Some 90% of pension funds have failed to beat a UK equity tracker over the past decade, according to data from AJ Bell, which showed the scale of poor performance suffered by those saving towards retirement.

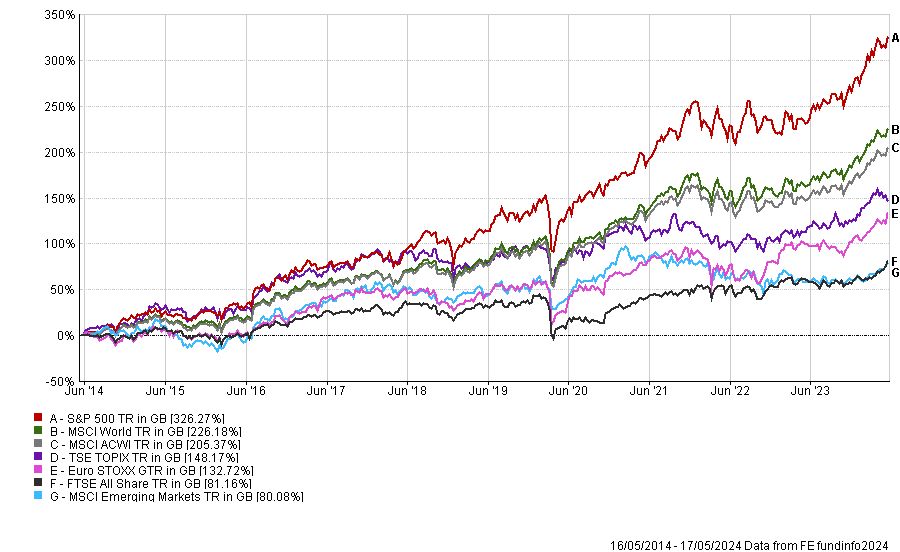

The benchmark has hardly been a demanding one. Indeed, the FTSE All Share index – which was used in this study – has been one of the worst performing markets globally over 10 years, as the below chart shows.

Around three quarters of the underperforming funds failed to beat the index by at least 10 percentage points, the study found, while more than a third were 20 percentage points behind or more.

It is worth noting however that not all are 100% invested in equities and will have other assets such as bonds and alternatives, which will have impacted performance.

Laith Khalaf, head of investment analysis at AJ Bell, said: “This doesn’t look like a market which is serving consumers well, and yet tens of billions of pounds are invested in pension funds posting disappointing performance.”

Performance of indices over 10yrs

Source: FE Analytics

Included in the list of underperformers were Standard Life/Invesco Perp High Income 4 Pension, which was the worst of the group, making just 13% over 10 years. This included a 0.25% platform cost per year, which was taken into account, although pension funds have different share classes and it is possible some performed better than others.

Standard Life UK Equity 4 Pension (44.5%), SE Ethical Pension (46.7%), Scottish Widows UK Equity 2 Pension (47.5%) and Sun Life Canada CLIC Equity 1 Pension (47.7%) rounded out some of the worst “big funds with small returns”.

Poor performance can have seriously damaging effects in the real world, Khalaf said, as it will dramatically impact the size of savers’ pension funds when they retire.

“If you are able to get a 6% net return on a £50,000 pension pot for 20 years you will end up with £167,357. Reduce that return to 4%, and you end up £57,801 poorer, with a pot of just £109,556.

“Returns from the UK stock market itself haven’t been great over the past decade, but funds which have fallen significantly behind a tracker add insult to injury.”

There are several reasons why pension funds are performing so poorly. First is that many were set up decades ago before the invention of tracker funds. Instead, they invested in ‘closet trackers’ which charged active management fees, Khalaaf said.

Another is that charges on older pension plans tend to be higher. Khalaf said they “look high by modern standards, because they were set a long time ago before investment and platform costs started to fall”.

For example, Stakeholder pensions were popular in the early 2000s. They were marketed as a low-cost scheme with a maximum cost of 1.5% per year for the first 10 years and 1% thereafter.

“But you can now buy an index tracker fund for an annual charge of under 0.5% in a SIPP, and many successful active funds will cost less than 1% per annum including platform charges,” Khalaf noted.

The final reason is the “inertia tax”. This is a result of many pension schemes now being closed to new money, which has meant there is a lack of motivation to improve the products.

“The Financial Conduct Authority’s (FCA’s) Consumer Duty regulation will apply to closed books from July, which should in theory help drive improvements for investors in closed pension funds. There is still the risk that providers drag their feet, are hamstrung by the original pension fund mandates, or make improvements which still fall far short of the most competitive pension plans now available to savers,” the AJ Bell head of investment analysis said.

All savers should assess the performance of their pensions by requesting a performance factsheet and compare the fees they are being charged. Some older pensions can charge as much as 2.4% per year, according to a 2019 paper by the FCA.

“As a rough rule of thumb, you can now buy a UK tracker fund for around 0.3% to 0.5% including platform costs, and an active equity fund for around 1% to 1.2% including platform costs. Some active funds, especially multi-asset funds, cost significantly less,” Khalaf said.

If you are being overcharged or find you are in a poorly performing portfolio, it could be time to transfer to a cheaper or better performing option.