Momentum is gathering for UK stocks, which surged through record highs last month, and the upcoming elections are drawing even more attention to the domestic market.

Indeed the FTSE 100 peaked at 8,445.8 in May, almost 600 points ahead of its pre-Covid levels, although it remains some way below the likes of the US’ S&P 500 index (11.2% return year-to-date), with the UK large-cap index up 9% in 2024 so far.

Whether this resurgence will be enough for investors to reconsider their preference for global investments and return to the unloved UK market remains to be seen, but experts are becoming more vocal about the opportunities cropping up domestically.

Trustnet has recently asked whether it's time for a patriotic punt on the UK stock market and many commentators pointed out the favourable entry point due to cheap valuations, increased international merger and acquisition (M&A) activity, improvement in economic data, imminent rate cuts and “voracious” share buybacks.

On top of that, many UK stocks have surged past most of the magnificent seven, with very few people noticing.

Hal Cook, senior investment analyst at Hargreaves Lansdown, said there is a lot to like about the UK stock market.

“With mature industries such as banks, oil and gas and tobacco, the UK has been known as a good place to look for dividend income, but there are plenty of growth opportunities too – from big consumer goods companies selling their products globally to smaller businesses looking to grow into the giants of tomorrow,” he said.

“We think this combination and the discount on offer compared to other regions make the UK an attractive place to invest right now.”

The main way – and the cheapest – to invest in the UK are exchange-traded funds (ETFs), according to Cook, whose preference was for two iShares and one Vanguard solutions.

For investors who want to get exposure to the largest UK companies, he recommended the iShares Core FTSE 100 ETF, which tracks the performance of the FTSE 100 index.

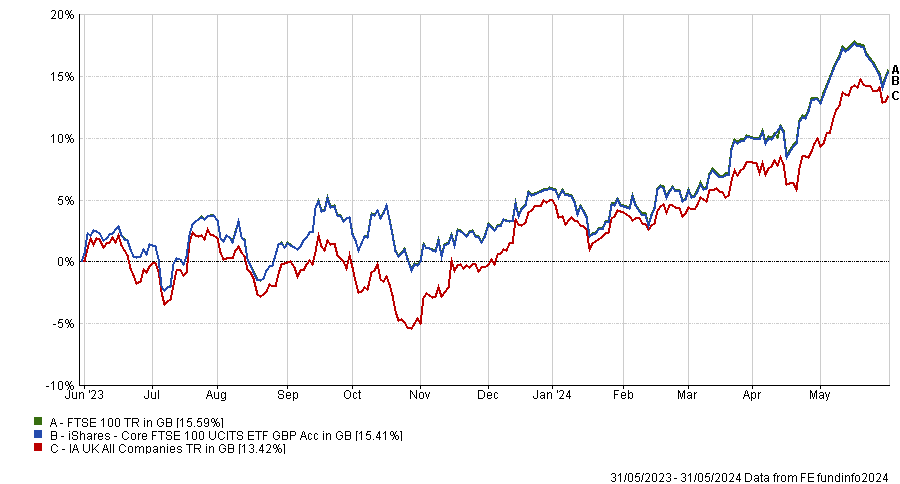

Performance of fund against sector and index over 1yr

Source: FE Analytics

“It does this by investing in every company and in proportion with each company’s index weight. This is known as full replication, which can help the ETF track the index closely,” he said.

The £2.2bn fund is passively managed by Blackrock, has achieved an FE fundinfo passive fund Crown-rating of five, and only charges 0.07%.

ETFs also offer access to income-paying stocks and Cook’s pick was iShares UK Dividend ETF, a low-cost option for tracking the performance of the FTSE Dividend UK+ index with a price tag of just 0.40%.

Performance of fund against sector and index over 1yr

Source: FE Analytics

This £848m vehicle offers exposure to 50 of the highest dividend-paying stocks listed in the UK, while still making sure it’s diversified across multiple sectors. The trailing 12-month yield is currently 5.45%.

Finally, medium-sized companies enthusiasts should consider the Vanguard FTSE 250 ETF, which aims to track the performance of medium-sized companies in the UK as measured by the FTSE 250 index.

Performance of fund against sector and index over 1yr

Source: FE Analytics

FE Investments analysts highlighted this fund for its simple method of replicating the performance of the index by direct ownership of all the underlying securities as well as its usage of stock lending, a practice by which a select third party borrows a limited amount of the passive fund’s holdings in exchange for a fee.

This supplements fund returns and compensates for the trading costs involved with direct ownership of the securities.

Among the investment management houses, Hawksmoor has been betting big on a UK recovery. Chief investment officer Ben Conway said that a FTSE 250 tracker would be a good option to capture a broad spectrum of opportunities in the mid-cap space, but fans of active management can also consider Aberforth Smaller Companies and Odyssean.

Not everything will be smooth sailing for the UK, however, and work remains to be done in a number of areas. The finance industry has been advocating for a number of changes to get Britain back on track.