There are seven sectors where every fund has made a positive return in the past three years despite some turbulent market conditions, research by Trustnet shows.

Earlier this week, we revealed the Investment Association sectors where every fund has made a loss over the three years to the end of August. The worst results came from bond sectors, including IA UK Gilts and IA UK Index Linked Gilts, which suffered as central banks hiked interest rates.

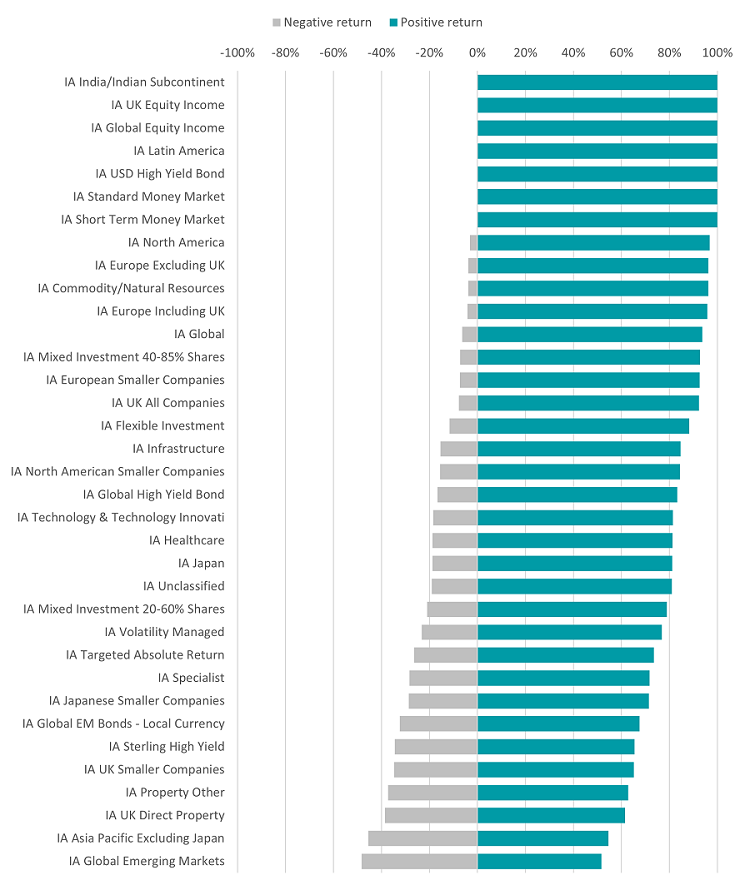

Here, we concentrate on the sectors with the most funds generating positive returns over the same three years. As the chart below shows, there are seven, with IA India/Indian Subcontinent being placed at the top with the strongest performing individual fund of the group.

% of funds making positive and negative returns over 3yrs

Source: FE Analytics

The Indian stock market reached a new record high earlier this year before selling off in the first half of August, although it has been recovering more recently. Investors have been attracted to India by its robust economy and strong corporate earnings.

Our research looked at the 23 IA India/Indian Subcontinent funds with a track record of three years or more and found that the average return over this period stood at 61.7%. The worst performer over three years still made a positive return of 29.5%.

The best performance, however, came from JGF-Jupiter India Select, which was up 88.6%. Managed by Avinash Vazirani, the £185m fund is split equally between large-, mid- and small-cap growth stocks with its top holdings including Godfrey Phillips India, State Bank of India and Hindustan Petroleum.

In a recent note, Vazirani said: “India stands out as one of the fastest growing large countries in the world, with the economy expecting to expand to the tune of 6% this year. The momentum is particularly visible in the earnings of the domestic-oriented companies that our fund is focused on.

“We see scope for earnings growth to continue at elevated rates for many years to come as under-penetrated industries such as aviation, healthcare and insurance grow from what remains a relatively low base in the global context.”

Equity income strategies also fare well in this research as 100% of the members in the IA UK Equity Income and IA Global Equity Income sectors generated positive returns over the past three years.

The average return of the funds examined in this research was about the same for both peer groups – around 33%.

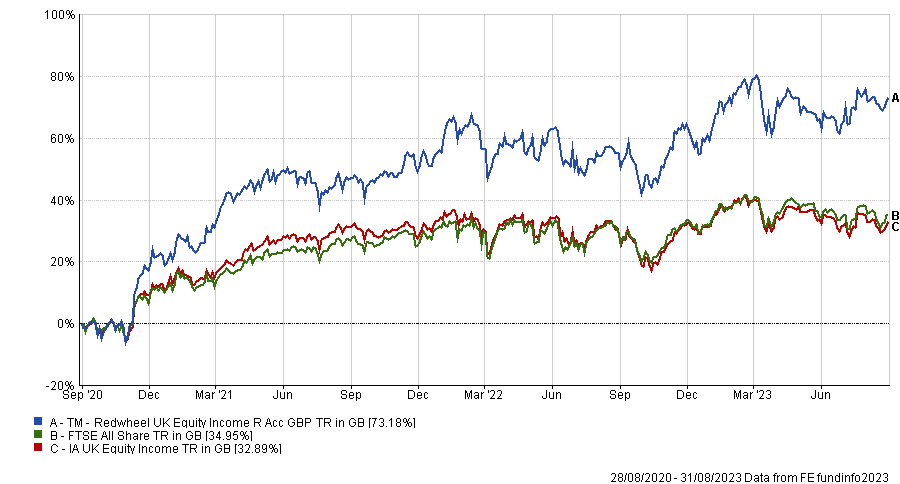

The IA UK Equity Income sector had the best performing individual fund of the two: TM Redwheel UK Equity Income, which made a 73.2% total return.

It is managed by Ian Lance and Nick Purves, who are veteran value investors. This style had a long time out in the cold, as ultra-low interest rates favoured growth stocks. However, rising inflation and interest rates turned investors off growth and sent them towards value stocks and dividend payers, favouring funds such as TM Redwheel UK Equity Income.

Performance of fund vs sector and index over 3yrs

Source: FE Analytics

In the IA Global Equity Income sector, the best performer has been Aptus Global Financials, up 59.8%. This is another value fund, albeit one that concentrates on financial stocks, so also benefitted from the shift away from growth stocks.

The two money market sectors also have a 100% rate of positive funds over the past three years. This is to be expected and we normally skip past these funds, but higher interest rates have boosted investor interest in recent months.

Popular sectors that have some loss-making funds but where more than 90% of their members made positive three-year returns include IA UK All Companies, IA Global, IA Mixed Investment 40-85% Shares, IA North America and IA Europe Excluding UK.

Among the funds from these sectors that have failed to make money on a three-year view are well-known offerings such as Baillie Gifford Managed, Baillie Gifford American, IFSL Marlborough Special Situations, Jupiter UK Mid Cap and CFP SDL UK Buffettology.