The first tenet of junior ISA (JISA) investing is that young children have long time horizons, so can afford to take risks and ride out stock market volatility. This is why most wealth managers and financial advisers recommend putting most, if not all, of a child’s JISA into equities.

For instance, wealth manager JM Finn uses its YFS JM Finn Adventurous portfolio for clients’ JISAs. The strategy has 95% in equities, then 5% in diversifiers such as government bonds, property and gold.

Lucy Coutts, an investment director at JM Finn, said: “Time is the most important word in investment. Nothing else really matters.”

Rob Morgan, chief investment analyst at Charles Stanley, concurred. “When investing for 10 years plus, being heavily, or entirely, weighted to equities is often appropriate. Enjoying the compounding returns of growing companies will likely result in the best returns over long periods.”

Nonetheless, the asset allocation chosen will depend on the young person’s age and what they intend to do with the money once they turn 18, said Victoria Clapham, investment manager at Manorbridge Investment Management.

“Younger children should be able to handle higher risk due to the longer period to weather market fluctuations. As the child nears 18, financial needs like buying a car or university fees may become more pressing.”

It might make sense to slowly de-risk by moving into bonds or cash a year or two before the young person turns 18 if they intend to withdraw the money straight away, said Rob Burgeman, senior investment manager at wealth manager RBC Brewin Dolphin. “You don’t want to be fully invested the day before it’s time to cash in.”

If, however, the JISA is going to be used for a deposit on a first property, the young person may wish to remain invested into their twenties or thirties.

When it comes to picking funds, “simple and cost-effective often wins the race”, Burgeman said.

“Over the next 18 years, it’s impossible to say what index or market will be the best to own – it’s like trying to pick winning lottery numbers. For that reason, a global fund is probably the best approach to take. It will ensure you have balanced exposure to all the world’s markets at an affordable rate, meaning you benefit from the growth of the global economy without the ups and downs involved with individual markets.”

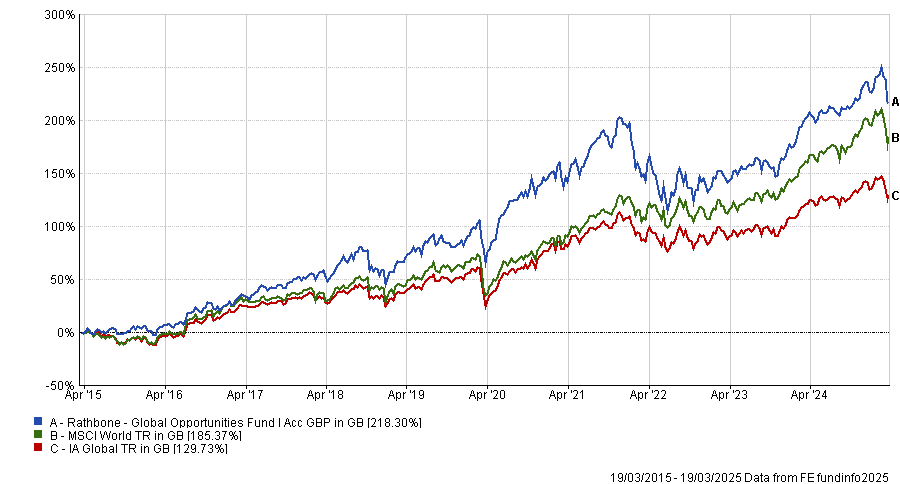

The Rathbone Global Opportunities fund is a good place to start, according to Tom Stevenson, investment director at Fidelity International. “The fund’s investment strategy prioritises innovative businesses with strong potential for long-term growth, making it ideal for building wealth over a child’s 18-year investment horizon.”

FE fundinfo Alpha Manager James Thomson and Sammy Dow “take an out-and-out growth approach”, he said, with a concentrated portfolio of companies they believe are future winners.

“They think that to be successful a business must offer something that others can't match – a star quality. It must also be easy to understand, different to its competitors, durable to change and difficult to imitate, as well as being able to grow rapidly without running out of money or overstretching its resources.”

