If there is one asset class that can emerge as the winner from last week’s market upheaval caused by President Trump’s tariffs it is emerging market (EM) debt, according to Mike Riddell, manager of the Fidelity Strategic Bond fund, who has upped his foreign exchange (FX) exposure in the region to the highest level of his career.

“Looking at valuations in risky assets around the world at the moment, EM local currency and FX are screaming cheap. We have been adding quite a bit to both – this is becoming one of our main conviction positions,” he said.

Riddell’s weighting to local currency emerging market debt has reached 16%, a “very large off-benchmark position” against the Bloomberg Global Aggregate index, which the manager adopted as the fund’s benchmark when he took ownership of the portfolio in the summer of 2024 following a long career at Allianz.

“It’s a defensive benchmark containing mostly global government bonds, some corporate debt and very little emerging market exposure.”

“At least half of our 16% is FX unhedged, so we are running emerging market currency risk as well as liking EM local bonds. This is the most emerging market foreign exchange that I have ever had in my career,” he declared.

His bet is based on how the asset class behaves in relation to the dollar and to US monetary policy. The last emerging market bull run was between 2001, when the Federal Reserve began to cut rates aggressively, and in 2013, when quantitative easing came to an end and the dollar began to strengthen.

“If we see a weaker dollar and weaker growth in the US, and if the Fed cuts interest rates by more than currently expected (and there's not much in the way of cuts priced in), then emerging markets could really fly,” the manager said.

He takes a different view from that of the market, which is pricing in interest rates to be cut to 3.5% against the Federal Reserve estimates that neutral interest rates in the US are about 3%.

“The market is not even pricing interest rates to go to neutral, only to stay elevated and policy to stay tight. If there are downside risks to US growth, why should the Fed stop at very high interest rates? I could easily see the Fed cutting rates to 2.5% or 2%, if we get a growth slowdown and as inflation dissipates from next year, which I think is most likely”.

This could play into emerging markets’ favour and change the perception that’s been around since 2013 that it is a niche and risky asset class.

“EM feels niche now because it is completely unloved. We’ve had a 10-year dollar bull market, which means EM has been terrible, but now it could well be an inflection point where we go the other way.”

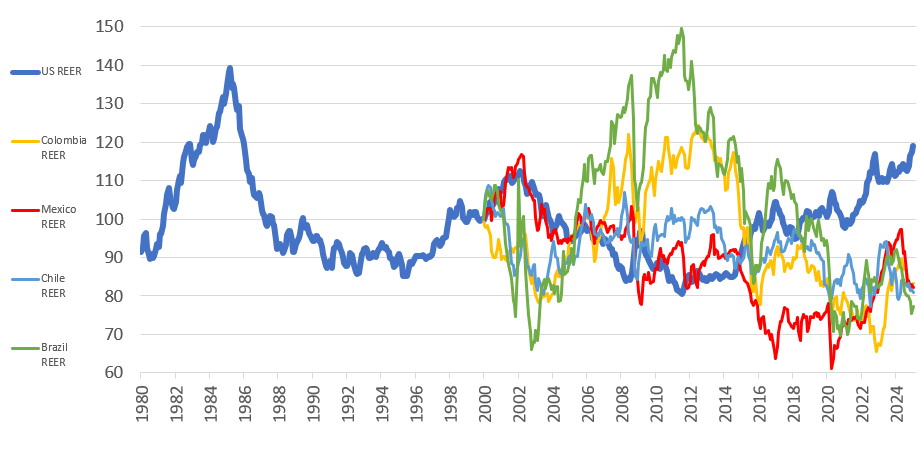

Another significant difference between today and the 2010s, the last time emerging markets were popular, is valuations, which were “completely obscene” back then, said Riddell, as the chart below shows.

Valuations of US dollar and Latin American currencies since 1980

Source: Fidelity

“Now, looking at global fixed income, I think it's the place to be. It's where the real yields, frankly, are at crisis levels when there is no crisis.”

As examples, the manager mentioned Brazil and Columbia, which have inflation rates of around 5% and local currency bonds yielding from 13% to 15%, and Indonesia, which has negative inflation (-0.1%) and bonds yield at 7%.

“The amount of juice you have in developed markets is nice and historically interesting, but EM is just on another level. Valuations are so cheap that you could combine not just a cyclical rally, but also more comprehensive multi-year, structural rallies. I'm absolutely an EM cheerleader,” he said.

As for the developed market that Riddell is most interested in, he is seeing particularly attractive valuations in the UK.

Concerns around its fiscal position have caused major underperformance of the gilt market in the past couple of months and, although there has been some improvement in UK economic data, Riddell’s assumption is that it's not going to persist, keeping yields elevated.

“UK interest rates are still very restrictive with very few rate cuts priced in, while a lot of inflationary pressure is still there. Wage growth is too high. That's why we are bullish on the UK, because gilt yields are so elevated versus other developed markets,” he concluded.