While the US has led markets higher in the bull run since the coronavirus-inspired March sell-off, one fund has stood out: the £5.9bn Baillie Gifford American fund.

The growth-focused asset manager’s five FE fundinfo Crown-rated US equity strategy is the IA North America sector’s best-performer of 2020 and also tops the tables over one, three, five and 10 years.

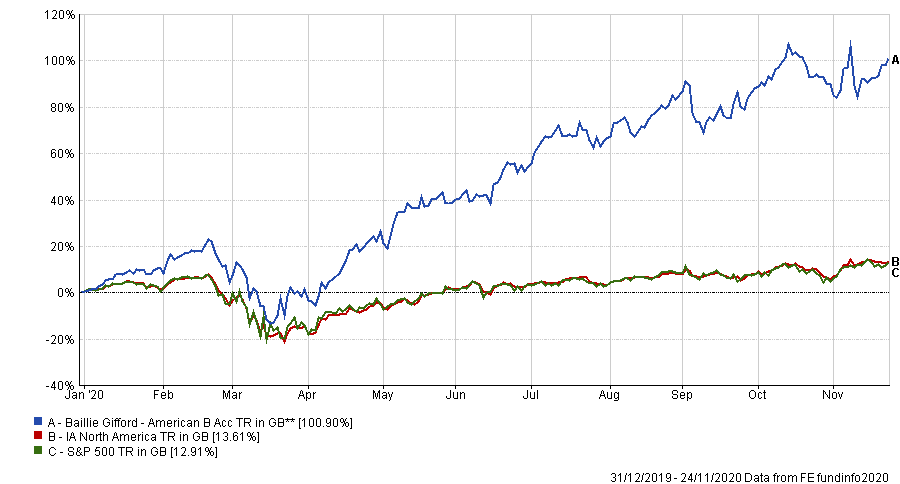

During 2020 (to 25 November), Baillie Gifford American has returned 100.9 per cent, compared with a gain of 13.62 per cent for the peer group average and 12.91 per cent for the S&P 500, in sterling terms.

Performance of fund vs sector & benchmark YTD

Source: FE Analytics

Managers Gary Robinson, Tom Slater, Kirsty Gibson and Dave Bujnowski run a concentrated, low turnover portfolio of 30-50 stocks they identify as “exceptional growth businesses”, owning them long enough so “the advantages of their business models and cultural strengths become the dominant driver of their stock prices”.

As such, its top holdings includes the likes of Tesla, Amazon and Zoom Video Communications – all of which have also performed strongly during 2020 as the Covid-19 pandemic raged.

But, if investors already hold it, what funds would complement it best? Below, four fund pickers make some suggestions.

Artemis US Select and Artemis US Extended Alpha

The first two fund picks both come from GDIM investment manager Tom Sparke, who chose two Artemis funds to sit alongside Baillie Gifford American: Artemis US Select and Artemis US Extended Alpha.

As mentioned above, Baillie Gifford American fund takes a growth-based approach.

Therefore, when considering what to hold alongside it the ‘obvious’ idea would be to pick a value-style fund to create diversity.

But this isn’t the way GDIM’s Tom Sparke thinks investors should go.

He explained: “As Baillie Gifford American has such a strong style and long-term view to it, I would be tempted to pair it with a fund that would be an effective diversifier alongside it.

“The natural pick to complement the growth-based approach would seem to be a deep value-based fund, as this would react very differently to the incumbent. However, as the last few years have shown, these have struggled, especially in the US, so I would be drawn elsewhere.”

As such, Sparke said he would pick the Artemis US Select and Artemis US Extended Alpha funds because none of the managers are especially biased to one style of investing and have still achieved “excellent performance at lower levels of volatility”.

Sparke did note that both funds had high allocations to quality and some growth recently, but said that they’ve shifted the portfolios into more cyclical stocks to be on the right side of the global economic recovery.

The £2.1bn Artemis US Select fund is run by Cormac Weldon, who has managed the fund since launch in 2014.

