Increased defence spending has become a common theme as nations face up to heightened geopolitical tensions and some significant shifts in the global order, leading to potential investment opportunities in defence stocks.

Data from the Stockholm International Peace Research Institute shows global defence spending has grown at an annual rate of 4.2% since 2020 – some four times faster than pre-pandemic levels. The institute also expects spending to accelerate to a 5% annualised rate by 2030, to reach $3.4trn.

Rob Morgan, chief investment analyst at Charles Stanley, said: “In the relatively peaceful post-Cold War era, governments around the world were able to implement large-scale cuts to defence budgets and redirect these funds elsewhere in the economy – a process frequently referred to as the ‘peace dividend’.

“However, the ongoing war in Ukraine, tensions between China and Taiwan, and various Middle Eastern conflicts in recent years has drawn increased focus on how this sustained underinvestment has hindered domestic defence capabilities.”

Below, Charles Stanley highlights five exchange-traded funds (ETFs) that offer exposure to defence companies and explains how they differ.

VanEck Defense

First up is the VanEck Defense UCITS ETF, which tracks the MarketVector Global Defence Industry index. When it was launched in March 2023, it was the first defence ETF that investors based in the UK and Europe could buy.

It invests in companies exposed to a range of defence themes, including aerospace and defence products and services, communications systems, unmanned vehicles, cybersecurity software and e-authentication/biometric identification.

The largest holdings are intelligence software platform builder Palantir Technologies, aerospace and defence conglomerate RTX Corporation and cybersecurity and data protection firm Thales.

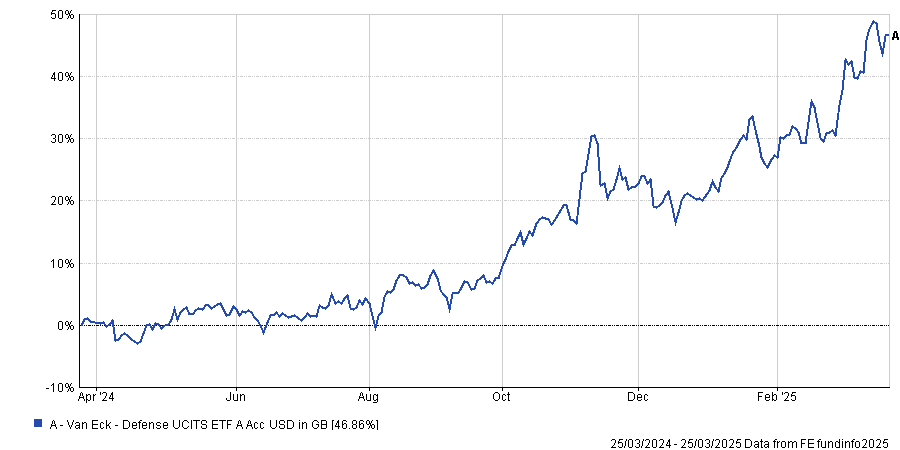

Performance of VanEck Defense over 1yr

Source: FE Analytics

Morgan said: “Although the ETF sits at the top end in terms of product fees (OCF: 0.55%), first-mover advantage has benefited VanEck with the ETF having taken a large share of flows with the product now standing at around $2.3bn in size.”

HanETF Future of Defence

Tracking the EQM Future of Defence index, HanETF Future of Defence UCITS ETF invests in global companies generating revenues from NATO and non-NATO ally defence and cyber-defence spending.

Its industrial defence component includes companies that derive more than 50% of revenues from the manufacture and development of military aircraft and/or defence equipment. There is no revenue screen for the cyber component but companies must have at least two contracts with a Nato+ member nation.

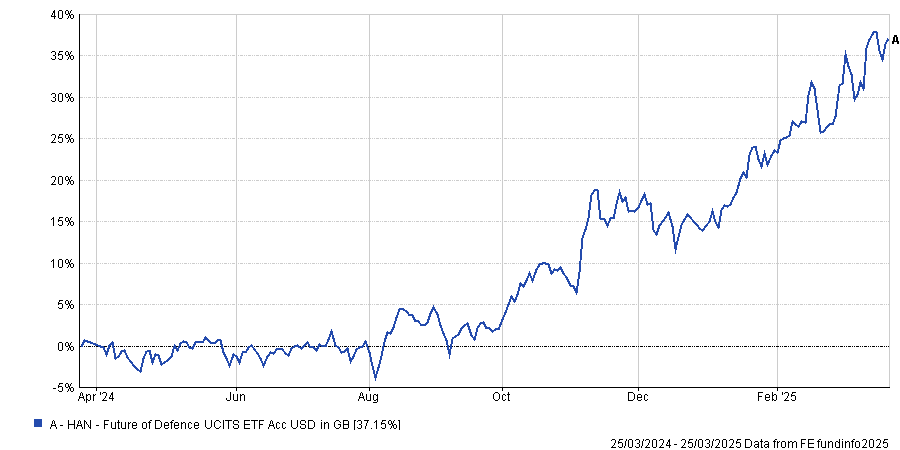

Performance of HanETF Future of Defence over 1yr

Source: FE Analytics

“A noticeable difference for this ETF is its skew towards digital defence as demonstrated by the largest exposure to the technology sector at 45%. Modern warfare is no longer confined to bullets and missiles, it is increasingly being played out in the digital realm,” Morgan said.

