The Vanguard LifeStrategy funds range is a favourite among investors who value simplicity and cost-effectiveness. However, many might find it beneficial to hold other funds alongside it in order to diversify their portfolios even further.

According to Square Mile analysts, the Vanguard LifeStrategy 80% Equity fund is “one of the simplest and cheapest ways for investors to obtain exposure to global equity and bond markets.”

But one of the risks that comes by holding it, they said, is that it “does not provide the required diversification” during short-term periods, when the return of global equities and bonds (the only two asset classes it invests in) can be highly correlated.

For this reason, Trustnet asked experts which funds they would suggest considering if you want to expand your exposure beyond Vanguard LifeStrategy 80% Equity.

Darius McDermott, managing director of FundCalibre, agreed with Square Mile’s analysis.

“This is a very simple and cheap ‘whole portfolio solution’ with a mixture of equities and bonds from around the world. It is obviously heavily dependent on overall market movements and what goes up can also come down – we saw last year how the simplicity of the Vanguard Life funds can get into trouble,” he said.

The lower risk 20-40% strategies suffered severe drawdowns from the sell-off in bonds but this fund, being 80% equity, was much less affected, as the chart below shows.

Performance of funds over 1yrs

Source: FE Analytics

To make up for the lack of alternatives within this vehicle, McDermott had a number of suggestions.

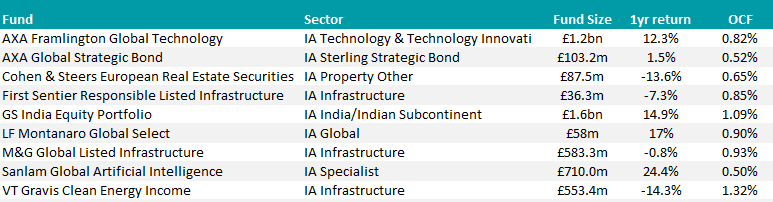

“You could combine it with a satellite position in infrastructure, for example through M&G Global Listed Infrastructure, or a property fund such as Cohen & Steers European Real Estate Securities,” he said.

McDermott selected the former, a strategy managed by Alex Araujo, for its focus on more than just the traditional areas and for its investments in modern infrastructure such as payment companies and data centres, which differentiate it against its peers.

He picked the latter for the resources and experience of manager Rogier Quirijns as well as the “number of drivers behind the performance of the European real estate market”.

Other thematic options included VT Gravis Clean Energy Income for investors who believe in the green transition and AXA Framlington Global Technology or Sanlam Global Artificial Intelligence for a play in the AI revolution.

“Finally, you might want to invest in a particular growing emerging market like India, with a specific India fund like the Goldman Sachs India Equity Portfolio,” he said.

Ben Yearsley, director at Fairview Investing, noted how the Vanguard fund is dominated by large-caps, which is why he suggested adding some small- and mid-cap exposure.

“The risk level will be higher, but you can adjust your weight accordingly,” he said.

His choice in this sector was Montanaro Global Select, a quality-growth fund seeking “simple businesses in growing niche markets”.

“This fund is Montanaro’s global best ideas fund – it’s their no holds barred fund with only 30 companies typically held. Ideally, they want companies with good cash generation and outstanding management.”

Like McDermott, Yearsley also recommended holding some infrastructure for diversification and his choice fell on First Sentier Responsibile Listed Infrastructure, a fund that invests in core assets in everyday use, such as toll roads, transmission networks, and freight rail.

“The team uses a proprietary ranking system for companies measuring on quality and value as well as sustainability. Many companies they invest in have inflation-linked revenue streams and often pay generous dividends,” he said.

“The managers have the ability to tilt the portfolio towards more economically sensitive areas if positive on the wider economy. To fit the sustainability criteria, companies have to be best in class or demonstrably improving.”

Finally, Yearsley’s last tip was to add a strategic bond fund to add to the 20% bond element in the Vanguard fund. Axa Global Strategic Bond run by Nick Hayes was the most suitable in his view. It is a traditional strategic bond fund that can invest in high yield and emerging markets at the risky end of the spectrum through to government bonds at the safer end.

“The fund aims to hold a diversified pool of fixed income assets by risk factors, including credit risk and duration risk. Whilst the ability to invest up to 60% in the riskiest bonds is there, it will rarely hit that level as the manager doesn’t want the most aggressive strategic bond fund,” he said.

“The team holds a quarterly macro meeting to help set asset allocation. To that end, there are three buckets: high quality, rate-sensitive bonds; high-quality company bonds; and lower quality but higher return bonds.”

This article is part of an ongoing Trustnet series on the Vanguard LifeStrategy range. In the previous instalments, we covered the Vanguard LifeStrategy 100% Equity, 60% Equity and 40% Equity funds.