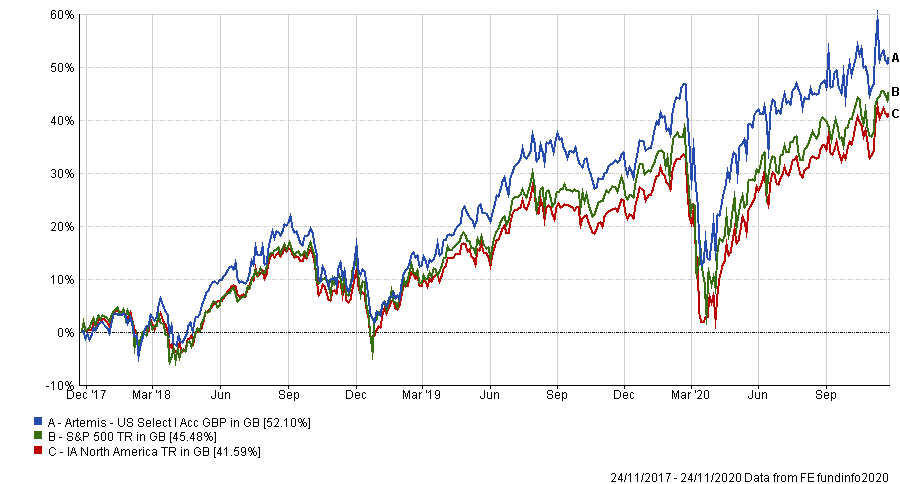

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Holding an FE fundinfo Crown Rating of five, the fund has made a total return of 52.10 per cent over the past three years, outperforming the S&P 500 index (45.48 per cent) and the IA North American sector (41.59 per cent).

It has an ongoing charges figure (OCF) of 0.85 per cent.

The second fund, £432.6m Artemis US Extended Alpha is run by FE fundinfo Alpha Manager William Warren. The strategy is able to take both long and short positions to generate alpha, a process Warren previously used on his funds at Colombia Threadneedle.

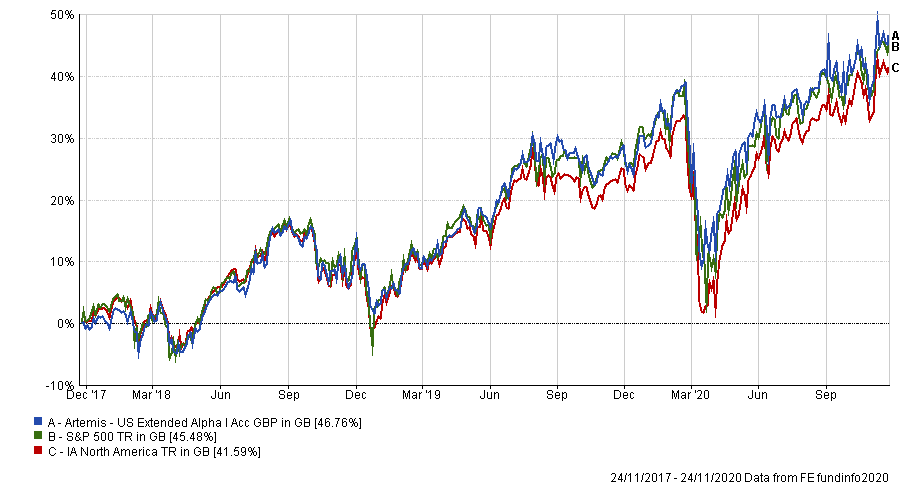

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over the past three years it has also outperformed both the S&P 500 and the IA North American sector, with a total return of 46.76 per cent.

It has an OCF of 1.05 per cent.

Federated Hermes US SMID Equity

Next up is the $787.1m Federated Hermes US SMID Equity fund, which was picked by Jason Hollands, managing director at Tilney Investment Management Services. Unlike the previous funds this one operates in the US small-cap space and runs a more value tilt.

Hollands said with the market showing clear signs of a rotation into more cyclical areas in recent weeks – catalysed by the positive vaccine news – this should benefit the more value-tilt, style agnostics funds.

