Markets outside the US will come to the fore if the Federal Reserve fails to cut interest rates this year, according to experts, who suggested investors might want to look outside of the world’s largest market if the central bank remains on its heels.

The market was quite upbeat at the end of last year, expecting the Federal Reserve to cut interest rates early in 2024, triggering a Christmas rally. Yet, things didn’t pan out as expected, with US inflation proving stickier than expected. Therefore, the question is now whether the Fed will cut rates at all in 2024.

For Peter Dalgliesh, chief investment officer at Parmenion, this change in expectations will have a big impact on equities, especially in the US.

He said: “The higher for longer backdrop of interest rates is likely to place increased challenge on the sustainability of growth and corporate earnings, raising risk of a de-rating in equity multiples, especially in longer duration sectors.

“As a result, care in identifying asset classes and sectors trading on attractive valuations and with a high confidence in being able to meet or exceed expectations is key.

He suggested US equities “look vulnerable to a pause” in the current climate, while the cheaper valuations and relatively low expectations for Europe, UK and the emerging markets mean stocks in these parts of the world look more attractive.

The caveat is the expected future direction of the dollar, with a sustained strength in the US currency usually correlating with a reduction in risk appetite – a headwind for non-US growth assets.

Dalgliesh added: “The dollar index remains some way below its 2022 highs with recent strength appearing to stall suggesting that investor risk appetite may be beginning to broaden.”

While a ‘no cuts this year’ scenario will likely impact investor sentiment across the board, Richard Carter, head of fixed interest research at Quilter Cheviot, believes bonds would suffer more than equities.

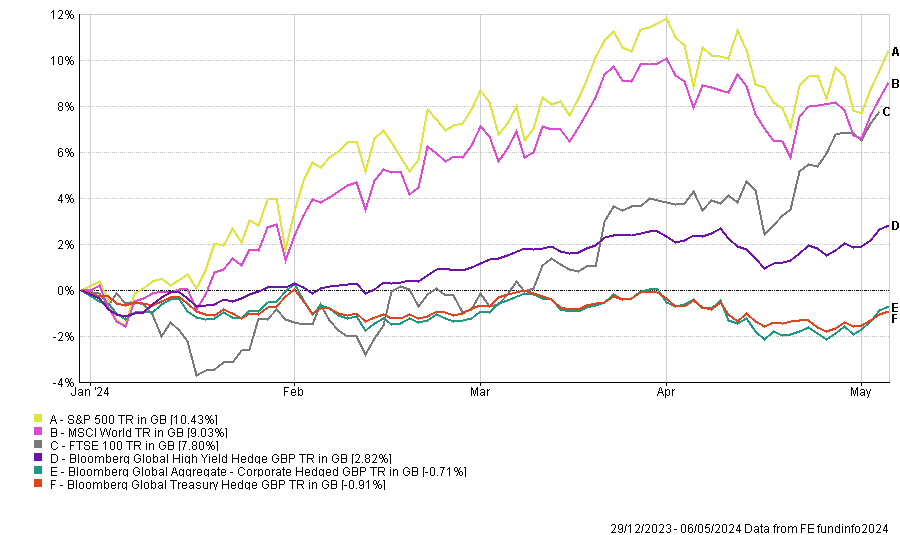

This would be in line with the dynamics in place since the beginning of the year. While equities have been generally more resilient, the higher-for-longer narrative has hampered the performance of bond indices.

Performance of indices YTD

Source: FE Analytics

To hedge against the risks of the higher-for-longer scenario, Carter pointed to very short duration bonds, cash and sectors that benefit from higher rates such as banks.

However, with government bonds yielding over 4%, Dalgliesh sees them as an attractive source of income and a way to protect a portfolio against downside risks in the event of a growth shock stemming from the delayed effects of tighter monetary policy.

He explained: “The continued inversion of the yield curve suggests this remains a possibility and shouldn’t be totally ruled out.

“In the same way with equities, care is required within corporate bonds having seen spreads narrow towards their historical lows, with a focus on quality, balance sheet strength and cashflow generation a necessity.”

Yet, Tom Becket, co-chief investment officer at Canaccord Genuity Wealth Management, is not overly worried about a no cuts scenario. While rate cuts would probably be helpful for most markets, he is not convinced they are necessary.

He said: “Bond prices are 'about right' and equity markets are marching to the beat of the economy's drums. Whilst the economy is ok, corporate profits are growing and inflation is moving in a progressively downward direction, we think the outlook for both bonds and equities is solid, but unspectacular.”

What if the Fed hikes rates again?

As US inflation has proved more persistent than expected, the market is fearing that the Fed might hike interest rates again, although Jerome Powell recently indicated that the US central bank is unlikely to move in this direction for now.

Dalgliesh explained: “Growth would need to be materially stronger and broad based for rates to move higher. It is widely acknowledged that real rates are already restrictive, so to move them even higher would require very strong data to be seen.”

However, if the Fed was to throw a curveball at the market and hike rates, the impact would likely mirror the no cuts scenario, leading to a weaker bond markets and volatility in equities, according to Carter.

In this situation, Dalgliesh expects value style equities, emerging markets, commodity as well as mid- and small-caps to play catch up as those asset classes have been beaten up out of fear of a recession.