Equities and bonds fell in tandem as inflation returned with a vengeance in 2022. As a result, while several funds across the IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors generated positive returns over the past three years, only a handful have made a real return, that is in excess of inflation.

Below, Trustnet looks at the four multi-asset funds that have achieved this feat.

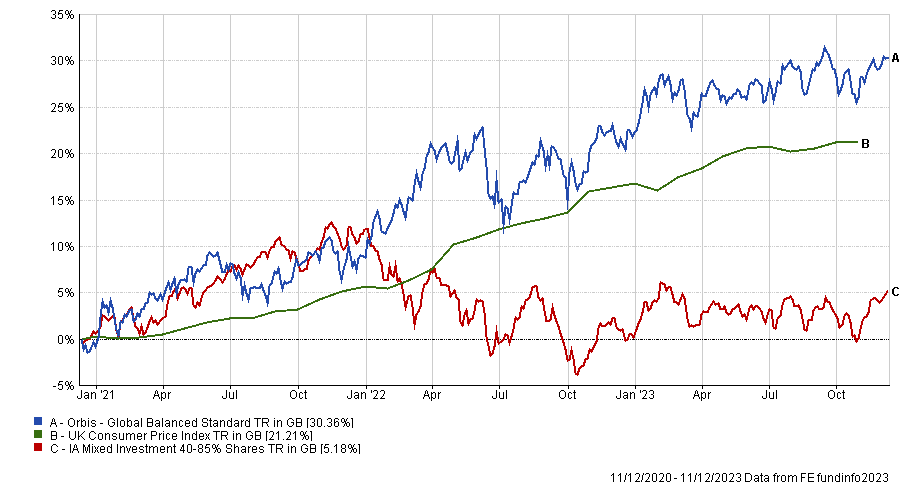

Orbis Global Balanced, managed by FE fundinfo Alpha Manager Alec Cutler, has outperformed UK inflation by roughly nine percentage points, making it the multi-asset fund that has delivered the strongest real growth since December 2020.

Chris Salih, senior research analyst at FundCalibre, said: “The fund follows the wider process at the asset manager of being contrarian, long-term global investors – searching for intrinsic value.

“Stock selection has played a significant role within the equities bucket, with the portfolio holding a number of shares trading at depressed valuations in late 2020, with energy names such as Shell and Schlumberger becoming strong contributors.”

The fund was significantly underweight fixed-income during the period of zero interest rates back in 2020, which helped performance as government bonds incurred losses since then.

Salih also highlighted that the fund’s allocation to hedged equity as an alternative to bonds aided performance, allowing it to avoid the pain in bonds as rates and yield rose.

He added: “Although there have been significant shifts, the fund has roughly held 15% in fixed income in the past three years.

“Within the asset class, its holdings in short-duration bonds, Treasury inflation-protected securities and selected corporate bonds also outperformed versus the 60/40 benchmark.”

Performance of fund over 3yrs vs sector and UK inflation

Source: FE Analytics

Another fund is the IA Mixed Investment 40-85% Shares sector that has managed to beat inflation is Invesco Global Balanced Index (UK). Managers Georg Elsäesser and Moritz Brand build their portfolio around four concepts: earnings expectations, market sentiment, management as well as quality and value. They also consider their allocations across sectors, industries, countries and currencies to limit the portfolio’s overall risk.

Ben Yearsley, director at Fairview Investing, said: “This fund has an unusual benchmark in that's its 50% FTSE All-Share, 25% MSCI World and the balance in cash and gilts. So, it hasn't had the tailwind of a weak sterling, for example, to propel returns.

“It’s also got a holding in another Invesco fund, Sustainable Global Structured Equity, which largely invests in consumer discretionary stocks and has a large tech weighting. Unsurprisingly, it's done quite well.”

Performance of fund over 3yrs vs sector and UK inflation

Source: FE Analytics

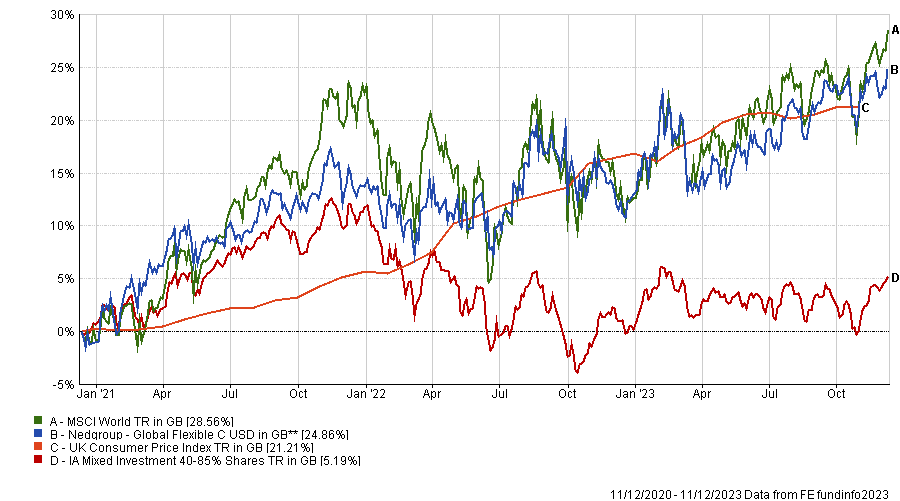

Another inflation-beater in the same sector is Nedgroup Global Flexible, which aims to generate equity-like returns over-the long term but with less risk than a pure equity play.

To do so, the fund predominantly invests in US and European equities and has large positions in cash and cash-like instruments.

While the fund has produced real returns over the past three years, it has, however, underperformed its benchmark, the MSCI World.

Performance of fund over 3yrs vs sector, benchmark and UK inflation

Source: FE Analytics

WS Canlife Diversified Monthly Income is the only multi-asset fund outside of the IA Mixed Investment 40-85% Shares sector to have made returns in excess of UK inflation over the past three years.

Managers Craig Rippe and Jordan Sriharan may invest in bonds, equities, cash, near cash and money market instruments, properties, infrastructure and commodities.

Yet, the allocation to bonds must remain with a 30-70% range, while the manager must invest between 25% to 55% of its assets in equities. As for the allocation to property, it must stay within a 0-20% range.

While Rippe and Sriharan invest for the long term, they may adjust their positions to reflect short- to medium-term market and economic developments.

Performance of fund over 3yrs vs sector and UK inflation

Source: FE Analytics

The fund currently has 24.9% of its assets allocated to Sterling corporate bonds, 14.2% to global corporate bonds and 6.2% in high yield fixed-income securities. UK and global equities both account for slightly more than 21% of the fund’s allocation, while property makes up 2.6% of the fund.