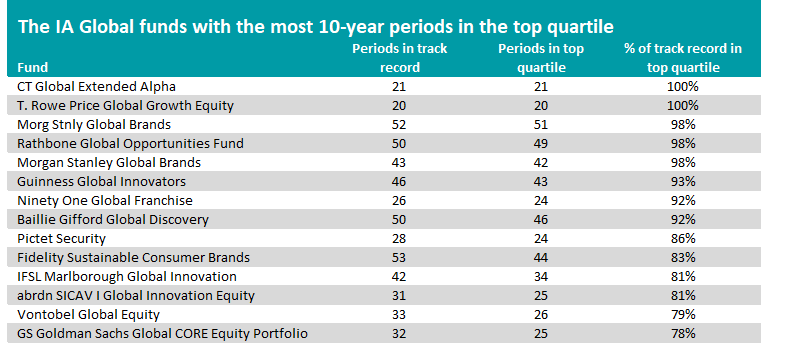

Almost 15 funds in the IA Global sector have a strong record of delivering top-quartile returns time and time again for long-term investors, research by Trustnet has found.

While investors spend plenty of time worrying about the short-term outlook, the real aim of investing is to build wealth over the long run. With this in mind, this article aims to find out which funds have spent the most time in the top quartile of the IA Global sector for investors who held onto them for long enough.

To do this, we examined the rolling 10-year returns of all the sector’s funds starting at the turn of the century. These rolling decades were calculated on a quarterly basis, giving us 56 periods to look at. To focus on long-term performance, we only reviewed funds with a history of at least 15 years.

This found that there are 14 funds in the top quartile of the sector in three-quarters or more of the periods examined in this research – but only two have a 100% success rate. Of course, it should be kept in mind that past performance is not a guide to future returns.

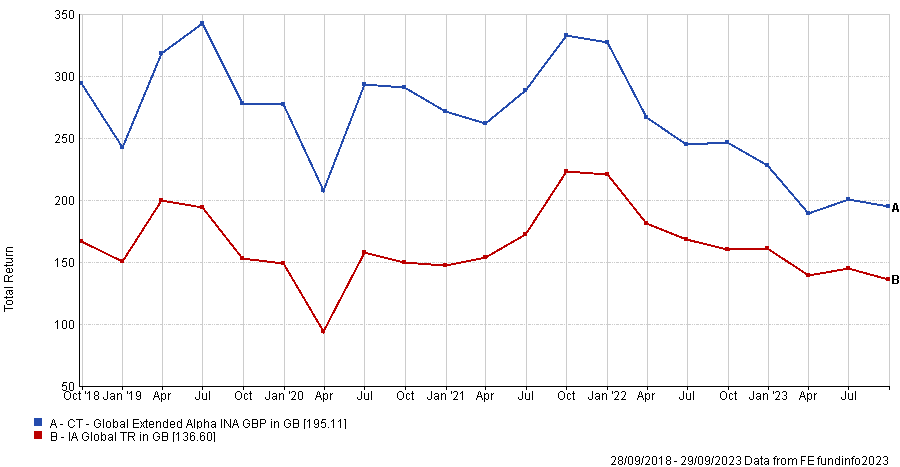

Rolling 10yr returns of fund vs sector

Source: FE Analytics

The first is Neil Robson’s £141m CT Global Extended Alpha fund, which launched in September 2008 and has been in the IA Global sector’s top quartile for all 21 of the rolling 10-year periods since then. Since launch, the fund is up 405.5%, compared with 235.3% from its average peer and 322.5% from the MSCI AC World.

CT Global Extended Alpha differs from many of its peers in the fact that it takes both long and short positions in global stocks. Long positions allow it to benefit from rising share prices while shorts (which are taken using derivative) allow it to profit from falls.

Columbia Threadneedle explained: “The fund follows an ‘equity extension strategy’, which allows proceeds from short positions to be used to extend long positions within the portfolio (leverage), to include more of the fund manager’s strongest investment ideas. The fund does not usually short more than 30% of its value and long positions don’t normally exceed 130% of the value of the fund.”

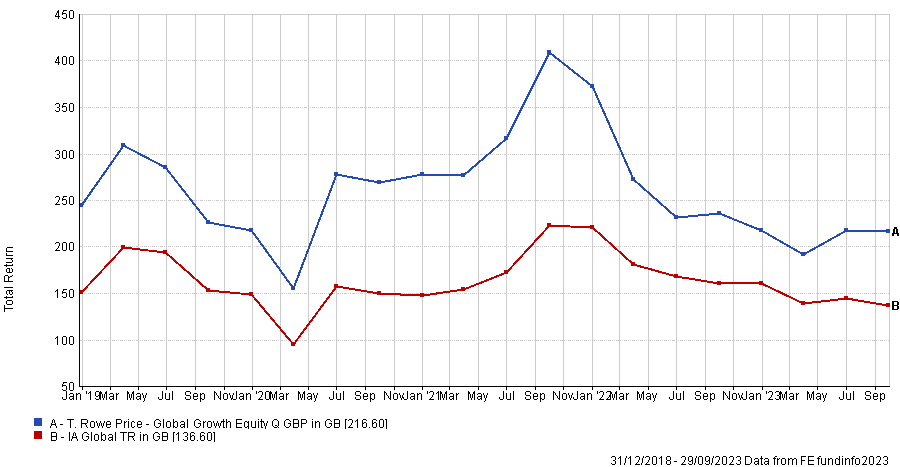

Source: FE Analytics

As the table above shows, the only other fund to make top-quartile returns in all its rolling 10-year periods is T. Rowe Price Global Growth Equity. Managed by Scott Berg, this £388.6m fund invests in the best ideas of T. Rowe Price’s global research team and has made a 625.9% total return since launch.

As its name suggests, the fund follows the growth style of investing, which has enjoyed a strong period of market dominance over the value style. Berg prefers to invest in “high-quality, durable businesses with sustainable growth prospects”, with top holdings including Microsoft, Nvidia and Eli Lilly.

In a recent note, the manager predicted that markets will be led by the prospects of individual stocks rather than investors flocking to one investment style over the other.

“While the past three years have been dominated by the swinging pendulum between growth and value stocks, we believe the future implies more of a focus on stock specifics and on companies that can grow and compound their earnings through a fundamentally changed cycle,” he said.

“We believe the era of stimulus, consistently expanding multiples and a repeat of post‑global financial crisis equity return patterns are largely behind us. This implies breadth in portfolios and risk management and the readiness to increase equity exposure when risk events happen and when contrarian opportunities present themselves.”

Rolling 10yr returns of fund vs sector

Source: FE Analytics

While CT Global Extended Alpha and T. Rowe Price Global Growth Equity are the only funds to sit in the IA Global sector’s top quartile for all the 10-year periods in their history, several others have come close.

Morgan Stanley Global Brands, Rathbone Global Opportunities, Guinness Global Innovators, Ninety One Global Franchise and Baillie Gifford Global Discovery were top-quartile in more than 90% of periods, for example.