, fund of funds manager at Downing, 2024 was a “reminder of an uncomfortable truth” about market irrationality.

Markets in 2024 demonstrated a “lust for all things enormous and growthy”, with Nvidia being the best example. While he noted that it was a great company in a sweet spot, he argued that some of the other mega-caps had far less acceptable fundamentals.

This posed a challenge for his team, which had to choose between following the herd on these favourites or sticking to its philosophy and waiting out the frenzy surrounding these stocks.

“We will do the latter every time,” Evan-Cook said. “But 2024 has provided a reminder of how frustratingly long you can wait before the cycle finally turns.”

RBC Brewin Dolphin’s Zoe Gillespie – The bubble may burst

The ‘Magnificent Seven’ and continued rise of artificial intelligence (AI) remained one of the most critical trends of the year and holds the lesson for Zoe Gillespie, senior investment manager at RBC Brewin Dolphin in 2024.

“Having lived through the 90s technology bubble, I never thought I would see anything like it again. Three decades later, the AI boom has been the hottest story in town and felt very familiar to the excitement all those years ago,” she said.

On the one hand, this positive momentum was appreciated after two years of market turbulence, she added. However, she warned investors that like any bubble, “there is always a propensity for it to burst”.

As a result, while it is tempting to follow momentum, Gillespie reminded investors that diversification is crucial. Protecting against downsides is just as important as chasing the upside.

AXA IM’s Nicolas Trindade – Be critical

In the fixed-income market, Nicolas Trindade, portfolio manager at AXA Investment Management, concluded that 2024 reminded investors to avoid following the herd. It is only by going against consensus that you can create opportunities for outperformance, he argued.

Initial predictions of seven rate cuts from the US Federal Reserve failed to resonate with Trindade and his team, who instead cut duration, which minimised the impact of a surge in US treasury yields.

Similarly, despite woes around businesses such as Thames Water, Trindade argued that the most attractive sterling credit opportunities were in UK water companies, which had a significant gap between fundamentals and valuations.

“The biggest and ever-recurring investment lesson is to be critical of the consensus and always endeavour to see where it could be wrong.”

Stonehage Fleming’s Gerrit Smit – Do not underestimate portfolio correlations

For Gerrit Smit, portfolio manager of Stonehage Fleming Global Best Ideas Equity, the biggest lesson of 2024 was how the correlation of global markets could unexpectedly impact portfolios.

Smit explained that China was a clear example of this in 2024. While many investors may not buy stocks for their Chinese exposure, many leading global businesses are highly active in the region.

As a result, many investors would have found their portfolios surprisingly impacted by the volatility of the Chinese market in 2024.

He reflected: “The correlation amongst these stocks has picked up and affected the overall portfolio more than many would have budgeted for.”

Orbis’ Alec Cutler – A lesson in humility

Finally, for Alec Cutler, manager of the Orbis Global Balanced and Orbis Global Cautious funds, 2024 was a reminder that investment outcomes can be far wider than initially expected.

Indeed, as Cutler conceded, several things surprised him in 2024, most notably the continued “stunning performance” of the US mega-tech stocks, none of which featured in Cutler's portfolios.

Similarly, he explained that hedges against the US dollar had seemed prudent, protecting against the risk of a dollar drop following a divisive election. Cutler reflected that following the Republican clean sweep in the US election and the resulting resurgence in US exceptionalism, this predicted drop in the dollar failed to manifest.

“Every year, one way or another, I receive a lesson in humility from markets,” Cutler explained.