Performance of fund vs sector and MSCI World over 10yrs

Source: FE Analytics

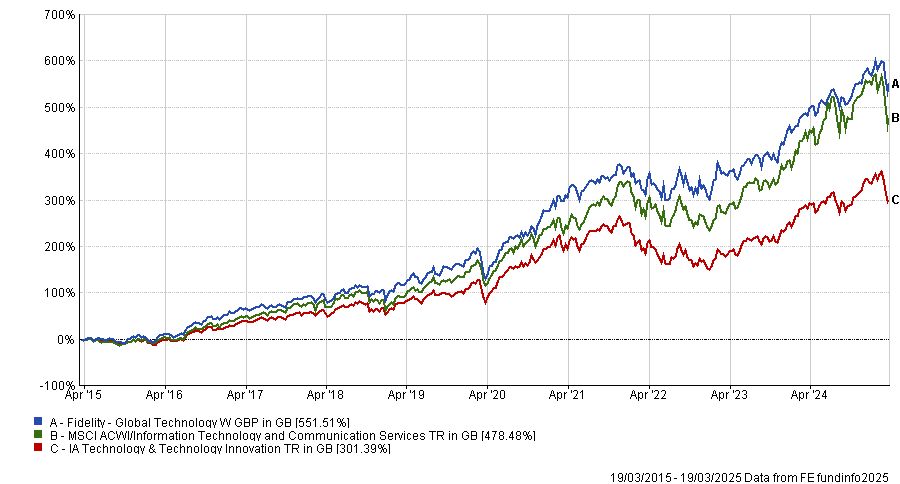

Stevenson also suggested the Fidelity Global Technology fund for “families looking to capitalise on the long-term growth potential of the technology sector”.

“The manager, Hyun Ho Sohn, looks for growth companies focused on innovations or disruptive technologies, cyclical opportunities with strong market positions, or special situations that are mispriced with recovery potential,” he said.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

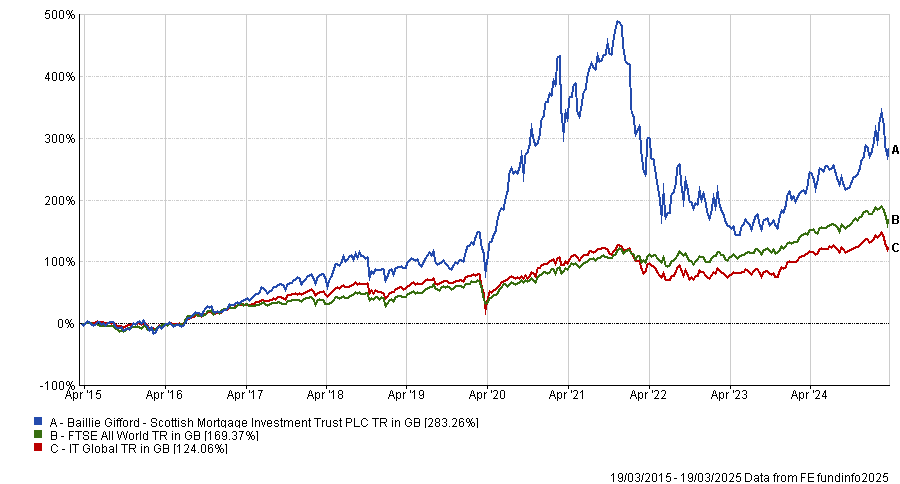

Clapham and Morgan both highlighted Scottish Mortgage, with Clapham praising the trust’s forward-looking approach.

“Whilst it contains large US technology names such as Nvidia, Tesla and Netflix, its tech exposure is not solely focused on the US, with holdings also in TSMC and ByteDance. China’s competitiveness in areas such as artificial intelligence is something I feel a young investor would benefit from having exposure to,” she said.

“Its largest holding is SpaceX, the private space transportation company founded by Elon Musk. The structure of investment trusts allows for private company exposure which is a key benefit, as many high-growth companies are choosing to stay private. Elsewhere, the trust also provides access to areas such as payment platforms, healthcare and cybersecurity.

“The trust has also been the top performer in its sector over one year, recovering some of the ground from a difficult 2022. However, even after this, the share price stands at an 8% discount to the underlying value of the assets, making it an opportune time to invest.”

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

However, Morgan noted this trust is not for the faint-hearted, as it can be quite volatile and its strategy of backing high-growth companies is risky.

“At times a good deal of optimism can be factored into the share prices. This means any disappointing news can be severely punished, especially in a market downturn. In addition, there is gearing (borrowing to invest) within the trust, which serves to exacerbate the price movements of an already-adventurous portfolio,” he pointed out.

