Chinese stocks are back in the headlines this week as tariffs have left the Asian powerhouse and the US on the brink of an all-out trade war.

President Donald Trump announced tariffs of around 50% last week on China during his ‘Liberation Day’ tirade, before this was upped again this week to 125%. The latest hike followed a retaliatory tariff of 84% by China.

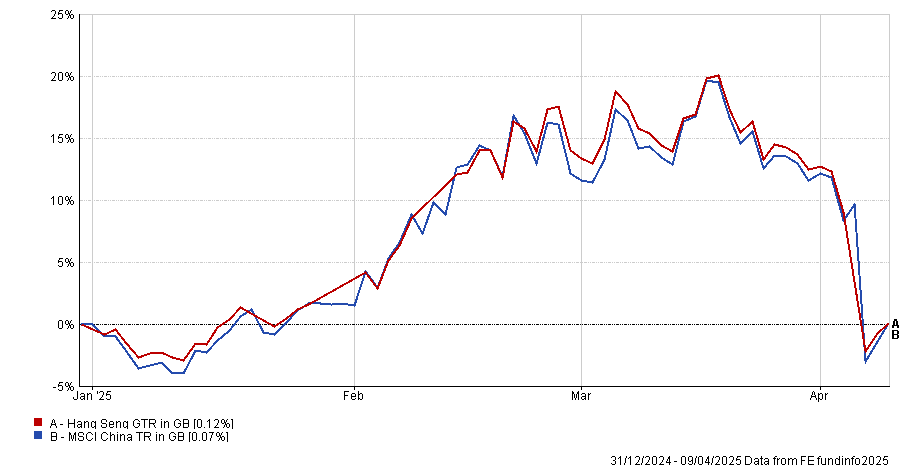

Stocks have reacted accordingly, with the Hang Seng and other Chinese indices rocked over the past week or so.

Yet the large Asian market had been on the upswing to start 2025 after several disappointing post-Covid years and had looked to be the comeback place for investors to put their cash in the first quarter.

Performance of market index YTD

Source: FE Analytics

It remains to be seen if these tariffs will destroy the market or whether the underlying drivers that propelled Chinese stocks in the first quarter can carry on in the face of such adversity.

For some investors, the fundamental characteristics that enabled China to rally are still in place, meaning China could surge again in the not-too-distant future.

Below, Trustnet asks experts from Fidelity International, Janus Henderson Investors and Charles Stanley if Chinese stocks were worth investing in.

Fidelity: Fundamentals were in the driver’s seat

For George Efstathopoulos, multi-asset manager at Fidelity International, the common denominator behind China’s recent short-lived rallies has been that “they were driven by hope”, rather than fundamentals.

“The question on everyone’s mind is whether this time it’s different. I’m inclined to say yes,” he said.

Following the fiscal stimulus last year, China’s economic data has unevenly but gradually begun to improve. While more needs to happen to make economic growth truly sustainable, Efstathopoulos said increased consumption was a promising start for a resurgence in Chinese equities.

Elsewhere, the launch of Chinese artificial intelligence (AI) app DeepSeek in January reminded investors that “China can, and does, innovate”.

US exceptionalism, he said, was based primarily on its tech superiority and the strength of its consumer. DeepSeek challenged assumptions regarding the former and highlighted that China is a legitimate competitor on the global technology stage.

More widely, he argued AI will have fundamental benefits for the Chinese market and will help drive earnings, productivity and even employment. As such, at present, “hope is taking a back seat while fundamentals are in the driving seat”, he said.

He added that protectionism has been “on the rise for some time now” and while recent tariff announcements complicate the global backdrop, they also “amplify the need for China to stimulate its domestic demand”, which would help soften some of the tariff headwinds.

He concluded: “China holds the (fiscal) keys to help fight its own deflationary forces, rebalance its economy and create more sustainable growth domestically.”

However, he warned that the tools China chooses to navigate the current conditions will be crucial – if it goes for a currency devaluation instead of a fiscal stimulus, this would undermine this positive outlook.

Janus Henderson: Reality is different from expectations

The most recent rally in Chinese stocks at the start of 2025 was fundamentally different from the one in September, according to Sat Duhra, manager of the Henderson Far East Income fund.

September’s rally was “based on short-term stimulus measures” that had limited real impact due to the size of the economy and the “weak multiplier effect from any new announcement”.

By contrast, the current interest in China’s tech sector has been “years in the making”, driven by policies such as Made in China 2025, which encouraged greater self-sufficiency amongst Chinese businesses.

He identified the emergence of DeepSeek and the significant market shock it caused as an example of the growing appeal of Chinese technology in modern markets.

Duhra said: “There is something quite exciting brewing in China despite recent restrictions, and we are seeing that in several areas, e.g. world-class electric vehicles and batteries. The reality may be that China is not as far behind as market participants have expected.”

Charles Stanley: This rally was driven by sentiment

However, not all experts were optimistic that the recent rally could occur again. For Matej Lovrenovic, asset management strategist at Charles Stanley Direct, China’s rally “appeared to be driven by sentiment”.

Lovrenovic conceded that DeepSeek had challenged the dominant AI narrative, which has been leading equity markets. If cheaper alternatives to the Magnificent Seven (Microsoft, Nvidia, Apple, Amazon, Meta, Tesla and Alphabet) exist, then their current capital expenditure may be unjustified, which could impact corporate earnings and potentially prompt investors to look elsewhere.

However, while there are high-quality Chinese companies available, “at the index level, this rally was disconnected from fundamentals”, he said, preventing it from being a genuinely long-term development.

He concluded: “A broader, fundamentals-driven rally in Chinese equities would require a stronger commitment from the Chinese government to address internal imbalances, primarily weak domestic demand and the associated overreliance on exports.”