November was dominated by the US election. Equity markets hailed the president-elect with a rally in smaller companies, which are thought to be the main beneficiaries of Donald Trump’s possible future policies.

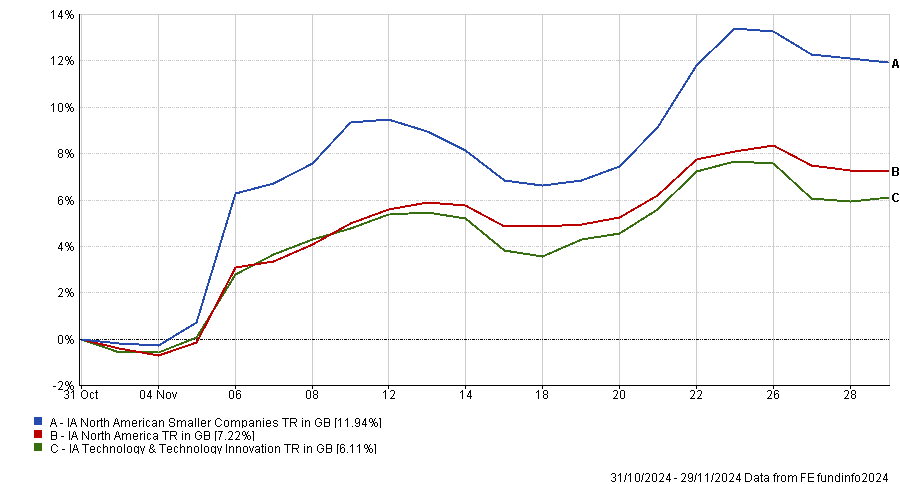

IA North America Smaller Companies was the top sector last month, with an 11.9% return, beating both American large-caps and tech companies, as the chart below shows.

Performance of sectors in November Source: FE Analytics

Source: FE Analytics

Most of the gains in small-caps came shortly after the election, as Fairview Investing director Ben Yearsley noted. Meanwhile, the S&P 500 recorded the 52nd all-time high of 2024, which he said was “simply astonishing”.

The best small-cap funds were Artemis US Smaller Companies (17.2%), Alger Small Cap Focus (15.9%) and Alger Weatherbie Specialized Growth (15.6%).

The weakest performers were Federated Hermes US SMID Equity (8.4%), Barclays GlobalAccess US Small & Mid Equity (8.5%) and Brown Advisory US Smaller Companies (8.6%).

Source: FE Analytics

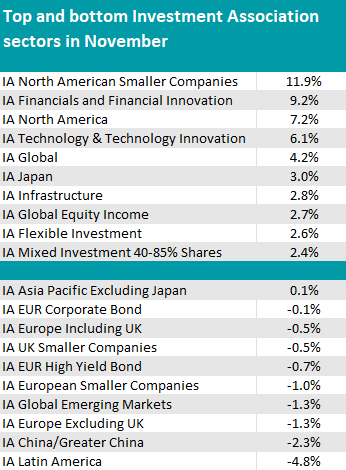

At 9.2%, the second-best sector was IA Financials and Financial Innovation, with the Xtrackers MSCI USA Financials UCITS exchange-traded fund (ETF) in the lead (12.3%) and Jupiter Financial Opportunities behind all its peers (5.9%).

In third position was the IA North America sector, consolidating the US market as the best of the month.

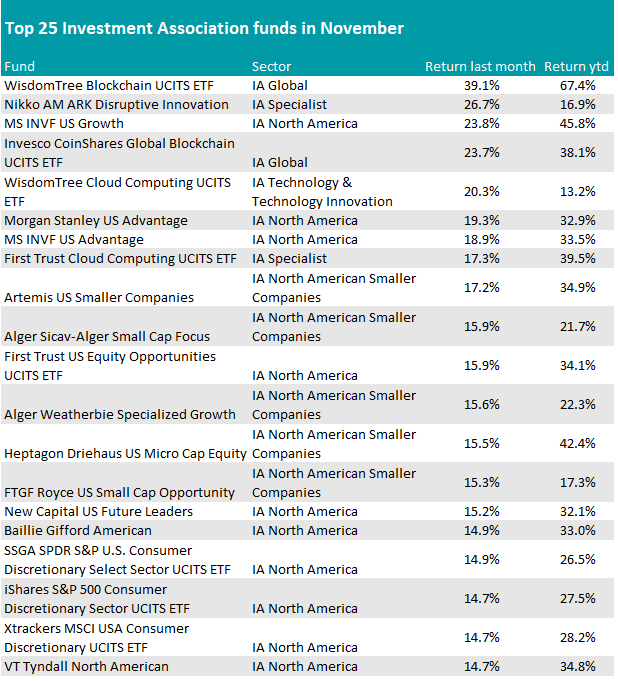

Its prevalence was also evident by looking at the list of funds from across all sectors, where the top names were all US-centric, as the table below shows.

Source: FE Analytics

“The combination of upwardly moving markets and dollar strength meant US equities had a stranglehold on the top 10 – though it was split between North America and North American Smaller Companies,” said Yearsley.

The best-returning fund in November was the $25.3m WisdomTree Blockchain UCITS ETF, a passive vehicle tracking the WisdomTree Blockchain UCITS Index, which contains companies involved in blockchain and cryptocurrency technologies that meet certain environmental, social and governance (ESG) criteria.

Morgan Stanley took up a few positions in the table with three funds represented, the MS INVF US Growth (23.8%), Morgan Stanley US Advantage (19.3%) and MS INVF US Advantage (18.9%).

