UK fund groups have opened 2024 with elevated inflows compared to 2023, the latest Pridham report released today has shown.

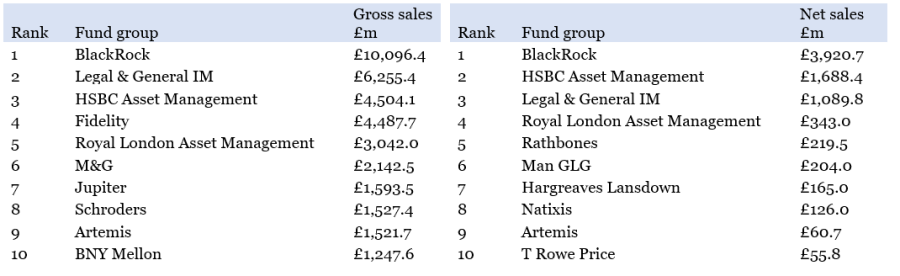

BlackRock, Legal & General Investment Management and HSBC Asset Management were the main beneficiaries thanks to their passive offerings, which accounted for 74% of all new flows.

But active managers also benefitted from recent growth trends, with seven houses moving into positive sales territory – most notably Jupiter Asset Management, Artemis and Rathbones, as the tables below show.

Most popular asset managers in Q1 2024

Source: Pridham report

Compared to 2023, BlackRock’s leadership position was further strengthened this year, with gross retail flows into its UK domiciled open-ended investment funds surpassing £10bn for the first time since the final quarter of 2020.

HSBC also moved up one ranking on the back of its passive funds.

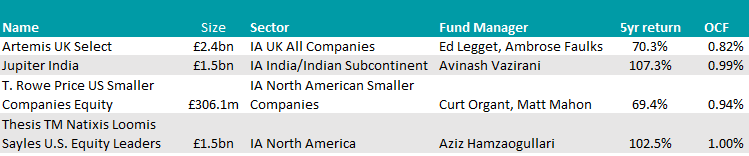

In the active cohort, Artemis entered the top-10 best-selling gross and net sales rankings with strong demand for its equity funds, especially Artemis UK Select, which was its top retail seller.

Jupiter moved up two spots for gross new business and has seen growth in three consecutive quarters. The Jupiter India fund received the most retail attention, placing it within the quarter’s best-selling retail funds.

The popularity of US equities among UK-based investors also gained Natixis Investment Managers and T. Rowe Price a spot in the top 10 best-selling net new business rankings – Natixis Loomis Sayles U.S. Equity Leaders and T. Rowe Price US Smaller Companies Equity were the most bought strategies.

Source: FE Analytics

With equity markets buoyant and fixed income offering investors both yield and capital appreciation potential, the future looks bright for the

“Q1 retail sales showed that demand for high-performing active funds remains there. The active opportunity, however, is diverse, with fund groups often only seeing success in a limited number of investment categories at one time,” he said.

“As retail investors and their advisers adjust their portfolio allocations to reflect the outlook of higher for longer interest rates, opportunities will be created for fund groups to win new business.”