A dilemma for investors wanting to get US exposure is deciding between weathering high interest rates or positioning themselves for a world of lower inflation in an undetermined future.

Two funds in the IA North America sector reflect this dilemma: Artemis US Select and JPM US Equity Income, which are both among AJ Bell’s favourite funds in North America.

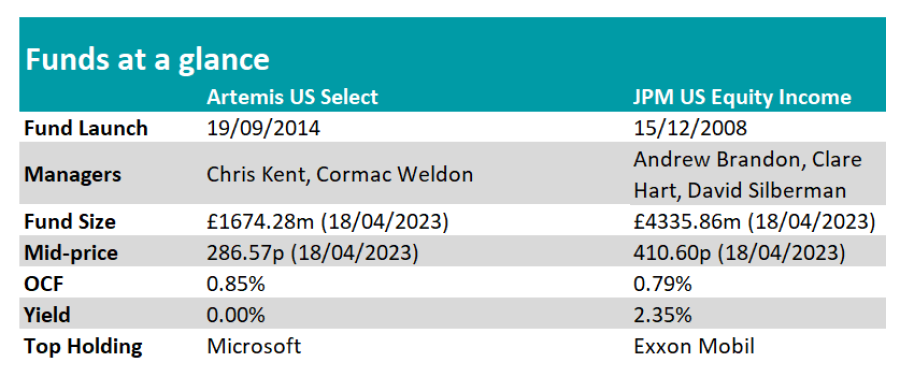

JPM US Equity Income is larger with a fund size of £4.3bn and slightly older, having been launched in 2008. In comparison, Artemis US Select was launched in 2014 and has a fund size of £1.7bn.

Both trailed the S&P 500 over the long term but will harbour ambitions of beating the US market over the coming years as market volatility picks up.

Andy Merricks, fund manager at 8AM Global, said: “With all the resources available to large investment houses such as Artemis and JP Morgan it just shows how difficult it is to outperform the S&P 500 on a consistent basis running an actively managed US large-cap fund.”

Performance of funds vs sector and benchmark over 5yrs

Source: FE Analytics

Both funds tap into distinct sectors of the US market, which means that they thrive in different environments.

JPM US Equity Income has beaten the sector average over one year, in a difficult period during which the IA North America sector delivered a negative performance.

A reason for this is the fund’s singularity, as it is one of the few US equity funds to focus on dividend-generating companies.

Alena Kosava, head of investment research at AJ Bell, said: “JPM US Equity Income fund’s allocation towards stocks with an inflation capture across more cyclical areas of the market, whilst still focusing on the underlying fundamentals of each business to ensure consistent yield generation and quality of the business franchise, offers attractive characteristics in the current environment.

“As we remain more cautious on equity markets more broadly, a dividend strategy such as JPM US Equity Income could be seen as attractive since it provides a level of yield at a time when capital returns may continue to come under pressure.”

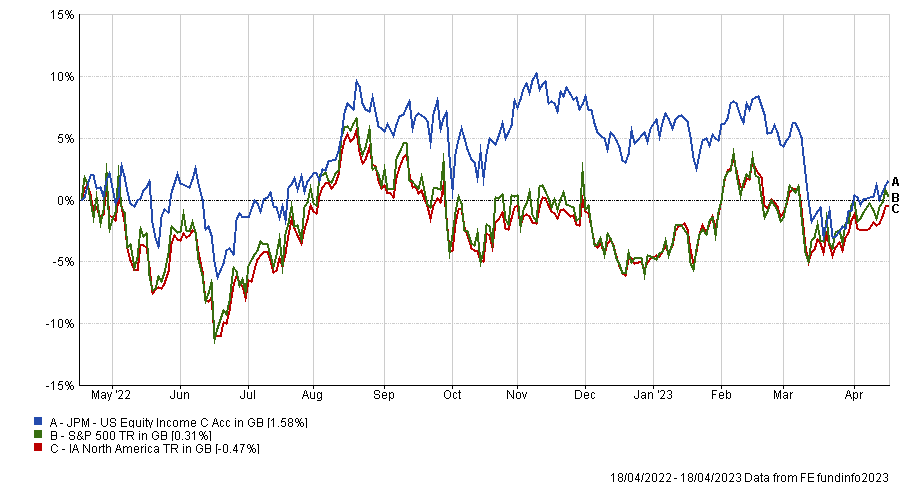

Performance of the fund vs sector and benchmark over 1 year

Source: FE Analytics

Source: FE Analytics

The fund is underweight technology and has its largest sector allocations in financials, healthcare and energy.