The largest holdings are German automotive and arms manufacturer Rheinmetall, Thales and UK aerospace, defence and information security giant BAE Systems.

Global X Defence Tech UCITS ETF

Next up is Global X Defence Tech UCITS ETF, which tracks the Mirae Asset Defence Tech index. This is made up of the top 50 global companies earning more than 50% of revenue from cybersecurity, defence technology and advanced military systems and hardware.

The ETF focuses on pure-play defence companies and its ‘purity revenue’ criteria states that revenues linked to commercial aircraft components, aircraft interiors and other components are not considered in contributing to defence technology revenue. Therefore, it does not own the likes of Boeing and Airbus.

“The index/ETF is the most concentrated of the ETFs reviewed when looking at its allocation to the top 10 holdings, which currently account for 72%. The top allocations are to Palantir Technologies (9%), Rheinmetall (8%) and RTX (8%),” Morgan said.

“It has concentrated exposure to the defence industry given its focus on revenue purity and picks up a lot the major defence players that we would expect to see represented in the index/ETF.”

Invesco Defence Innovation

The Invesco Defence Innovation UCITS ETF tracks the S&P Kensho Global Future Defence index, which classifies companies into two categories: core and non-core.

Core companies derive a significant portion of their business operations and/or revenues from defence while non-core companies provide vital inputs such as critical subcomponents to defence end products.

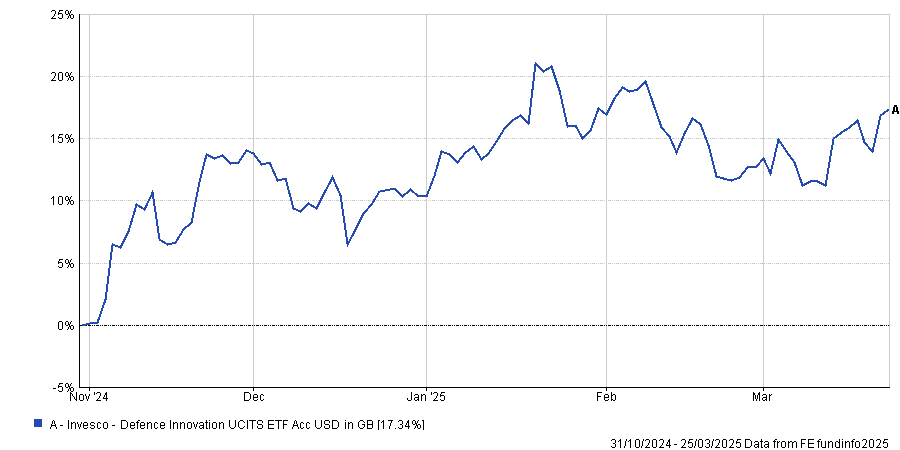

Performance of Invesco Defence Innovation since launch

Source: FE Analytics

“Of the ETFs listed here, this contains the greatest proportion in smaller companies, typically adding to the risk involved, plus it is the most differentiated from competing products,” Morgan added. “It is the only ETF to have allocations to the communications, energy and healthcare sectors.”

Its largest holdings are humanoid robot specialist Rainbow Robotics, aerospace manufacturer Rocket Lab and military electronics manufacturer Kratos Defense & Security.

First Trust Indxx Aerospace & Defense

The newest ETF on Charles Stanley’s list is First Trust Indxx Aerospace & Defense, which launched in December 2024.

It tracks the Indxx Global Advanced Aerospace & Defence index, which is made up of the top 50 aerospace and defence companies. These are in two groups: traditional (or companies that manufacture construction material, electronics and telecommunications equipment used in both defence and commercial aircraft) and advanced (in areas such as hypersonic, directed energy, space technologies or unmanned aerial vehicles).

Morgan said: “This is the most geographically diverse option reviewed with 14 countries represented in the index/ETF and is the only ETF to have an exposure to India (Bharat Electronics and Hindustan Aeronautics). It also has the highest allocation to the UK.”

Top holdings include Rheinmetall, Howmet Aerospace and RTX Corporation.