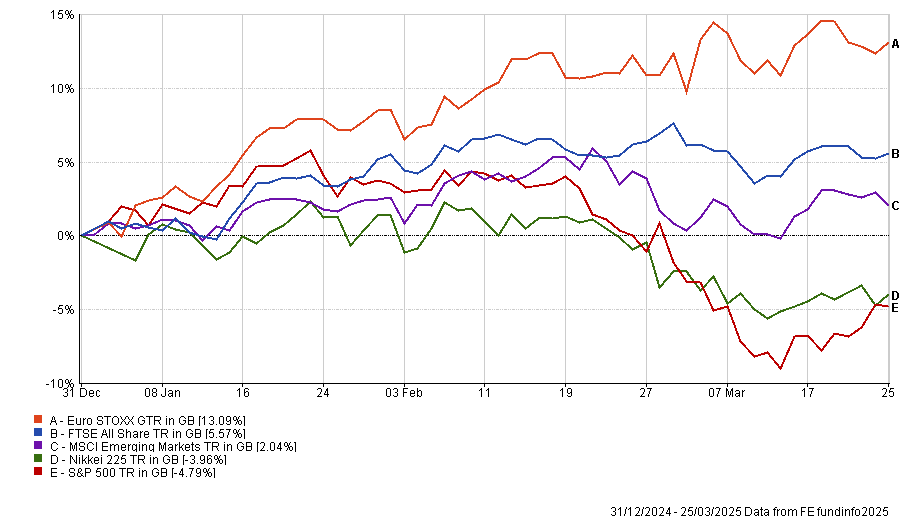

Global equity markets have had a tumultuous start to the year.

The elephant in the room has been president Donald Trump’s proposed implementation of tariffs on key trading partners, which has caused overseas investors to take a more cautious stance on the US.

Indeed, the S&P 500 has slid by 4.8% year to date and every single fund in the IA North America and IA North American Smaller Companies sectors is down since Trump’s inauguration.

Performance of stock market indices YTD

Source: FE Analytics

While Europe has been the big winner so far, the UK is following suit, said Nigel Yates, portfolio manager at AXA Investment Managers, and offers a “haven should global economic data weaken”.

“This is a new era for world economic activity and has the potential to create difficulties but also is likely to promote a level of introspection not seen in half a century,” he added.

For Helen Jewell, chief investment officer of BlackRock Fundamental Equities, the composition of the UK index goes part way towards explaining why it has started the year strongly.

The FTSE All Share is composed primarily of “defensive and service-orientated businesses” with low exposure to the “ups and downs of global trade”, she said. The index is dominated by businesses such as RELX, London Stock Exchange Group and AstraZeneca, which are tied to multinational megatrends like artificial intelligence, rather than global trade.

These businesses possess “vast proprietary data sets”, which allow them to build on strong fundamentals, she noted.

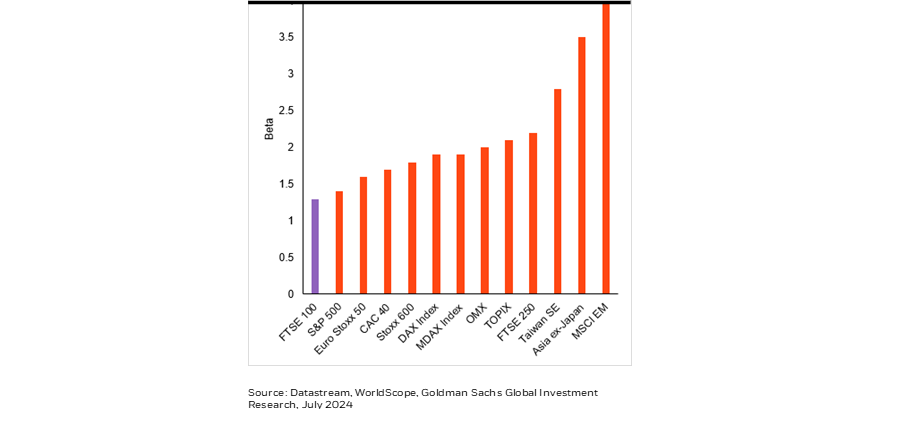

As a result, due to the type of companies in the index, the UK has had the lowest correlation to global trade levels compared to other stock market indexes since 1997. “Investors worried about US exceptionalism may look at the UK’s cheap valuations and defensive qualities and see an opportunity to diversify”, she stated.