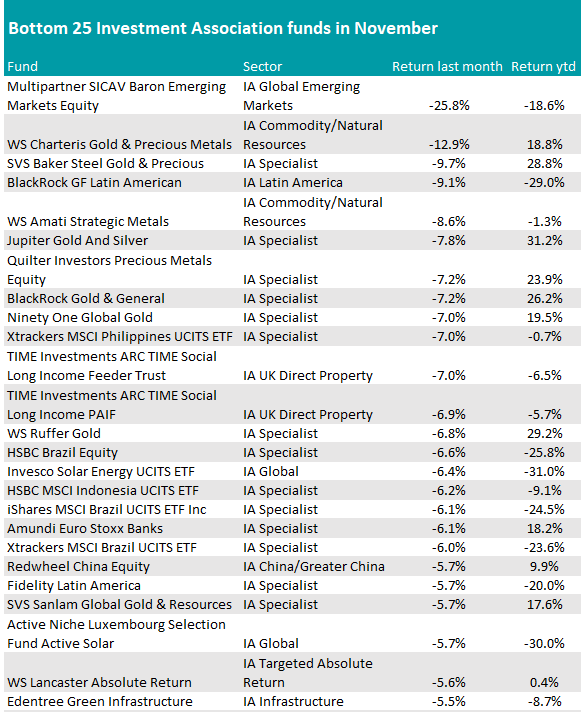

Turning to the bottom of the table, emerging markets underperformed due to concerns over tariffs and a strong dollar, with Latin American funds falling almost 5% on average and the worst performer, BlackRock GF Latin American, falling 9.1%.

The IA China and Global Emerging Markets sectors were also affected, losing 2.3% and 1.3%, respectively. Redwheel China Equity shed 5.7%, while Multipartner SICAV Baron Emerging Markets Equity was the worst across the whole Investment Association universe in the past month.

Europe and European Smaller Companies joined the sorry parade of underperformers with a -1.3% and -1% return, respectively. According to Yearsley, this was due to worries about stagnation and potential fallout from a US-China trade war.

No European funds were in the bottom 25 from the industry-wide table, however, where the dominant themes were gold and precious metals. Gold fell less than $100 and is 25% ahead of last year’s price, yet gold-related equities took a tumble. Charteris Gold & Precious Metals propped the table with a fall of 12.9%.

Source: FE Analytics

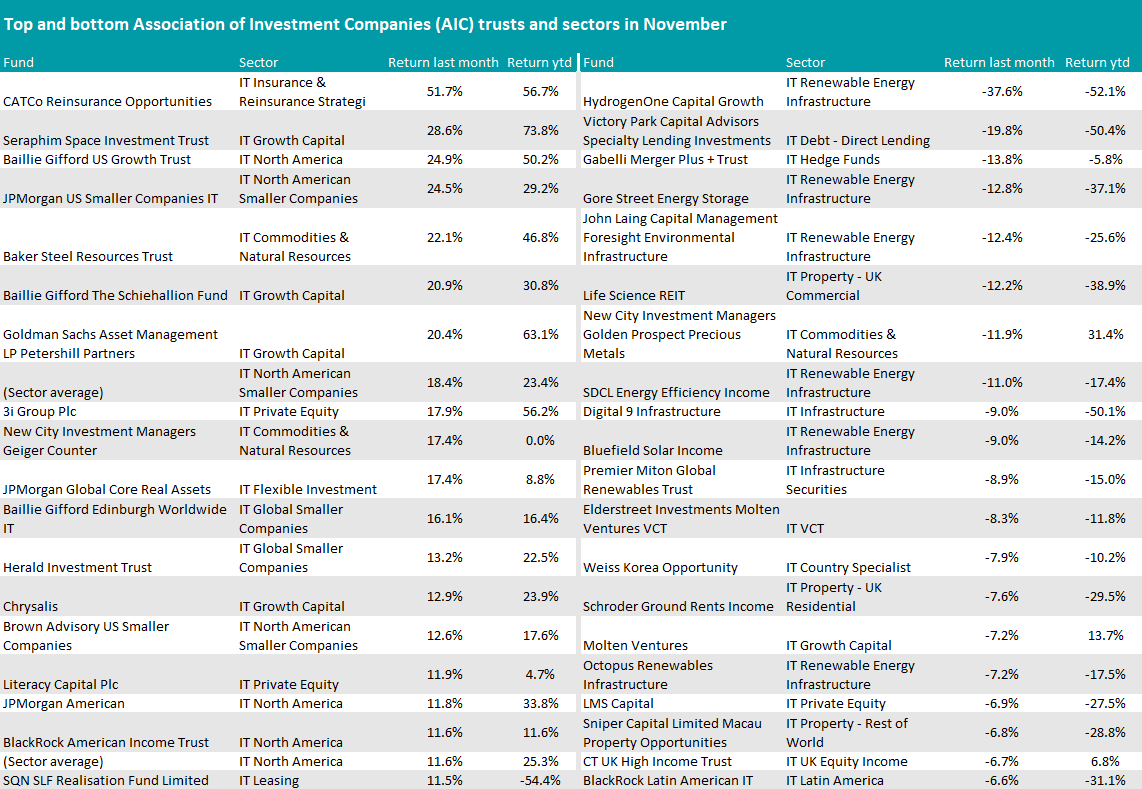

“In the wacky world of investment trusts, it’s been a record year for takeovers,” the director said.

There have been 14 mergers and the number of trusts has fallen from 327 at the turn of the year to stand at 299 now.

“With fundraising tough to come by when many trusts sit on double digit discounts, that number will surely continue to shrink.”

Last month, open and closed-ended products performed similarly, as North American Smaller Companies trusts led the way with an average gain close to 19%.

Source: FE Analytics