Combining thorough bottom-up research with personal convictions is the way many try to tackle their investments, but striking the right balance is tricky.

This is how Ayaz Ebrahim runs the JP Morgan Asia Growth & Income trust, which he co-manages with Robert Lloyd. Between 70% to 80% of the risk comes from stock selection with the rest deriving from country and sector allocations.

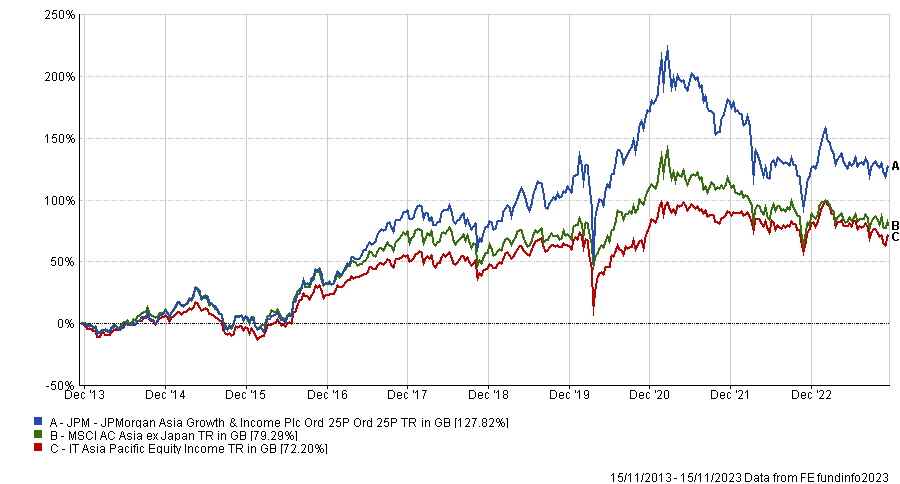

The investment company, which is intended as a ‘core’ solution and has no bias to any investment style, is the cheapest in the IT Asia Pacific Equity Income sector (with an ongoing charges figure (OCF) of 0.77% while its four peers all charge more than 1%) and stood out for having beaten its benchmark, the MSCI AC Asia ex Japan index, in nine out of the past 10 years (coming close in 2014).

Ebrahim, for example, is convinced of the attractiveness of Indian private banks, despite some disappointments in the sector, and still expects a Chinese recovery, despite post-Covid recovery falling flat.

Below, he explains how these views translate into allocations and reveals the one sector he would buy more of, if it wasn’t for the price tag.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

What are your philosophy and investment process?

We invest in companies we believe will generate compounding returns over the long term. We do robust analysis and build high-conviction stances on stocks, which we hold for multiple years. Around 70% to 80% of our risk comes from stock selection, but we balance it with country allocation as well.

By doing this we have a much better chance of doing it right rather than trying to figure out whether China is going to outperform India over the next one or two years, or other much more difficult things with so many variables.

Do you invest more for income or growth?

Shareholders receive an income every quarter from the trust but that’s driven by the board, we are agnostic to that and don't manage the portfolio thinking that we have to pay dividends. They only thing we need to ensure is that there's enough cash to meet that payment.

We are investing for capital growth, increasing the net asset value (NAV) and hopefully creating shareholder returns over a reasonable period of time.

What sectors do you find interesting at the moment?

We are overweight some of the technology companies – we have been for a while. That’s driven by the D-RAM [dynamic random-access memory, a type of semiconductor] place, which we expect to do very well.

We also see a compelling case also for private sector banks in India and Indonesia. Both countries have growing populations that are underbanked and getting more prosperous, so the pie keeps getting bigger and demand for insurance, wealth plans and bank accounts grows. For similar reasons we are also overweight in insurance companies in mainland China.

Miscellaneous consumer sectors are also attractive and we would like to increase our overweight, if it wasn’t for valuations. We want to buy good companies, but also want to own them at the right prices and some of the better quality consumer names tend to be quite expensive.

What’s your view on China?

We went overweight China in the fourth quarter of last year, which helped the performance because it had a good rally, but when that was done, companies we owned started to get a little bit too expensive compared with others around the region, so we have gradually taken some off the table.

As a result, we are now close to neutral if not a little bit overweight when factoring in Hong Kong. Excluding Hong Kong, we are underweight.

The post-Covid comeback story was disappointing, but we still believe in it. It is getting better but more gradually, and we will continue to see improvement.

What was the best performer of the past 12 months?

SK Hynix, a Korean IT company contributed 42.8% in the year ending October 2023, owing to an improving outlook in the memory sector and its deal to supply premium high-bandwidth memory (HBM) chips to Nvidia.

And the worst?

HDFC Bank, India’s largest private-sector bank with a leading presence in retail and corporate banking, fell 9% in the year to last month as it merged with its parent company, HDFC Ltd. The resultant share swap led to volatility in the share price.

Shares of the bank also underperformed after announcing results, largely due to weaker deposit growth and higher costs as the bank invests in expanding its branch network. The long-term view on HDFC Bank remains positive given robust profitability, strong asset quality, stable margins and cyclical tailwinds.

What do you do outside of fund management?

I like sports, both watching and playing, especially cricket and golf.