Investing for income has been a difficult task over the past 18 months, particularly for holders of UK stocks.

Last year dividends were hammered by the coronavirus, as many businesses cut payouts to conserve cash in an effort to stay afloat during the government-enforced lockdowns.

But although the Link Dividend Monitor said it did not expect dividends to recover for several years, there are already signs that the market is improving.

In the second quarter, dividends jumped more than 50% on the previous year, with 90% of the increase due to companies restarting their payouts.

Income investors should consider overall performance as well as dividends, though. Picking an income fund that can protect against crashes is vital for anyone who relies on this money, such as retirees, as an early fall can have a severe impact on your long-term wealth if you need to sell investments to maintain your standard of living.

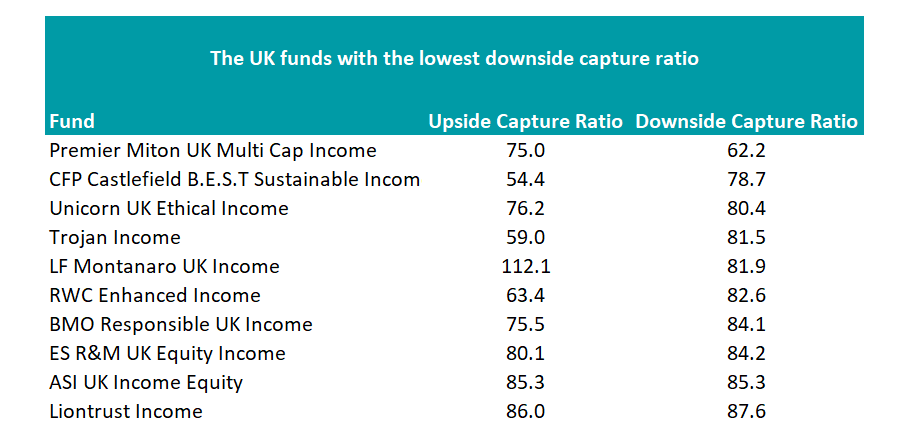

As a result, we looked at the funds with the best upside and downside capture ratios in the IA UK Equity Income sector.

Premier Miton UK Multi Cap Income may be the best choice for risk-averse income investors, as it has the lowest downside capture ratio of any fund in the sector over the past five years (62.2).

Source: FE Analytics

The £1.1bn fund, which yields around 3.6%, is managed by Gervais Williams and Martin Turner. It has more invested in the AIM market (30%) than it does in FTSE 100 companies (21.4%).

While the junior market tends to be more volatile, the fund benefited in the peak of the pandemic last year from a put option on the FTSE 100, which it then rotated into shares that had fallen.

The fund has made 55.5% over the past five years, the third best figure in the 75-fund strong IA UK Equity Income sector.

Ethical funds also made an impression on the list, with both Unicorn UK Ethical Income and BMO Responsible UK Income cracking the top 10 for downside protection.

These types of funds avoided some of the worst-affected parts of the market last year such as the oil majors, which tanked as the price of the underlying commodity plummeted.

Meanwhile, technology stocks and renewable energy firms, the types of businesses that these funds favour, did well.

Investors would have had to have given up some of the upside if deciding to pick a lower-risk income fund however.

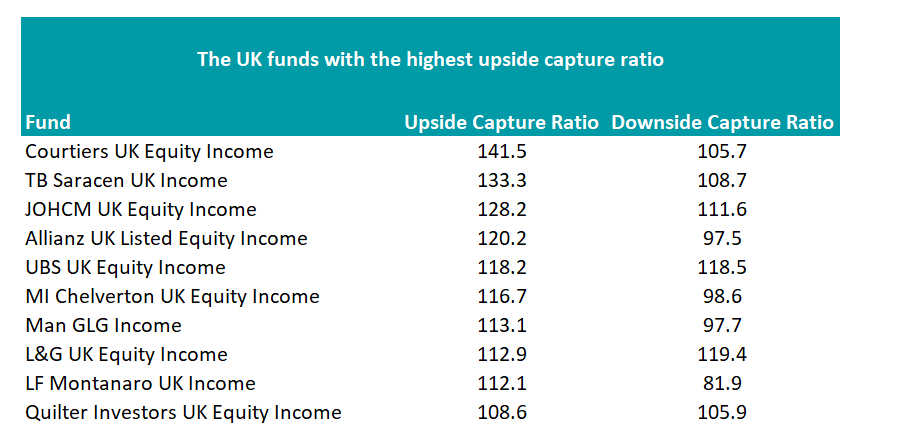

Although some investors will only want to protect their capital, others will want to choose a fund that can rise ahead of the market, focusing more on the recovery than avoiding the worst of the falls.

The £24.6m Courtiers UK Equity Income fund was top in this regard, with an upside capture ratio of 141.5 over the past five years.

Source: FE Analytics

The mid-cap value strategy was the fourth best performer in the sector over this time, despite falling slightly more than the market in downturns.

Value has had a strong recovery since the vaccine announcement in November. As economies began to return to normal, travel stocks, retailers and other unloved industries rebounded.

JOHCM UK Equity Income and Man GLG Income benefited from this move, as they both have large weightings to consumer stocks, financials and miners.

LF Montanaro UK Income was the only fund to appear on both lists. The £46.5m fund, managed by Charles Montanaro and Guido Dacie-Lombardo, specialises in small- and medium-sized businesses with an eye on ESG, excluding it from sectors such as oil.

Analysts at Square Mile Investment Research & Consulting said the fund can be volatile, despite its low five-year downside capture ratio of 81.8, but that investors should be “rewarded with both capital growth and income”.

“We believe this strategy would suit investors who want to diversify their UK Equity Income streams away from being reliant on large, blue chip companies and want their investments to be sustainably aligned,” they said.

Methodology

In this series, we looked at upside and downside capture ratios, which measure how much a fund has risen or fallen relative to a benchmark index over the past five years. For equity income funds, we used the FTSE All Share.

If a fund has a downside capture ratio of 100, the fund has lost the same amount as the market. A ratio of 50 shows that if the market were down 10%, the fund would be down 5%.

Similarly, 150 would imply a 15% drop if the market fell 10%. The opposite is true for upside – a score of 150 would imply a 15% rise if the market were up 10%.