He said: “Long-term holders of a large cap-biased growth fund like Baillie Gifford American might therefore consider dovetailing their holding with a position that extends their exposure to medium- and smaller-sized companies and is a little more neutral in style, such as the Federated Hermes US SMID Equity fund which employees both quality and value criteria to identify stocks trading below their intrinsic value.”

The Federated Hermes US SMID Equity fund is run by Mark Sherlock and deputy managers Michael Russell, Alex Knox and Henry Biddle.

While the team doesn’t usually take big sector bets according to Hollands, the portfolio currently has a greater exposure to financial and basic materials than the peer group average. Some of the “notable consumer cyclicals in the portfolio”, include Brunswick Corporation and ServiceMaster which Hollands said should benefit from a recovery.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over the past three years the fund has underperformed the Russell 2500 index and the IA North American Small Companies sector, shown in the chart below.

It has an OCF of 0.84 per cent.

LF Miton US Opportunities

The final pick is £829.4m LF Miton US Opportunities, which co-managed by FE fundinfo Alpha Manager Nick Ford and Hugh Grieves. This fund was picked by both Charles Stanley Direct’s Rob Morgan and Dzmitry Lipski, head of funds research for interactive investor, for similar reasons.

Firstly, running a concentrated multi-cap portfolio, with a bias towards mid-caps there would be “little or no overlap with Baillie Gifford in terms of holdings”, Morgan said.

He added: “In particular, there is no big tech so would make a good diversifier.”

Indeed, the fund has no allocations to the S&P 500’s mega-caps, such as Facebook, Amazon, Apple, Netflix and Alphabet (Google).

This is because the managers’ “more nimble and pragmatic approach”, as Morgan described it, is centred on identifying quality companies and paying “appropriate valuations”, for them.

Lipski added that the team tend to look for business services with high levels of intangible assets, industrials and consumer names.

“Usually these are considered to be less ‘glamorous and boring businesses’,” he said. “The managers take a pragmatic view to investing and will tilt the portfolio towards more favourable parts of the market at different times in the economic cycle, but still maintaining a broadly balanced multi-cap portfolio.”

But the lack of exposure to the main S&P 500 drivers hasn’t hurt the fund’s performance.

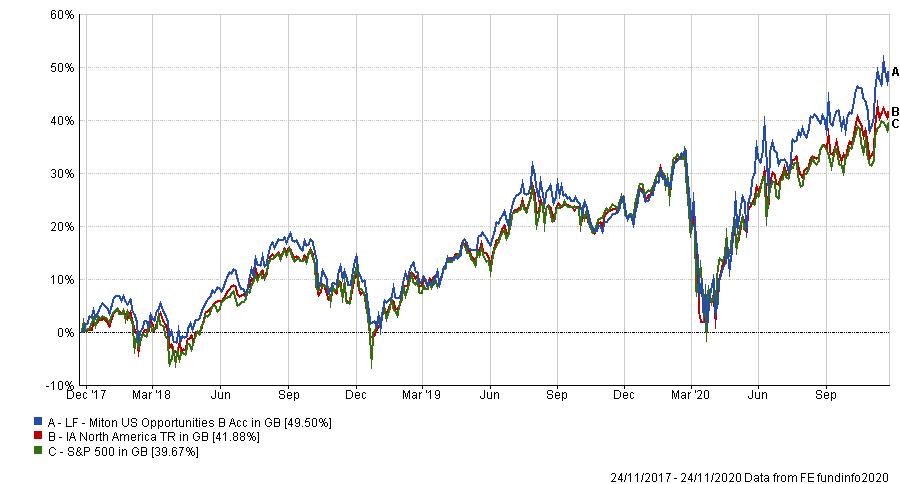

Performance of fund vs sector and S&P 500 over 3yrs

Source: FE Analytics

Over the past three years, the fund has outperformed the IA North American sector, with a total return of 49.50 per cent. It also outperformed the S&P 500 over the same time frame.

The fund has an OCF of 0.90 per cent.