As the dust starts to settle post the much anticipated, and in many respects highly controversial, first budget of the new Labour government, it is time to take stock on the implications for the UK economy and the investment case for UK assets.

The headline from the Office for Budget Responsibility’s (OBR) own website sums up the essence of the budget rather well: “Budget delivers large increases in spending, tax and borrowing.”

Specifically, the OBR estimates the budget increases spending by almost £70bn annually, with two-thirds on current and one-third on capital spending. Half will be funded through a £36bn per annum (pa) increase in taxes, taking the tax take to a record 38% of GDP. The rest will be funded by a £32bn pa increase in borrowing, one of the largest fiscal easings in recent times.

The net effect is expected to temporarily boost GDP growth to 2% in 2025 but leave output largely unchanged in the medium term.

Given the radical departure from recent budgets, not to mention legitimate questions over potentially reneging on pre-election manifesto promises, tensions have been running high in many quarters post event.

The general perception, certainly from the business and financial market communities, has been a negative one. That also appears to be the case for the general public, if the latest survey from Ipsos is correct. Net favourable ratings towards both prime minister Kier Starmer and chancellor Rachel Reeves are extremely low currently, having fallen dramatically over the relatively brief time they have been in office.

To be clear, we are not fans of many measures introduced in the budget ourselves. However, in an environment where being negative on all things UK-related appears the default position, we are less concerned, from a medium-term perspective, than many others appear to be. Whilst these measures clearly create headwinds for business and, at the margin, make the UK less desirable than pre-budget as a home for investment, we remain far from convinced the impact will be anywhere near as dramatic as the worst-case fears.

For us, the key remains how the data unfolds going forward, along with listening intently to what our investee companies are saying. In both regards, we find relative reassurance as things currently stand.

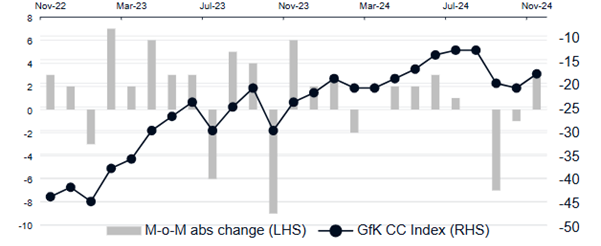

Recent economic datapoints we can point to include a welcome, albeit modest, recovery in the GfK Consumer Confidence index in November, as shown in the chart below courtesy of Shore Capital.

GfK Consumer Confidence

Sources: GfK, Shore Capital

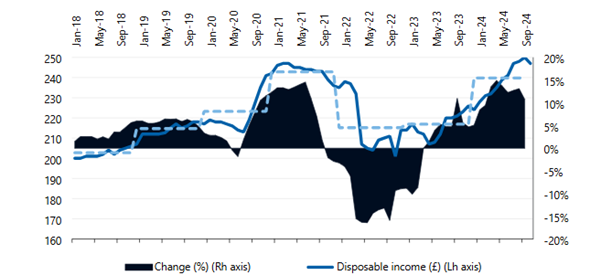

We think this improvement is impressive in the context of all the budget furore, although perhaps it should be expected given continued robust improvements in disposable income, as evidenced by the widely followed Asda Income Tracker highlighted below, again from Shore Capital.

Asda Income Tracker

Sources: Asda Income Tracker, Shore Capital

The VT Tyndall Unconstrained UK Income fund holds DFS Furniture, the UK’s market leader in sofa retailing – a ‘big ticket’ discretionary purchase if ever there was one.

DFS recently issued a trading update covering the period running up to and immediately after the budget. In its full year results, announced on 25 September 2024, it noted an improvement in trading performance in the final quarter of the period, with year-on-year growth in its order intake. “This trend has continued into the current financial year, with order intake remaining in growth over the first 20 weeks of the period,” the company stated.

We are by no means complacent as to the outlook, but equally we prefer to rely on data and evidence rather than alarmist headlines. In that respect, for now at least, we remain constructive as we look to 2025, particularly as regards consumer spending.

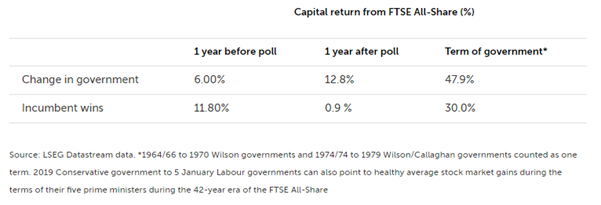

From a stock market perspective, we are reminded that historically it has made surprisingly little difference to market returns whichever party has been in power, with at best a marginal preference for Conservative governments over Labour.

Perhaps more interestingly, as the chart below from AJ Bell highlights, market returns since the inception of the FTSE All-Share index have typically been significantly better following a change in government than when an incumbent party wins, regardless of the party concerned. Perhaps, given the rather inauspicious start, it will be different this time, only time will tell.

Ultimately, we are convinced that starting valuations are the single biggest determinant of likely future expected returns, as changes in valuations typically dwarf the impacts of economic growth and earnings growth over time.

In that respect, it is worth remembering just how cheap the UK equity market has become, at least relative to the mighty US, during the current multi-year period of angst over the UK’s prospects. On a 12-month forward price-to-earnings basis, admittedly only one valuation metric, UK equities now sit at a 50% discount to their US counterparts.

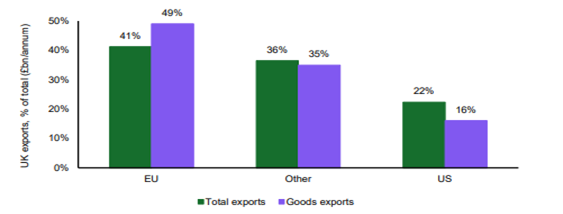

One final thought, directed at those looking to Donald Trump’s new administration in the US and the prospect of trade tariffs as another reason to boycott the UK equity market. The chart below, from Panmure Liberum, offers a useful reminder that, when it comes to goods exports, the US is a relatively small exposure for the UK at just 16% of our total exports, representing just 2% of our annual GDP.

Whilst definitely not insignificant, we are certain there are numerous countries in a far more difficult position than the UK should the worst-case scenario materialise.

UK export destinations in 2023

Source: Office for National Statistics

So it should come as no surprise that we very much intend to ‘keep calm and carry on’. Whilst cognisant of the risk of ‘flogging a dead horse’ as it pertains to investing in UK equities – and the mid-market in particular – we simply cannot ignore what we believe is a generational valuation opportunity in UK equities today.

We understand how we got here, a culmination of all the negative factors that have been thrown at the UK stock market dating back to at least 2016 if not before. How we get out of it will be the interesting bit. We are confident we will, but please do not ask us for ‘the catalyst’.

Simon Murphy manages the VT Tyndall Unconstrained UK Income fund. The views expressed above should not be taken as investment advice.