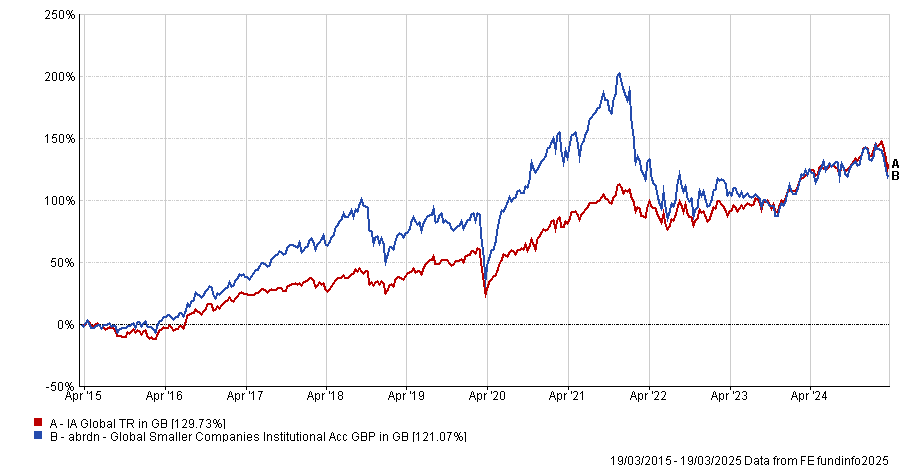

Paul Angell, head of investment research at AJ Bell, stuck with a global remit but suggested investing in smaller companies, which have outperformed large-caps over the very long term.

“Recent years have been more challenging for smaller companies, partly due to the rising, and now structurally higher, interest rates. That said, a period of falling rates could provide the catalyst for a revival, given the lower financing costs, increased profitability and reduced discounting of future revenues that this would bring,” he said.

His choice was abrdn Global Smaller Companies. The nine-strong investment team uses a propriety screening tool called ‘The Matrix’, which weights stocks across four factors: quality; growth; value; and momentum.

“The team then undertakes fundamental analysis on the shortlisted companies where they look for strong company balance sheets, as well as sustainable earnings growth that is not reliant on external factors,” he explained.

Performance of fund vs IA Global sector over 10yrs

Source: FE Analytics

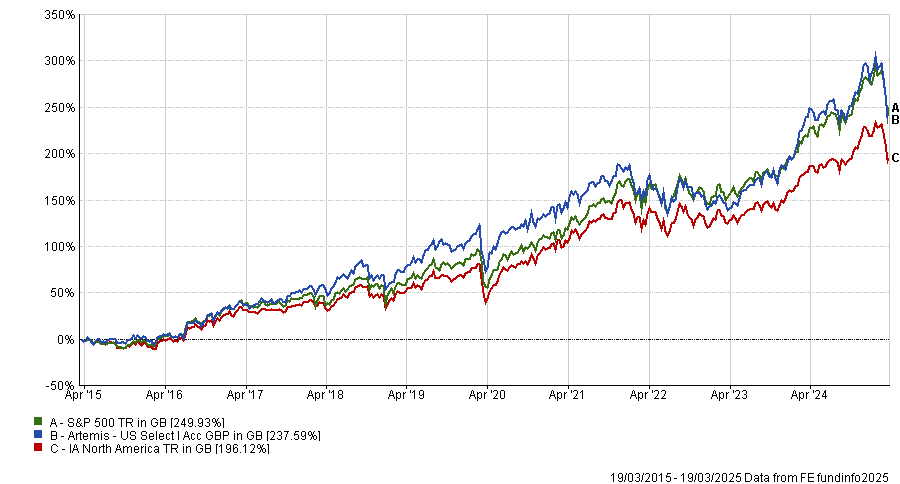

For investors looking to capitalise on the US equity market’s long-term growth prospects, Angell proposed Artemis US Select, managed by Cormac Weldon and Chris Kent.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“The managers are style agnostic in their investment approach, assessing the fundamental strengths of businesses. They seek to find businesses which they assess to have a two-to-one risk/reward potential. This often results in the fund displaying a higher growth profile than the index,” he explained.

“The fund has enjoyed a return to form in recent years, with stock selection within the Magnificent Seven tech companies being particularly beneficial.”