Interest rates and inflation were once again the topic of conversation in financial realms in May as both the Bank of England and Federal Reserve upped their rates last month.

The latter increased by 0.5 percentage points, its biggest hike in 20 years, and some believe it is likely that investors should brace for rate hikes over at least the next four meetings.

Meanwhile in the UK, inflation hit a 40-year high in April with the consumer prices index (CPI) at 9% driven by the big increase in the energy price cap.

There seems no let-up for those struggling with a cost-of-living crisis, with another price increase in energy expected in the autumn, suggesting that year-on-year price rises could break the 10% mark.

There was small consolation, however, as chancellor Rishi Sunak’s emergency budget gave free cash to households which will paid from a windfall tax from the oil majors.

This is coupled with a jobs market that is booming. Indeed, the number of jobs vacancies in both the UK and US is near all-time highs, with US employers adding more than 400,000 jobs in April with unemployment of 3.8%, an 18-year low. The UK unemployment rate of 3.7% is a 50-year low.

Ben Yearsley, director at Fairview Investing, said: “These big jumps in inflation and a corresponding fall in consumer and business confidence are stoking fears of an imminent recession: the US economy contracted 1.5% in the first quarter of 2022.

“It feels as if the global economy is at an inflexion point and could tip either into recession driven by high inflation or muddle on through with government spending and handouts keeping the plates spinning.”

However, markets are “surprisingly sanguine about events”, he noted. Indeed, looking at the performance of fund sectors in May, the areas that made losses were a bit more subdued than last month.

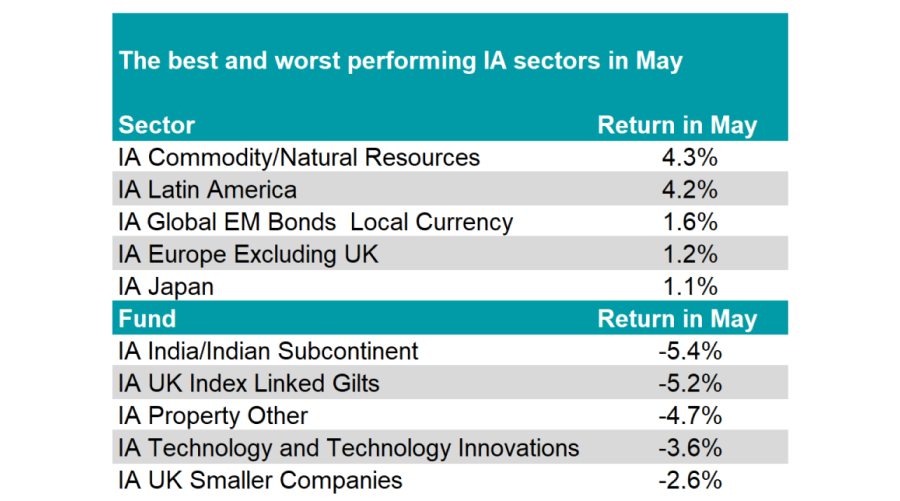

It was a poor month for Indian equities as investors feared a global recession would impact the country, which is reliant on global trade. The high cost of oil and other commodities has also been a drag for the net-importer.

May was another poor month for the IA Technology and Technology Innovations sector, which lost 3.6%, while other risk-on areas such as IA UK Smaller Companies (-2.6%) were also down.

Perhaps surprising to some, the inclusion of the IA UK Index Linked Gilts sector among the top fallers in May caught Yearsley’s attention. “This might sound bizarre when inflation is running at multi-decade highs, but with index-linked gilts it is better to be invested on the journey to high inflation rather than when you have arrived,” he said.

Source: FE Analytics

At the other end of the scale it was another strong month for commodities and funds, with the corresponding sectors up more than 4% in May.

Both the IA UK All Companies and IA Europe Excluding UK made reasonable returns of around 1% last month as value stocks continued to do well. Yearsley said: “Old world stocks really are starting to dominate with energy and commodities leading the charge.”

However, he noted that financials had been “left behind a bit”, especially banks, as worries over recession and loan impairments offset rate rises and improved margins.

“If there is no meaningful recession, expect banks to play catch up later this year and into 2023 as profits surge,” he added.

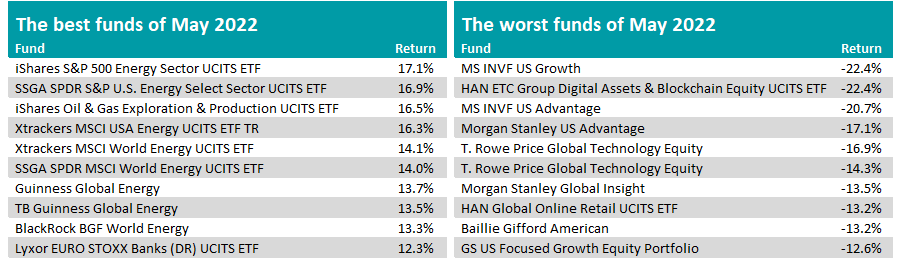

At an individual fund level it was more of the same in terms of winners and losers.