Trade beta of stock market indexes

Despite attracting “less media attention”, Jewell said the UK is rapidly becoming a “haven amid global trade tensions”.

Alan Dobbie, co-manager of the Rathbone Income fund, thinks investors “should not be surprised” by the UK’s outperformance this year.

He also believes the structure of the FTSE All Share explains its relative stability. Defensive sectors such as Consumer Staples and Healthcare represent 13.7% and 11.6% of the FTSE All Share, meaning a large component of the UK’s revenue is insulated from global trade fluctuations.

“This allows the UK market to perform relatively well when global macroeconomic worries take hold and defensive sectors outperform,” he said.

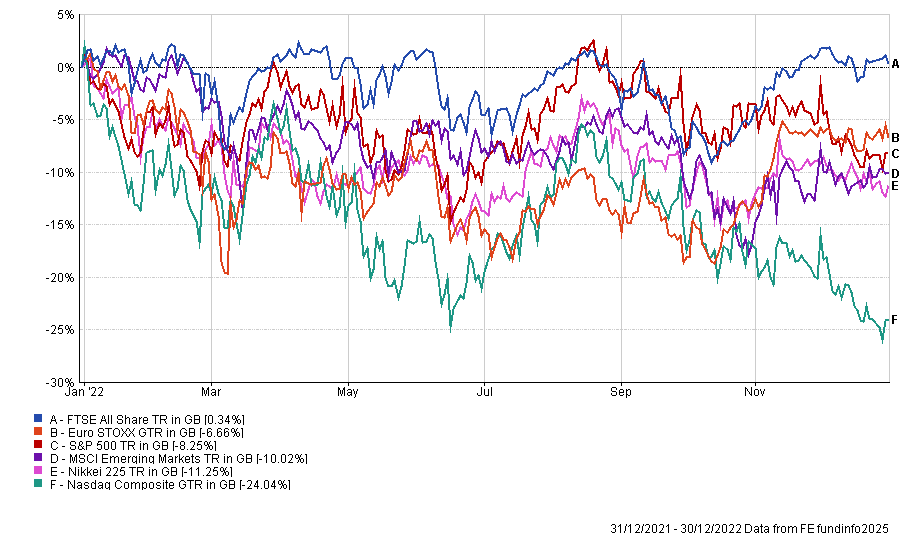

For example, he argued this was not the first time the UK differed significantly from other major stock markets; in 2022’s bear market, the FTSE All Share delivered a small positive return, while the Nasdaq slid by almost 25%.

Performance of stock market indexes in 2022

Source: FE Analytics

Peter Hewitt, manager of the CT Global Managed Portfolio Trust, further supported this. Despite the UK’s reputation as an “open economy”, he explained most of the FTSE All Share “does not reflect either the domestic or even the wider global economy”.

Over half of the index is accounted for by its top 10 constituents, of which very few are sensitive to global trade volatility.

For example, Rolls Royce and BAE Systems are the only two manufacturers in the top 10. While these businesses have cyclical elements susceptible to global volatility, both are also involved in defence contracting, which is “about to experience a prolonged upturn in fortunes”.

Meanwhile, AstraZeneca and GSK represent more than 10% of the index but are impacted more by the “sale of key drugs or whether new drugs are being approved” rather than fluctuations in global trade.

“The point is, the UK economy is less sensitive to global trade than investors might think, and so the UK stock market will move to the top of the performance league table during periods of heightened uncertainty”, he concluded.

Changes in investor sentiment and priorities also have a role. Gervais Williams, manager of The Diverse Income Trust, said Trump has introduced “all sorts of open-ended uncertainties” to global markets.

Williams said equity income stocks are becoming more appealing in this more volatile environment because they have a “degree of resilience when the global economy is unsettled”. This is why Europe and the UK – traditional dividend markets – performed so well this year.

While global equity markets remain volatile, Williams expects flows into equity income funds and stocks will continue, driving further outperformance for defensive markets such as the UK.

“Normally, most of the market’s return is generated by good and growing dividends. In our view, all that is happening is that global equity markets are returning to past norms, and as such, the new trend of UK outperformance may persist for many years from here,” he concluded.