While concentrated, high-conviction portfolios have their merits, holding a larger number of stocks can enable equity managers to spread their bets more widely and gain exposure to different themes. Diversification increases the odds of finding winners while reducing the impact of misses.

This is particularly pertinent for higher risk strategies such as small-caps where individual stocks can plummet in value. By diversifying their portfolios across a wide range of stocks, managers can limit the detrimental impact of any individual company turning sour.

Below, experts explain which highly diversified funds they use.

Rowe Price US Structured Research Equity

Sam Buckingham, an investment manager at abrdn Managed Portfolio Service, recently allocated to T. Rowe Price US Structured Research Equity.

“The fund is an analyst-driven research portfolio, combined with a portfolio oversight team to enable alpha via stock selection with benchmark-like volatility and characteristics,” he explained.

“There are approximately 30 analysts on the strategy who each are responsible for all stocks within certain sub-sectors. The portfolio oversight team are then responsible for monitoring overall portfolio exposures in conjunction with analysts to maintain benchmark-neutral sector/factor exposures.”

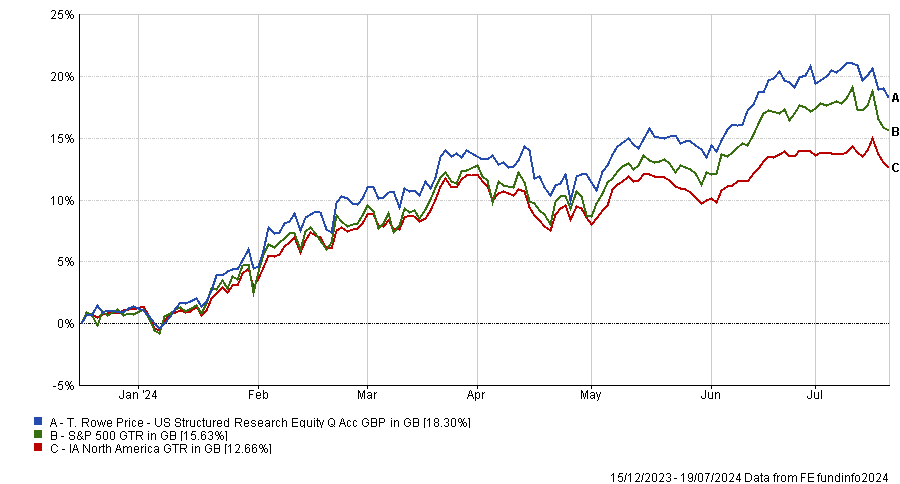

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

The strategy has been running for more than 25 years in the US and T. Rowe Price launched a version for UK-based investors late last year.

Buckingham said this is one of the few funds with a track record of outperforming the S&P 500 and doing so with minimal tracking error.

He added that its diversified nature means the outperformance has been broad-based and not concentrated in the technology sector.

First Eagle US Small-Cap Opportunities

Simon Evan-Cook, a fund manager at Downing, invests in First Eagle US Small-Cap Opportunities, which holds approximately 250 stocks.

Manager Bill Hench applies a deep-value investment strategy, which partially explains why he holds so many stocks.

Evan-Cook said: “Some of the companies Hench’s team looks at are in a life-or-death situation, in which a factor such as tough macro conditions or bank debt rolling over could mean them going bust. If they go bust, they’ll lose their stake, but if they survive, the share price might rally several hundred per cent in relief.

“Clearly, such an approach doesn’t lend itself to a concentrated approach of, say, holding 10% positions in any one of these companies.”

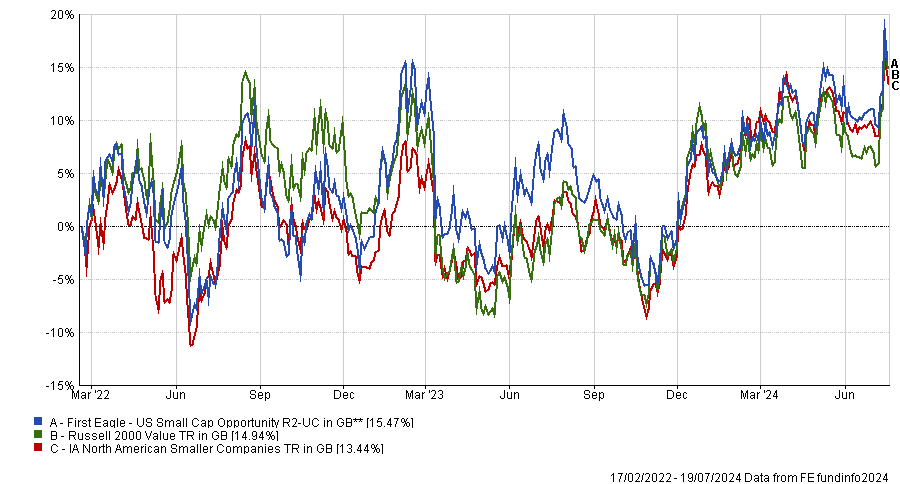

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

The fund has been available in the UK since February 2022 and has so far outperformed its benchmark, the Russell 2000 Value index.