The top funds were dominated by oil & gas portfolios, with tracker funds making up four of the top five: iShares Oil & Gas Exploration & Production UCITS ETF; SPDR S&P U.S. Energy Select Sector UCITS ETF; iShares S&P 500 Energy Sector UCITS ETF; and Xtrackers MSCI USA Energy UCITS ETF.

Returns from these funds ranged from 15.8% to 14.8% as the Brent crude oil price continued to march higher, up around $10 (£8) per barrel in May to $117.

Source: FE Analytics

At the other end, another poor month for growth stocks led to a familiar sight in 2022, with the likes of Baillie Gifford, Morgan Stanley and T.Rowe Price among the biggest fallers in May.

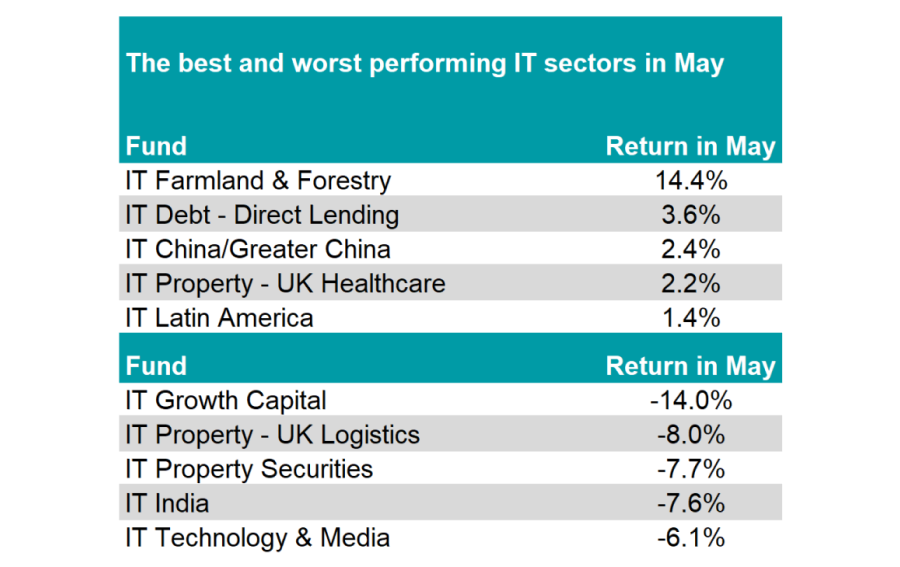

Turning to investment trusts, it was an unusual set of sectors leading the charge. Trusts in the IT Farmland & Forestry sector made 14.4% on average over the month, (Foresight Sustainable Forestry is the only trust in the sector). There were subdued gains for Chinese and Latin American trusts as well.

Source: FE Analytics

At the other end, the IT Growth Capital sector dived 14%, while property took a hit, with the UK Logistics and Property Securities sectors among the worst performers for the month.

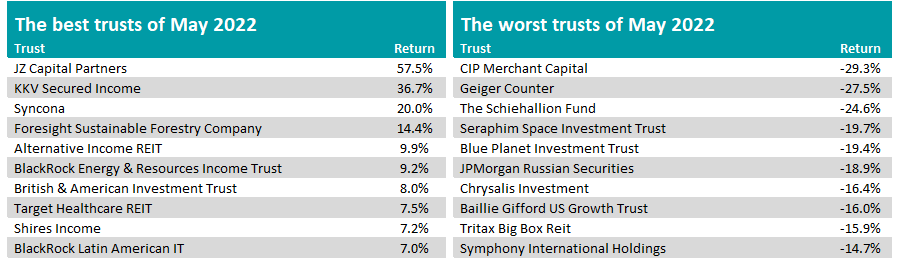

At an individual trust level, it was the usual mixed bag. JZ Capital rocketed this month as the trust announced it expected to pocket proceeds on the sale of US micro-cap companies.

Healthcare trust Syncona also rallied after it announced a $56m investment in SwanBio, taking its stake to near 80%, while KKV Secured Income rebounded after it plummeted 14% last month.

Source: FE Analytics

At the other end, CIP Merchant Capital plummeted after the board announced shares in the Guernsey-based investment company are to be cancelled this month.

Geiger Counter also dropped after it raised money through a discounted fund raising, while the Schiehallion Fund and Baillie Gifford US Growth Trust made seemingly mandatory appearances in the bottom for the growth-investing asset management firm.