A fund manager’s job is to identify companies that are going to thrive and pick them over those likely to struggle. It might be easier said than done, but this fact doesn’t change when the environment is more or less hostile.

In fact, today’s uncertainty – courtesy of US President Donald Trump – might even generate opportunities, according to Andrew Hall, manager of the Invesco Global Equity fund.

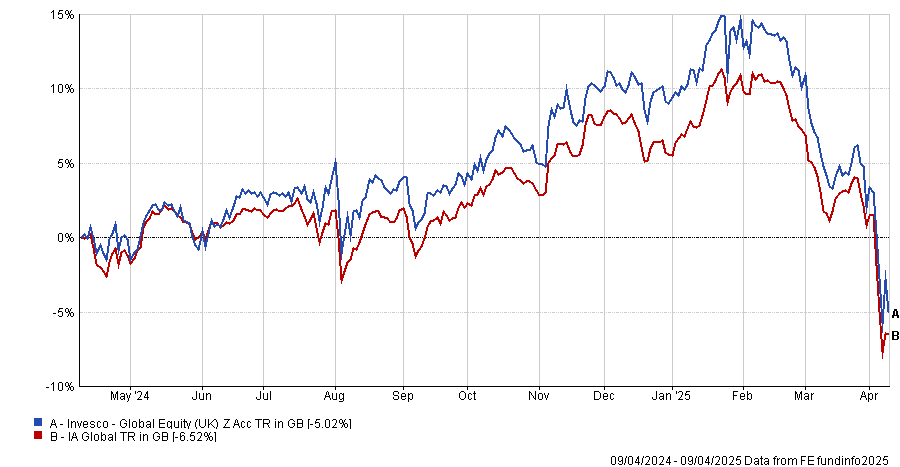

Hall has achieved FE fundinfo Alpha Manager status for the first time this year on the back of his strong performance, as the fund ranked in the top quartile of the IA Global sector over the past five and three years (slipping to the second quartile over 12 months).

Below, he discusses the benefits that can derive from market uncertainty and explains why he’s avoiding the traditional ways to measure company returns.

Performance of fund against index and sector over 1yr

Source: FE Analytics

How do you invest?

The first pillar of the process is identifying businesses that are able to reinvest capital sustainably at above-average rates of return.

The second pillar is strong balance sheets, which help to protect the downside when the market environment turns hostile (as it is at the moment) and also provide optionality to management teams to capitalize on the weakness of competitors in difficult moments.

The third and final pillar is finding managers who think long term, treat stakeholders with the care and respect they deserve and run the business in the most sustainable way possible.

What does the resulting portfolio look like?

It’s a relatively narrow group of companies that can out-compound the rest of the market. We have a bench of approximately 120 of them and invest in 60 – roughly 45 core holdings and 15 positions on top of that.

What makes these companies better at compounding?

We don’t like the traditional measures of return that most of the industry uses, such as return on capital employed (ROCE) or return on equity (ROE), as they rely on data from a company’s balance sheet. Ultimately, the return a business is making today is not the same as its historic accounting.

What we do instead is capture what the business is spending through capital expenditure, research and development or investments in facilities, and measuring the incremental return it is getting on the incremental spend. This gives us a reliable estimate of what returns the business is generating today and then we try to form a judgment on what those returns will be in the future.

What risks does this process entail?

One of the risks is that the future is different to history so part of our job is assessing which companies are truly sustainable and which ones aren't. Some are later in their life cycle and deteriorating, others in earlier stages and improving.

The other key risk is to identify the very best businesses and pay the highest prices, which isn't necessarily going to result in a good investment outcome. So we wait for an opportunity to pick up those superior businesses at fair or hopefully even better-than-fair valuations.

What is your read of Trump’s Liberation Day tariffs?

Fundamentally, the US is trying to pivot away from public sector or government spending, which tends to be less efficient, into the private sector, which tends to be more efficient. We're going through a process of rebalancing the economy.

Tariffs are a negotiating tactic but also part of a plan to bring more manufacturing activity onshore and reduce the trade deficit that the US has been running for some years. This is going to create pressure in the near term, but their hope is that ultimately the economy will be on a more sustainable footing and with lower interest rates and a re-engaged private sector, supported by deregulation of the banking system and lower interest rates.

In 12 months’ time, the environment will be somewhat more healthy. Ultimately, once the short-term pain has passed, what they're doing is probably going to put the US economy on a more sustainable footing.

Why did you call today’s environment “hostile”?

There isn't a coherent set of policies governing the current world order, with much more uncertainty than normal having a direct impact on both consumers and businesses confidence. It feels as though most businesses have put investment decisions on hold until they've got a clear view on exactly what the Trump administration is trying to achieve. This makes the investment environment quite complex.

The good news is that's probably going to create some opportunities. Our job now is to make sure we sift through what's going on, figure out what is temporary and what is permanent, and assess which businesses can win from this and which ones will lose.

Uncertainty can be a benefit. It's really our job to make sure we pick off the winning businesses, if the markets are offering them up at attractive prices.

What were your best calls of the past year?

To the end of February, the best performer has been British private equity company 3i, which contributed 1.2% to alpha.

We bought the shares in 2020 at around £10 and they’ve gone up around three-fold. Its journey has been about rolling out the discount retail store chain, Action, in Europe. The model is quite similar to how a Walmart or a Costco looked in its early days.

US semiconductor supplier Broadcom (0.6%), US insurer Progressive (0.5%) and O’Reilly (0.3%) were also among the best performers.

What were your worst calls of the past year?

The worst performer has been Old Dominion Freight Line (-0.6%).

It has been a really good stock for us over five years, but less good over one. The US is going through a freight recession as the post-Covid hangover is drying up. It is a wonderful business with an astute management team and we think the characteristics of the industry are intact. We are just enduring a cyclical downturn at the moment.

Other underperformers were LVMH (-0.5%) and Nvidia (-0.5%), as we've been underweight Nvidia at a time when the shares have done very well, so it counts among the biggest detractors.

What do you do when you're not managing money?

I love playing tennis, cycling and running. I do some gardening and play football in the garden and cycle with my son. A fairly simple life.