Murray International has become the newest ‘Dividend Hero’, according to data from the Association of Investment Companies (AIC), after the investment trust upped its dividend for a 20th consecutive year in 2024.

With a yield of 4.47%, the trust has been an above-average performer in the IT Global Equity Income sector over the past one, three and five years, although it has fallen below the average over the past decade.

Formerly run by veteran stockpicker Bruce Stout, who retired last year, the trust is now co-managed by Martin Connaghan and Samantha Fitzpatrick, who had worked alongside Stout on the trust since 2017 and 2019 respectively.

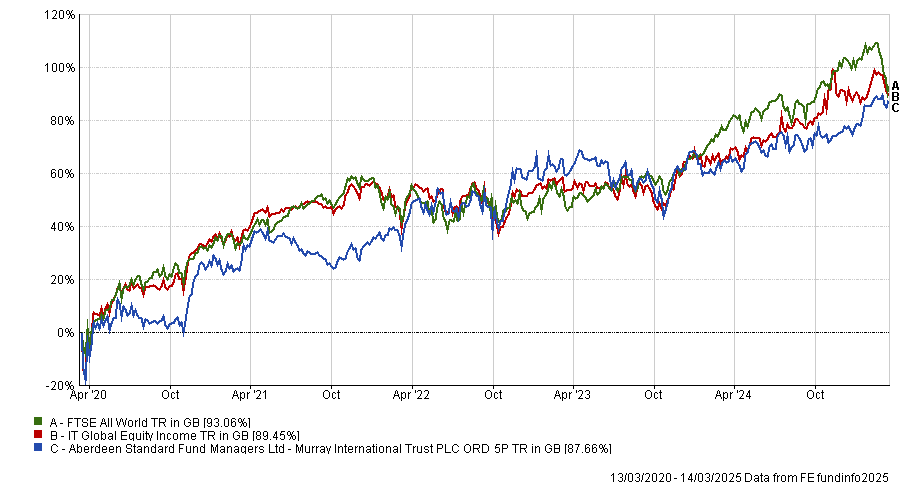

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

In the trust’s latest factsheet, the managers wrote that the global economy presents a “mixed picture”. Although there were “signs of opportunity and resilience”, this was “tempered by persistent risks”.

“While growth remains steady in many regions, structural challenges and geopolitical uncertainties could affect economic activity in the coming months,” they said, highlighting protectionist policies and trade disruptions as key risks.

“Recent rhetoric over tariffs between the US, Mexico and Canada has added to market volatility. Meanwhile, escalating trade tensions between the US, China and Europe have raised uncertainty around global supply chains and inflation, which remains a lingering issue.”

However, Murray International invests in stocks that can deliver growing income and make capital returns, they noted, with an emphasis on diversifying across geographies and sectors.

At present, the trust is underweight in the US (31.3% of the portfolio) relative to the FTSE All World index, with overweights to Europe excluding the UK (25.1%) and Asia excluding Japan (22.9%).

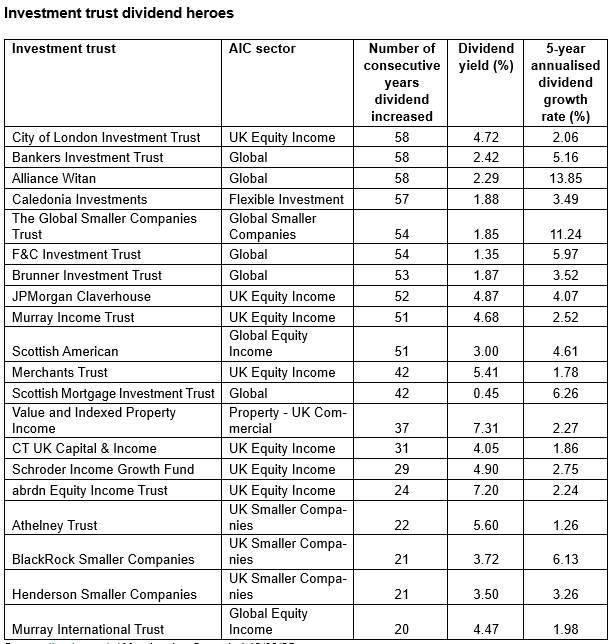

This year, the ‘Dividend Hero’ title was awarded to 20 investment trusts in total, the same as last year, after Alliance Trust and Witan Investment Trust (two heroes) were merged.

The newly created Alliance Witan has the joint longest track record, with 58 years of dividend rises, as the resulting trust kept Alliance’s record. Witan had previously been on the list with 49 consecutive years, meaning it would have broached the half-a-century mark in 2025 had it remained its own entity.

City of London Investment Trust and Bankers were the other two trusts with 58 years, followed by Caledonia Investments with 57 years. Half of the 20 names listed below have increased their dividends for 50 or more consecutive years.

Source: AIC

Annabel Brodie-Smith, communications director of the AIC, said: “Investment trusts are particularly suitable for income investing over the long term. They can retain up to 15% of the income they receive each year and this reserve of income can be used to boost dividends when markets are tough. This allows investment trusts to smooth their flow of dividends and produce these long records of dividend growth.

“Our dividend heroes have shown remarkable resilience whilst continuing to raise their payouts during recent and historic high inflationary periods in the 1970s, the recession of the 1990s, the global financial crisis in 2008 and the pandemic. Whilst dividends are never guaranteed, investment trusts’ dividend hero track records are exceptional.”

While many trusts come from traditional income-paying sectors, such as equity income specialists, broader global equity strategies and multi-asset portfolios, four small-cap trusts also made the list.

Three came from the IT UK Smaller Companies sector (Athelney Trust, BlackRock Smaller Companies and Henderson Smaller Companies), while the longest track record belonged to the sole constituent of the IT Global Smaller Companies sector: The Global Smaller Companies Trust.

Nish Patel, fund manager of the trust, said: “Investors in smaller companies tend to focus on prospects for capital growth but there is a wealth of opportunity in the more mature end of the small-cap spectrum for investors looking for a balance of capital growth and long-term income growth.”