Inflation may be on a downward trajectory, but there are plenty of potential shocks, Royal London Asset Management head of multi asset Trevor Greetham has warned.

Although resurging inflation is not his base case scenario, Greetham highlighted the drive towards net zero, geopolitics and populism as potential sources of inflationary shocks.

“Our economists are expecting inflation to fall further, but when you make economic forecasts, you do not include shocks, and there are lots of potential shocks out there at the moment,” he said. This makes it “quite plausible” that inflation could rise again.

In particular, he noted oil prices will have a big impact on whether the rate of price growth spiked higher, or remains manageable.

A consequence of the net-zero target is lower investment in fossil fuel capacity. While Greetham believes it makes “absolute sense” if economies around the world are planning to use much less fossil fuel in the coming decades, he warned that it also means a much tighter supply versus demand today.

“As we saw with natural gas prices last winter, if you interrupt supply, you get an immediate price move,” he said.

On geopolitics, further escalations in the ongoing wars in Ukraine and in the Middle East could create another inflationary shock.

As for populism, Greetham worries that it is combined with high levels of government debt.

“A lot of governments think the right thing to do now is to use fiscal policy, either because of rearmament or for populist reasons,” he said.

“If you look at what's happening in France, the far left and the far right disagree about almost everything, but one thing they agree on is that more money needs to be spent. High debt levels mean that there's a temptation to let inflation overshoot.”

Due to those potential, yet unpredictable inflationary shocks, Greetham believes investors will need inflation hedges such as commodities in their portfolios and to be more responsive to risks.

“You will also have to be willing to hold much less in fixed income when interest rates appear to be too low relative to the inflation outlook,” he added.

“If you only have stocks and bonds, you just need to look at what happened in 2022: they both lost money while commodities were up 30%.”

On average, Royal London has a 5% allocation to commodities in its multi-asset funds.

“We keep commodities in there as a hedge against inflation and we're quite ready to dial up if we see signs of an inflationary shock coming through,” Greetham said.

More generally, he explained that environments with sudden inflation spikes and surging interest rates tend to point to shorter business cycles and, therefore, a more volatile macro environment.

He added: “When we look back at the current environment in five or 10 years, we'll probably have been through several inflation shocks.

“It's not a new thing. If you think about the UK, we've had three big inflation shocks since 2008: the GFC when sterling collapsed and inflation surged, Brexit which led to a 15% devaluation of the pound at one point and then Covid.

“If you look at the real return of cash in the UK in the 1970s, you lost about 29% of your purchasing power by keeping cash on deposit over that decade. Since 2008, you've lost 39%. It’s been worse than the 1970s already.”

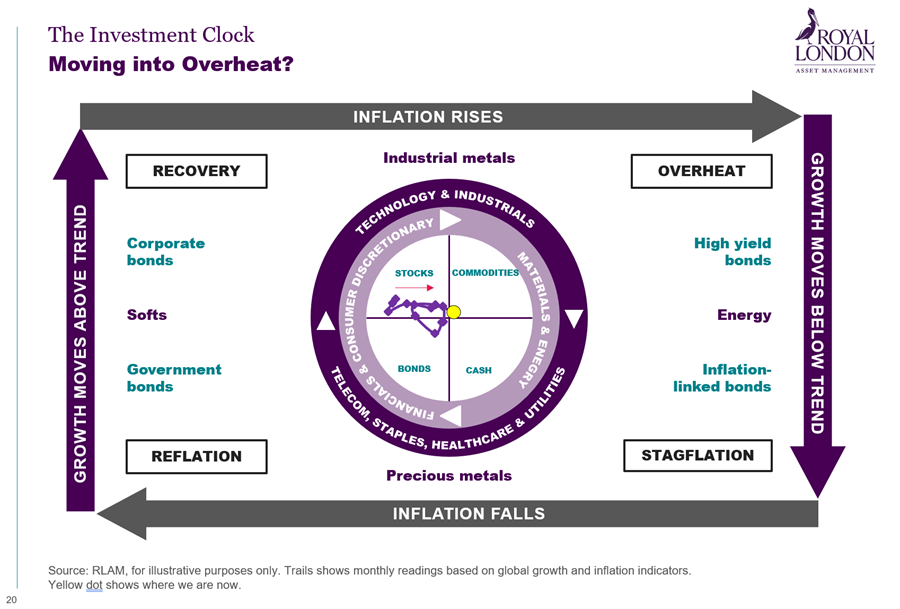

Although Greetham is mindful of inflationary shocks, he explained that economic indicators show low signals of either growth or inflation at this point in time. His assessment is that we currently are slightly in the overheat phase of the business cycle, but he stressed that it is not a high conviction call.

“At the moment, the growth indicators are okay, but if they were absolutely brilliant, that yellow dot would be higher up on our ‘investment clock’,” he said.

“Inflation indicators are also pretty balanced. If anything, they're pointing upwards, but if we had a stronger conviction, it would clearly be on the right-hand side. At the moment it's quite marginal.”

At this point in time, he is positioned for “okay growth” and inflation drifting lower and is, as such, overweight US stocks with a particular skew towards technology.

He concluded: “We are not in a bad situation. Economies are growing, there are signs of recovery in Europe and in the UK, things are not collapsing in America and inflation is alright.

“We’re in an environment in which central banks might squeak in a rate cut or two, but it's not weak enough for them to cut rates a great deal. I don't see the sharp downturn in growth that they would need to deliver a large series of interest rate cuts.

“I think there's a bit of a course correction going on here by central banks as they feel they can ease interest rates a little bit at the margin, but they don't need to do much more than that.”