Less than a third of IA UK Equity Income funds have managed to grow investors’ cash pot while also paying out dividends over the past five years, according to a Trustnet study.

One of the most popular ways for investors to pick an income fund is to look at the yield and work out the amount they might be paid in dividends each year. This is typically then used to supplement an income or pension savings.

Yet it is crucial not to ignore capital growth too. After all, if an investor takes £500 out each year from an initial £10,000 pot, that £500 becomes a larger percentage of their savings as the cash pot get smaller and smaller.

So investors should focus on both the income paid and the capital gains, as both are crucial parts to the income puzzle. Below, we look at the funds best for both in the IA UK Equity Income sector.

In total, just 19 funds in the peer group (29.2%) managed to make investors money once dividends were stripped out over the past five years. To calculate this, we took the dividends paid on an initial £10,000 investment on 31 December 2019 through to December 2024. We then subtracted this from the total return of a £10,000 investment made over the same period.

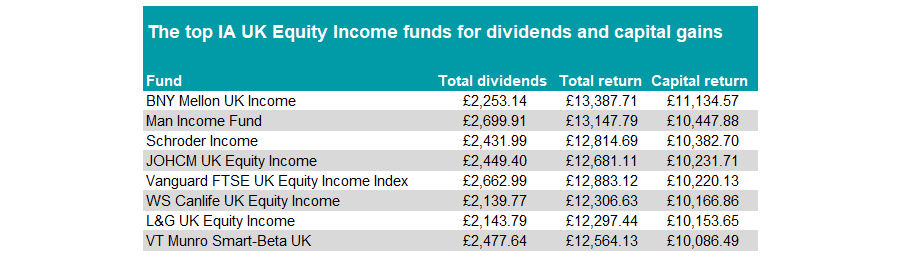

But this includes those with lower payouts that perhaps focused more on capital returns. So we then took the average income paid across the sector to leave just eight funds that managed to pay an above-average income of £2,120.84 while also making capital returns.

Source: FE Analytics

The top performer was BNY Mellon UK Income, which paid out £2,253.14 over the five years to the end of 2024. It managed to also grow the cash pot by £1,134.57 (assuming all dividends were withdrawn), giving a total return of £13,387.71 on an initial £10,000 investment.

Managed by David Cumming and Tim Lucas since 2022, the £1.6bn fund was previously managed by Emma Mogford. The managers make full use of the fund’s overseas allowance, with some 18.4% of the portfolio in European companies listed in France, Germany, Belgium and the Netherlands.

Its bread and butter is the UK, however, where 81.2% of assets are invested, with oil giant Shell (9.2%), pharmaceutical company GSK (7.2%) and banking group Barclays (6.1%) its top holdings.

The fund has consistently upped its payouts each year we looked a, culminating in in a £558.21 dividend in 2024 for those that first invested at the end of 2019.

In second place was the £1.9bn Man Income fund, headed by FE fundinfo Alpha Manager Henry Dixon. The value-oriented strategy paid the most of any fund on the list in dividends (£2,699.91), which accounted for most of the total return. It would have paid out £651.96 to investors who put £10,000 into the fund in December 2019.

It was not a one-trick pony, however, managed to increase investors initial starting pot by £447.88 over the five-year period.

Recommended by AJ Bell analysts, they said it “disciplined valuation investment approach is a real benefit here”.

“Additionally, [Dixon’s] analytical mind-set provides a level of pragmatism that allows the fund to navigate through a variety of market conditions,” they said.

However, as the fund invests across the capitalisation spectrum it can look very different to the benchmark and “can be susceptible to bouts of volatility”, they noted.

In third place was Schroder Income, headed by Nick Kirrage and Andrew Evans. Kirrage worked on the fund for many years with co-manager Kevin Murphy, who left Schroders to join Brickwood Asset Management last year. Kirrage returned to the Schroder Income fund in 2024 having previously moved over to the global equity team.

Analysts at Hargreaves Lansdown, which has the fund on its buy list, said Kirrage and Evans “have the experience and support to deliver good long-term returns to patient investors”.

“The fund could diversify an income-focused portfolio or offer value exposure to a more general portfolio,” they added.

It has paid out £2,431.99 in dividends over the past five years, while growing the cash pot moderately by £382.70.

JOHCM UK Equity Income, managed by James Lowen and Clive Beagles, was next, while the passive Vanguard FTSE UK Equity Income Index rounded out the top five.

WS Canlife UK Equity Income, L&G UK Equity Income and VT Munro Smart-Beta UK completed the list.