A year ago I streamlined my ISA, kicking out seven funds and reducing my investments into just four names. It marked the first major change to my portfolio in more than three years and was a shift that was a necessity, as with a new baby it was the last thing on my mind to keep tabs on so many funds.

Out went Baillie Gifford American, JPM Asia Growth, Polar Capital Technology, Lindsell Train Japanese Equity, abrdn Global Smaller Companies, TB Evenlode Income, Premier Miton European Opportunities and Pyrford Global Total Return.

All are good funds and some I made more money on than others: my timing on Baillie Gifford was poor and it was sold at a small loss, as were the JP Morgan and Lindsell Train funds – although there were also winners, including my long-term holding in the Polar Capital portfolio.

Left in my portfolio were Man GLG Strategic Bond and Jupiter Merian Global Equity – both long-time holdings – while I shifted the bulk of the money raised from the sales towards new entrants Fidelity Asia Pacific Opportunities and Vanguard LifeStrategy 100% Equity, which is my largest position.

This was my portfolio for the long term but last week I decided to make another change – selling out of the Jupiter Merian portfolio and buying into Rathbone Global Opportunities.

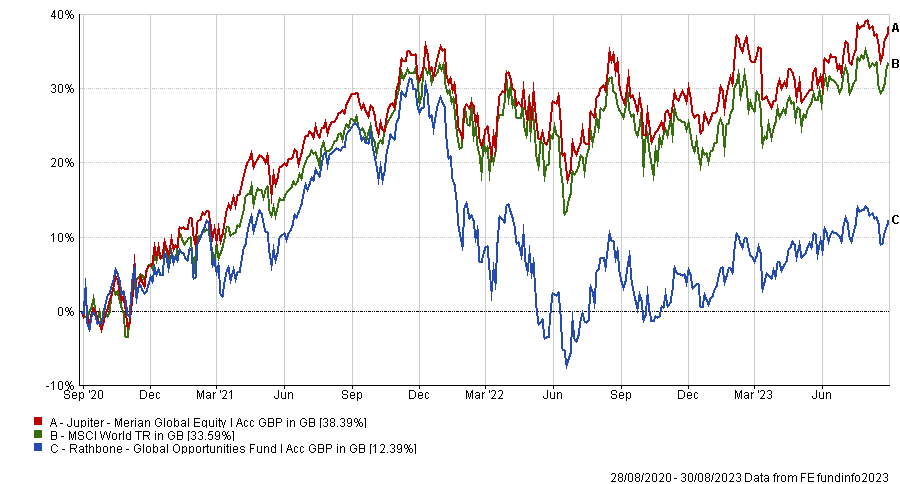

Jupiter Merian Global Equity has been a strong option for me in recent years and its performance was not a disaster. Indeed, it has been a top-quartile performer in the IA Global sector over three years and was in the black when I decided to make the change.

Rathbone Global Opportunities has had contrasting fortunes – sitting in the bottom quartile over this time, making it feel like a bold decision to make the switch.

Performance of funds vs MSCI World over 3yrs

Source: FE Analytics

However, there are several reasons for this. Firstly, the former is a quantitative strategy, tilting a portfolio of several hundred stocks when the managers believe one investment style is more likely to win than another.

This has been incredibly profitable for investors in the fund, but with the introduction of the Vanguard LifeStrategy 100% Equity portfolio last year I feared the diversification I was hoping for would be muted.

Indeed, running the two funds together as a portfolio on FE Analytics, the algorithm suggests there is a very low diversification benefit of holding the two funds together.

This improves slightly (albeit not by a lot) with the Rathbone fund. However, I prefer this mix as one is a passive portfolio with a higher-than-average weighting to the UK (22.9%) while the other is an actively run global fund with fewer names and a clear style bias towards quality-growth names, mainly in the US and Europe.

Second is that I like FE fundinfo Alpha Manager James Thomson and his approach – buying good companies at reasonable prices. I have met him several times over my career and always wanted to invest in the fund, but never found the right time.

Now, with performance waning due to higher interest rates and a general feeling of unease around central bank policy in general, it felt like a reasonable time to get invested. Do I think interest rates have peaked? I couldn’t tell you. But I have never been one to try and time the market anyway.

The final reason I made the switch was that this was not a like-for-like trade. Indeed, only around half of the allocation of the Merian fund went into Rathbone Global Opportunities. The rest went back into my Vanguard passive – where I feel the bulk of my money is more adequately positioned given the lack of free time I have to scrutinise my investments.

So there we are. One change this year after a full upheaval in 2022. I am content with my positioning, with two global funds combined with Fidelity Asia Pacific Opportunities – giving me exposure to an area neither the Vanguard team nor Thomson invest in – and Man GLG Strategic Bond for fixed income exposure… and some short-term cash if required.

Is this the right decision? Only time will tell. My history of making changes at the exact right moment is pretty poor (in fact doing the reverse of my trades may not be a bad investment strategy) but I think I now have a portfolio that is more well-rounded.

Let me know what you think. You can always reach me at Jonathan.jones@fefundinfo.com if you want to get in touch with any questions you may have or if you need help with your own investments. Although do not fear, I will find someone more qualified than myself to give the answers.