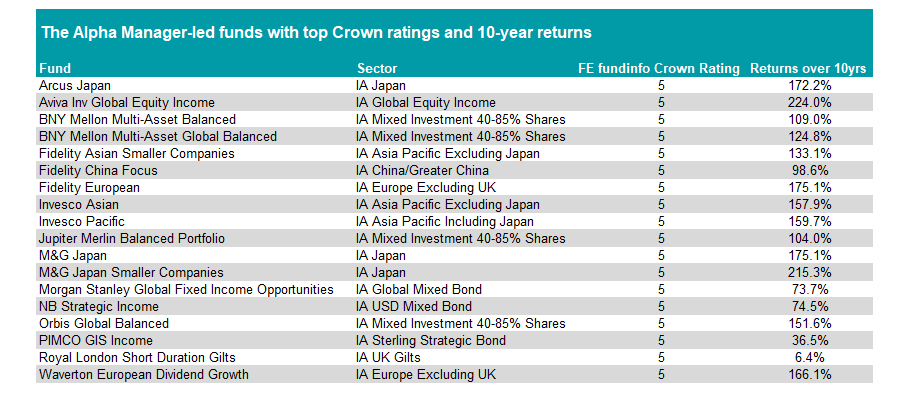

Just 18 funds have completed the trifecta of being managed by a top manager while producing excellent short-term returns and even more impressive long-term performance, according to a study by Trustnet.

To measure this, we looked at funds run by FE fundinfo Alpha Managers, who are selected for the title based on their performance for their entire career. Factors include risk-adjusted returns and outperformance of their benchmark, with only the top 10% of fund managers achieving the rating.

Next, we filtered for those funds with a top FE fundinfo Crown Rating of five. This metric focuses on three-year performance and includes metrics such as alpha generation and relative volatility.

Lastly – and most straightforwardly – we filtered out any funds that had failed to make a top-quartile return over the past 10 years in their relevant sector.

This left us with 18 names, including three from Asia, three from Japan, two investing in European stocks, four multi-asset picks, four bond specialists, one global equity income and one China fund, as the below chart shows.

Source: FE Analytics*

The best long-term performer on the list came from the IA Global Equity Income sector, with Aviva Investors Global Equity Income making 224% over the past decade. The £581m fund has been the second-best performer in its sector over 10 years.

Managed by Alpha Manager Richard Saldanha since 2013 and co-manager Matt Kirby since 2017, it predominantly invests in large and mega-caps and is most heavily overweight the UK (17.2% of the fund) relative to its benchmark – the MSCI ACWI – while underweighting the US (38.9%).

However, there were some that made lower returns, but took the top spot among their peers. NB Strategic Income made the best returns in the 11-strong IA USD Mixed Bond sector over 10 years, up 74.5%, while Invesco Pacific (UK) led the eight-fund IA Asia Pacific Including Japan sector over the period.

M&G Japan Smaller Companies also topped its peer group, beating the other 67 funds in the IA Japan sector to the top spot over the decade. Run by Alpha Manager Carl Vine, the fund focuses further down the market capitalisation than many of its peers – a happy hunting ground over the past decade.

Analysts at FE Investments said the manager has a “very strong track record” in the region and highlighted its strong environmental, social and governance (ESG) credentials.

After screenings, the managers end up with around 250 stocks they can choose from, which tend to slightly tilt the portfolio towards the value style.

“Even when the fund’s style hasn’t been in favour, it had the ability to generate superior performance than its benchmark and sector through stock picking,” the analysts said.

It was one of three names from the IA Japan sector, including Vine’s other fund – M&G Japan – which is more of an all-cap portfolio, as well as Mark Pearson’s Arcus Japan.

The sector with the most entrants however is IA Mixed Investment 40-85% Shares, with four names on the list. BNY Mellon provided two – BNY Mellon Multi-Asset Balanced and BNY Mellon Multi-Asset Global Balanced – but it is Orbis Global Balanced that has the highest returns of the group over the decade, up 151.6%.

Alpha Manager Alec Cutler is currently 75% invested in equities with 19% in bonds and 6% in commodities – a position he defended last year.

John Chatfeild-Roberts’ Jupiter Merlin Balanced Portfolio, which he runs alongside Amanda Sillars, David Lewis and George Fox, is the other fund from the sector on the list.

PIMCO GIS Income is the largest fund with an Alpha Manager, five crowns and a top-quartile return over the decade. It has some £6bn in assets under management (AUM). Headed by Alpha Manager Daniel Ivascyn alongside Joshua Anderson, the fund is a collection of the wider firm’s best ideas, according to RSMR analysts.

Close behind is the £4.5bn Fidelity European run by Alpha Manager Samuel Morse and Marcel Stotzel, who aim to have similar sector allocations to the MSCI Europe ex UK benchmark, but with a preference for quality stocks.

FE Investments analysts said the managers have a ‘three reasons’ sheet, “ensuring they do not fall in love with any one name”.

“They believe that being fully invested is key to long-term success rather than trying to time the market,” they added, suggesting the fund “would suit an investor looking for core European exposure amongst a diversified portfolio of funds”.

Morgan Stanley Global Fixed Income Opportunities and the aforementioned BNY Mellon Multi-Asset Balanced and M&G Japan funds are the other notably sized names, all with AUM of above £3bn.

*These rankings were correct before the FE Crown Ratings rebalance today. After the rebalance, NB Strategic Income has been dropped to four crowns.