Terry Smith’s Fundsmith Equity, a suite of Baillie Gifford funds and big value strategies all struggled to keep investors’ cash last year, while passive funds hoovered up net inflows, according to data from FE Analytics.

Global equities continue to be an incredibly popular area with investors who want broad access to world markets. The most popular way to achieve this has typically been through a tracker or a behemoth active fund that has proven competent at beating the market over the long term.

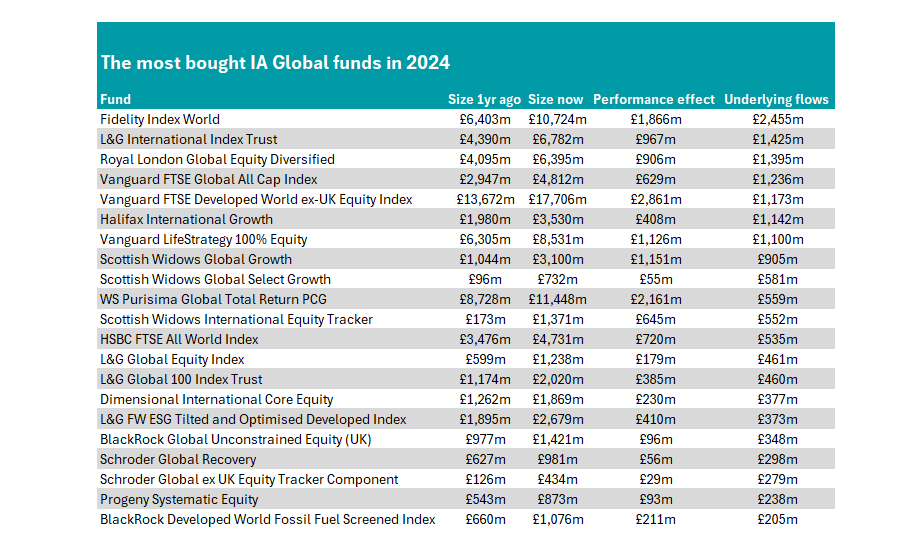

Last year, passives were in favour at the expense of the active managers. Fidelity Index World was the most-bought global fund of the year, with investors piling in a net £2.5bn in 2024. Combined with a performance uplift of almost £1.9bn, the fund’s assets under management (AUM) rose from £6.4bn to £10.7bn over the course of the year.

Source: FE Analytics

It was far from the only passive fund on the list, as illustrated by the table above, which includes all funds in the IA Global sector with net inflows of more than £200m.

This may be because it is so difficult to beat the market. Last year, just 15% of funds in the IA Global sector beat the MSCI World index, while this rose to 22% if compared against the slightly easier benchmark of the MSCI ACWI.

L&G International Index Trust came in second place, with investors putting £1.4bn into the fund, while four of the top five most-bought funds of the year were trackers. The other two were Vanguard FTSE Global All Cap Index and Vanguard FTSE Developed World ex-UK Equity Index.

The only active fund in the top five was Paul Schofield’s Royal London Global Equity Diversified fund, which took in £1.4bn in new money from investors. It aims to beat the MSCI World index by 0.4-0.8 percentage points over rolling three-year periods.

It uses a ‘Corporate Life Cycle’ model, which is based on the idea that returns and growth tend to progress along a life cycle and every company can be located economically in one of five categories ranging from early-stage accelerators and growth compounders to more mature returners and turnarounds.

The fund has caught the eye of investors having produced top-quartile returns in the IA Global sector over one, three and five years, beating the MSCI World index by 10.6 percentage points over half a decade.

Halifax International Growth and Vanguard LifeStrategy 100% Equity rounded out the list of funds with more than £1bn in net inflows last year.

On the latter, analysts at Square Mile said it was a “very cost-effective and simple” fund, which provides investors with exposure to a mix of 75% global equities excluding the UK and 25% UK stocks.

“Within the UK retail market this fund is one of the simplest and cheapest ways for investors to obtain exposure to global equity markets,” they said.

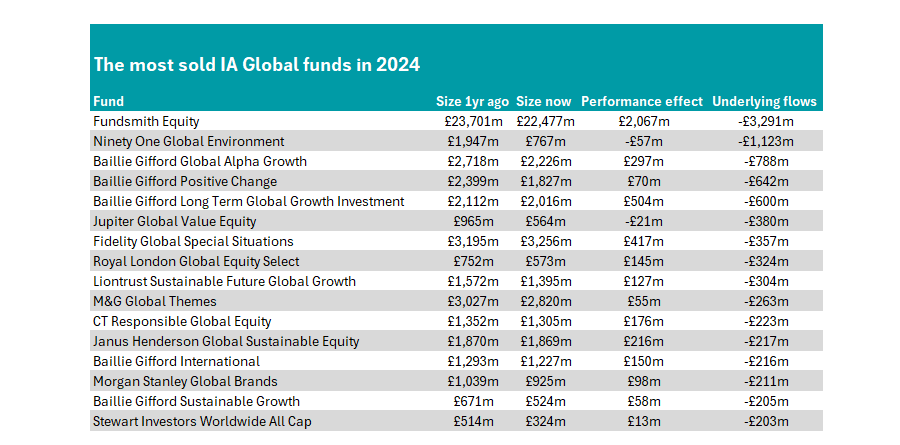

There were plenty of big names that investors turned away from in 2024, however. Despite making more than £2bn from its performance last year, Fundsmith Equity suffered net outflows of £3.3bn in 2024, taking its assets under management from £23.7bn at the start of the year to £22.5bn by 31 December.

The behemoth fund has failed to beat the MSCI World and the average peer in each of the past three years. Last year the fund’s performance of 8.9% was around 12 percentage points behind the MSCI World (20.8%) and 3.7 percentage points behind the IA Global sector average.

Source: FE Analytics

In second place was Ninety One Global Environment. Assets plummeted towards the end of the year, as the environmental, social and governance (ESG) darling struggled to convince investors. The fund sits in the fourth quartile of the IA Global peer group over one and three years and is below the average over five years. Assets have plummeted from almost £2bn a year ago to £767m by 31 December.

It was followed by a trio of Baillie Gifford funds: Baillie Gifford Global Alpha Growth; Baillie Gifford Positive Change; and Baillie Gifford Long Term Global Growth Investment.

All had more than £2bn in assets under management at the start of the year before investors took between £600m and £788m from the three funds. Despite starting the year with the lowest AUM, Baillie Gifford Long Term Global Growth Investment’s strong performance last year means it is no longer the smallest of the trio. Baillie Gifford Positive Change was the only one of the three to dip below £2bn in assets.

Other big funds affected by net withdrawals of more than £200m included Fidelity Global Special Situations and M&G Global Themes.