AJ Bell was the latest model portfolio manager to remove alternatives and revert to equities and bonds when it shook up its strategic asset allocation last month. This is becoming a trend; St James’s Place removed alternatives from its Polaris fund-of-funds range last year and FE Investments cut the majority of its absolute return exposure in March 2020.

Opinion remains divided, however. Hawksmoor Investment Management, TAM Asset Management and Schroder Investment Solutions hold a range of alternative investments, while Shard Capital uses managed futures funds.

Below, AJ Bell, FE Investments and St. James’s Place explain why they believe equities, bonds and cash are all investors need.

St James’s Place: Alternatives have left Polaris but remain within SJP’s model portfolios

St. James’s Place used liquid alternatives as a bond substitute from the launch of its Polaris funds-of-funds range in 2022 until the first half of 2024, said Hamish Gibberd, portfolio strategies manager. “This allocation to liquid alternatives served our portfolios well through 2022 as we experienced sharp increases in global interest rates and government bond yields.”

After a substantial rise in bond yields, the wealth manager changed its fixed income allocation to neutral from underweight in June 2024 and removed alternatives. Gibberd expects interest rates to remain elevated for some time so the real yield opportunities and margin of safety from bonds have become more attractive.

Gibberd hasn’t ruled out moving the Polaris funds back into alternatives in the future, however. “While we believe the hurdle for liquid alternatives has moved higher in the current yield environment, we see some emerging risks across valuation, market concentration and macro uncertainty,” he said.

“We are therefore interested in exploring opportunities to deepen portfolio resilience on a forward looking basis, which includes researching specific strategies which may add further diversification.”

St. James’s Place still uses alternatives for its model portfolio range, however, where all the portfolios except the most adventurous have a 5% allocation to its SJP Diversified Assets fund.

FE Investments: Cash is the third asset class in a 60/40 portfolio

Rob Gleeson, chief investment officer of FE Investments, used to invest in absolute return funds to achieve a higher return than cash with low volatility. However, in practice he found alternatives to be expensive and routinely disappointing.

“They would be very stable and then they’d do something weird, like a spike or a drop. So you're getting cash-like returns most of the time, apart from sometimes,” he explained. “What you end up getting is not diversification, but unpredictability. What you're effectively signing up for is random returns.”

FE Investments held the Jupiter Absolute Return fund, an equity long/short strategy, at the outset of the Covid pandemic. When the market sold off, “the fund had a net short position so we thought ‘this is going to be fantastic, this fund’s going to really make a fortune’. Only it was long value, short growth, so it lost about 30%,” Gleeson said.

Alternative investments are complex, selecting managers requires a huge amount of time and effort and “your chances of getting lemon are really high”, he continued.

FE Investments’ tactical asset allocation signal has turned positive for alternatives because the risk of inflation rising – and thus bonds and equities becoming more correlated – has increased.

However, there is a third, underappreciated asset class in a 60/40 portfolio, which Gleeson is currently using instead of absolute return funds: cash.

Cash provides a real return of 2% at low cost, given UK interest rates are 4.5% and inflation is 2.5%.

“When rates are as high as this, for us it’s cash, because it's more predictable, it's cheaper and you're not having such a big return drag,” he said.

AJ Bell: ‘Property failed all our tests’

AJ Bell removed infrastructure and property from its strategic asset allocation last month after an annual review.

It had been investing in UK real estate investment trusts (REITs), coupled with shorter-dated index-linked gilts to dampen leverage and volatility, whilst providing a long-term real return.

James Flintoft, head of investment solutions, said: “Looking through the lens of correlation, drawdown and real return: property in a simple, transparent and low-cost form failed all our tests. To us it appears to be just another pro-cyclical asset class that we’ll look at tactically from now on.”

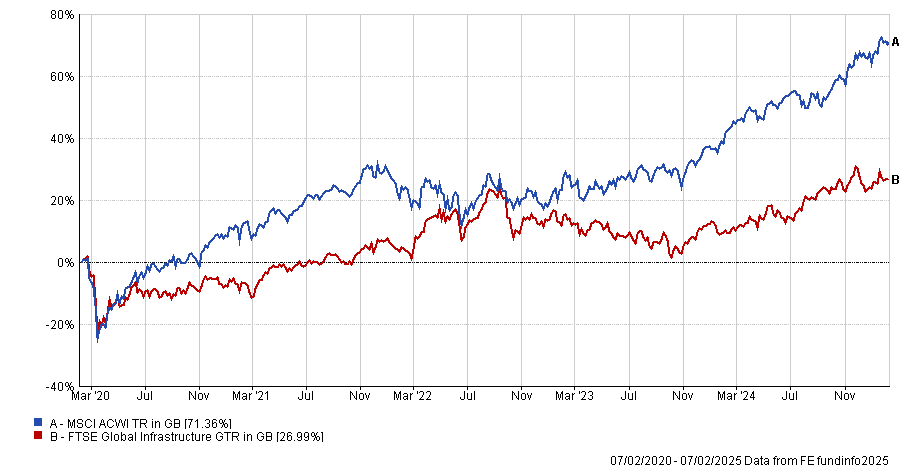

Global listed infrastructure “has failed to offer diversification benefits on several occasions in the past and produced drawdowns greater than that of the global equity market”, he continued. “As with property, we consider infrastructure to be just another equity sector, albeit sometimes lower beta.”

Performance of global infrastructure vs equities over 5yrs

Source: FE Analytics