Young children have a lengthy investment horizon so can afford to stomach the volatility of equity markets in return for long-term growth. Therefore, wealth manager JM Finn uses its YFS JM Finn Adventurous portfolio for clients’ JISAs, which has a strategic asset allocation of 95% equities, then 5% in diversifiers such as government bonds, property and gold.

JM Finn’s current macroeconomic view is also supportive of a high equity allocation for investors with the greatest risk tolerance, said fund manager James Godrich.

“In a world of reasonable nominal GDP growth supported by sticky inflation, you need to own assets which are inflation-linked. If you're owning long-dated fixed income or too much cash, we think you're going to really struggle to maintain pricing power. So we think you have to own equities,” he explained.

“We also do accept that it's a volatile world we live in, so we don't think that's going to be an easy journey. How we try to slightly smooth out volatility is within our bond or non-equity element.”

At present, that 5% non-equity allocation is mostly held in government bonds with a duration of five to six years.

Godrich has flexibility to tweak the asset allocation and is currently a couple of percent below the equity target.

Within equities, JM Finn is overweight the UK where valuations are attractive, slightly overweight Europe and underweight the US. “Everybody seems to hate the UK market [and] that just provides opportunities for a longer-term investor,” he said.

For instance, he described AutoTrader as “a fantastic UK business with unbelievable margins and really strong growth rates” on a reasonable valuation. “If you look at the financial metrics, this comes up as good as some of the US tech businesses,” he added.

The portfolio’s largest UK holdings are Burberry, GSK and Games Workshop.

JM Finn also favours the UK due to its higher weighting towards financials, oil & gas, and materials, which should do well in the current macroeconomic environment.

The wealth manager expects nominal GDP growth to be quite strong, driven by sustained inflation – which it believes will be stickier than consensus expectations due to expansionary fiscal policy.

“In that world, you want to own a lot of hard assets, things like oil & gas companies, like minerals. Longer-term interest rates might get pushed a bit higher – now that's a really nice world for financials,” he said.

The UK overweight is a small tilt because JM Finn prefers not to deviate extensively from benchmark allocations. “We live in a in an uber-volatile world where there's a lot that's unpredictable from a macro perspective, so we think it makes sense to tilt around the asset allocation, rather than to take massive, swingeing bets,” Godrich explained.

JM Finn has a very small overweight to Europe, which faces structural challenges, such as setting an appropriate interest rate. “Often the southern European states might need a different interest rate than northern European states,” he noted.

His short-term outlook is positive, owing to attractive valuations, increased government spending and the new German government’s stimulus plans. And as a stock selector, “you're not literally just buying Europe, you're picking the best [companies] in Europe”, he pointed out.

JM Finn bought Technogym about eight weeks ago, which makes sports equipment and is an Italian family-owned company.

Technogym users swipe their cards into weight machines, which record their workouts and statistics. The machines inform them how hard they are working and recommend when to increase the weight. Once gym-goers are plugged into the system, they want to continue using Technogym equipment, he said.

“It’s a net cash business; it generates a huge amount of money. It’s got really good returns on capital. It ticks all the boxes and it’s attractively valued,” he explained.

JM Finn’s slight underweight to the US has been beneficial during the first quarter of this year, when “markets in the US have completely rolled over”, he continued. “Our benchmark is down 3% and our funds are down 1.5% and a lot of that is down to macro positioning, where the UK and Europe have performed quite well.”

JM Finn has a counter-cyclical investment process which involves buying into market weakness to take advantage of lower valuations. In recent weeks, the firm has been increasing its US equity exposure as the market has fallen, whilst maintaining its underweight to the region.

If the market continues to fall then JM Finn will benefit in relative terms from its underweight allocation; whereas if the market has bottomed out, then its portfolios will have bought in at the lowest point and should gain from there. “We think we get the best of both worlds, in terms of short-term risk management,” Godrich explained.

The adventurous portfolio uses a blended approach: investing in stocks directly in the UK and Europe; using passive exchange-traded funds (ETFs) for North America; and actively managed equity funds for Asia Pacific, emerging markets and Japan.

“In the UK, we think we have the skills, knowledge, resources and ability to meet management teams that allow us to get exposure through direct equities,” Godrich said.

“But in areas like Japan or emerging markets, we think there's an opportunity to generate active returns but we're not best placed to do it because we're probably not going to go and meet the management teams in Japan. We don't speak Japanese. They're in a different time zone. It's actually a different accounting regime, we'd struggle to understand some of the accounts. So we use active funds there.”

The wealth manager opts for passive funds in the US because of the long track record of active fund managers underperforming there. “A lot of information gets disseminated, there's lots of analysts covering all the equities, so actually it's very difficult to have that edge,” he said.

When selecting external managers for Asia Pacific, emerging markets and Japan, JM Finn combines funds with different styles to avoid specific-style risks.

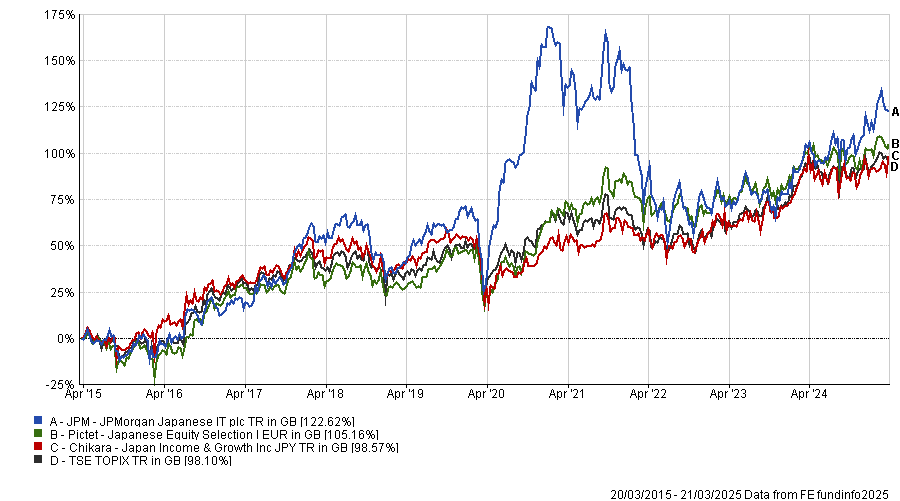

In Japan, it uses the JPMorgan Japanese investment trust for growth, the Chikara Japan Income & Growth fund for a value tilt and Pictet Japanese Equity Selection, which has a more blended approach.

Performance of funds vs benchmark over 10yrs

Source: FE Analytics

JM Finn then tweaks the allocations between these three managers depending on which style it expects it outperform in the near term.

“This is a living, breathing thing. Every day we're making decisions on these portfolios so we want to retain that bit of flexibility and having those three different funds allows us to do that,” Godrich said.