The start of the year brings with it a lot of prognostication about the coming 12 months. Experts can be quick to tell you what will work, what to sell and where to be for different political, macroeconomic and policy decision outcomes.

Yet for many, the most common advice is to keep out the noise and to focus on the long term – ideally for five, if not 10, years.

There is, of course, a middle ground to find. While all of us would love to put our money away for decades, allowing the phenomenon of compound interest to work its magic, the brutal reality of life means that there will be times when we need to delve into the pot.

I found myself in this exact dilemma this week when an unexpected tax bill wiped out a large portion of my savings.

Still, investing should be a long-term prospect. Which is why I found the release of Vanguard’s 10-year annualised return outlook of particular interest.

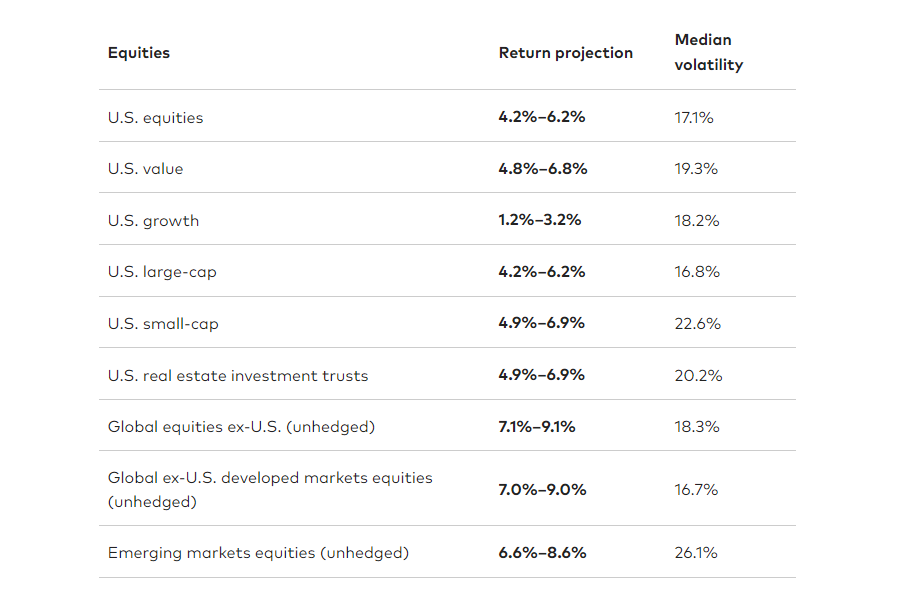

Using its Capital Markets Model, Vanguard looks at the factors that drive long-term returns (such as yield curves and stock valuations) and calculates how much return each factor will generate.

As the below table shows, the next decade could be very different to the previous one if the firm’s formula proves true.

It highlights annualised returns for the decade from 30 September 2023 to 2033, with a 2 percentage point band for error (although more extreme outcomes are possible). It also highlights the expected average volatility over the period.

After more than a decade of superior returns, US growth stocks – headlined by the ‘Magnificent Seven’ – will make paltry returns of between 1.2% and 3.2% over the coming 10 years, Vanguard predicts, easily the lowest returns on the table.

Powered by a resurgence of value stocks (4.8-6.8% per year), the US market as a whole should deliver 4.2-6.2% on an annualised basis.

Expected annualised returns from equities over 10yrs

Source: Vanguard

Better returns however will be found outside the US. Emerging markets are expected to deliver 6.6-8.6% per year for the next decade, although investors may require cast-iron stomachs when putting money in the region, with volatility expected to be significantly higher than other parts of the market.

The big winners, however, will be developed markets outside the US – namely the UK, Europe and Japan – where returns are expected to be between 7.1% and 9%.

Projections are always difficult and there is no guarantee that these figures will be proven right in a decade’s time.

But they do provide pause for thought, particularly for those with high exposure to passive funds, whether they track the S&P 500 or a global benchmark (which is heavily weighted to the US).

Those that do (myself included) may wish to consider diversifying to other markets for the coming years, or at least consider moving some of their allocation away from the dominant growth names of the past decade and a half.