Kosava added: “The importance of diversity has rarely been more critical than in the midst of a banking crisis. Despite market turmoil, the fund’s banking names (Bank of America and Wells Fargo) remain well capitalised, diversified and boast strong balance sheets.

“The fund managed to avoid exposure to any of the regional banks embroiled in the recent banking turmoil, a testament its process focusing on quality income businesses.”

Unlike JPM US Equity Income, the Artemis US Select fund has suffered over the past 12 months as it relies much more on technology, with Microsoft, Alphabet and Apple and among the top five holdings of the fund.

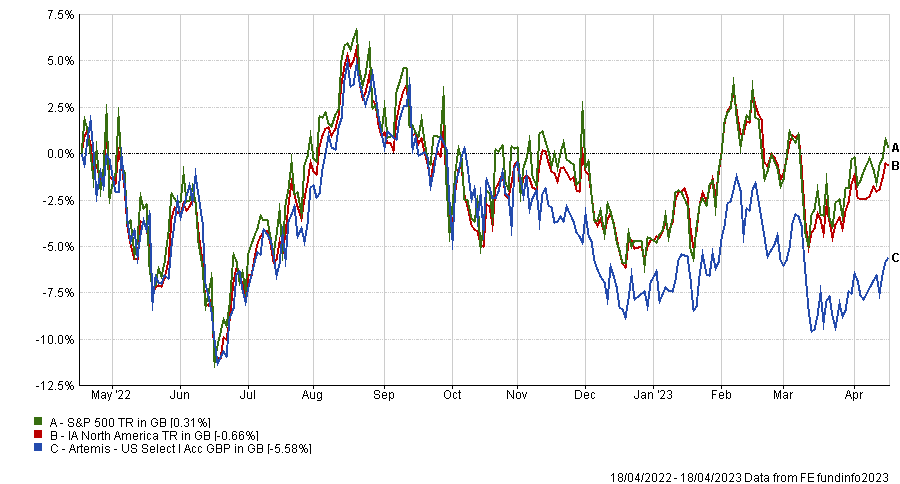

Performance of the fund vs sector and benchmark over 1 year

Source: FE Analytics

Source: FE Analytics

However, it offers different qualities from its competitor.

Jason Hollands, managing director of Bestinvest, said: “The most attractive attributes of Artemis US Select fund are the fund’s flexibility to invest free from benchmark constraints and it provides greater exposure to mid- and small-cap stocks than most US equity funds.

“Another positive is that it is relatively style agnostic compared to many US products and not therefore dogmatically biased towards growth or value investing, enabling it to adapt to changes in the market environment.”

Experts’ recommendations

Despite investing in the same market, the two funds have distinct approaches to the S&P 500 that come with their pros and cons.

Chris Salih, senior research analyst at FundCalibre, said: “This is all about your view on inflation and interest rates. Higher inflation and rising interest rates is likely to benefit a more value-orientated portfolio, like JPM US Equity Income.

“By contrast, Artemis US Select is more flexible and has a greater exposure to the technology sector – an area likely to benefit in a world of lower inflation and falling rates. It all depends on your medium-to-long-term macro view.”

Funds at a glance

Source: FE Analytics

However, Salih opted for Artemis US Select due to JPM US Equity Income’s underweight in technology. He said it has been a drag on performance in the past and that may continue to be the case over the longer term.

Bestinvest’s Hollands also chose Artemis US Select because it has a more flexible remit, unconstrained by index weightings and that it can invest in both value and growth stocks.

However, 8AM Global’s Merricks selected JPM US Equity Income because it has been less volatile over time. He added that investors also benefit from the compounding effect of reinvested dividends over the longer term, as the fund targets businesses that pay at least 2% dividend.

AJ Bell’s Kosava said she would go with JPM US Equity Income at this juncture, as inflation continues to challenge expectations.

However, she concluded: “Holding either/both funds ultimately boils down to views held by individual investors in terms of what environment they believe we are likely to experience from here.”