Fidelity UK Smaller Companies and Teviot UK Smaller Companies

Evan-Cook also pointed to Fidelity UK Smaller Companies and Teviot UK Smaller Companies as examples of funds that make good use of high diversification.

Like First Eagle US Small-Cap Opportunities, these two funds employ a value strategy to invest in UK small-caps.

“They’re not quite so extreme as First Eagle’s approach, and run on or around 100 stocks, but many of the principles are similar: find stocks with fantastic risk-reward characteristics, but acknowledge that any one of them might be vulnerable by not betting the ranch on them using a concentrated approach,” he explained.

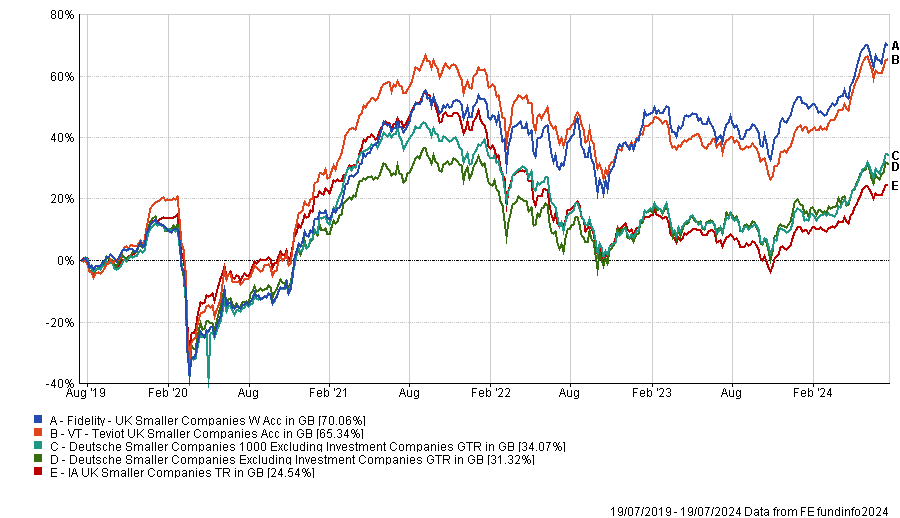

Performance of fund over 5yrs vs sector and benchmarks

Source: FE Analytics

Both funds have comfortably outperformed their average sector peers and benchmarks, a trend supported by the value rotation in recent years (excluding the USA).

M&G Global Emerging Markets

Chris Metcalfe, chief investment officer at IBOSS, added M&G Global Emerging Markets, to his portfolios in May 2023.

The fund, which holds about 80 stocks, invests across the whole market-cap spectrum, with circa 30% each in mega-, large- and mid-caps and then 10% in small-caps. It is managed by Michael Bourke.

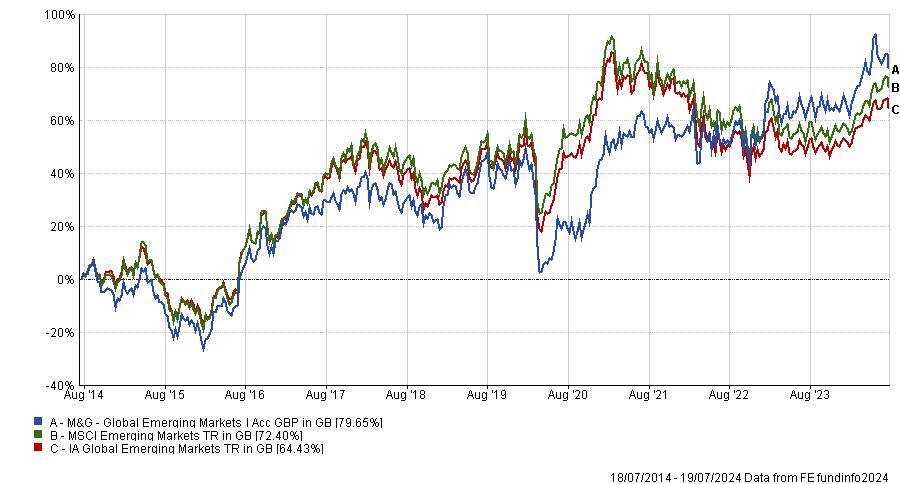

Metcalfe said: “Intuitively, having all these positions could cause concern about creating a tracking-like product, but this fund certainly doesn't exhibit tracker-like outcomes.

“Except for the Covid drawdown period, where the fund suffered drawdowns larger than the sector average, performance has been consistently strong. The fund is very much actively managed. For example, three years ago, it had an allocation of around 10% to Consumer Products, now a 20% allocation.”

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Chris Rush, IBOSS investment manager at Kingswood Group, recommended pairing M&G Global Emerging Markets with Federated Hermes Asia ex-Japan to gain broad exposure to emerging market equities.