The prolonged outperformance of the ‘Magnificent Seven’ has taken many by surprise, but none more so than Richard De Lisle, manager of VT De Lisle America, who had to admit he was “significantly wrong” to underestimate them.

Speaking to Trustnet in November 2023, he declared technology stocks would only go sideways from there on; but nine months later, they are stronger than ever, having made investors a 30% return since the start of the year and just above 40% in the past 12 months, as the chart below shows.

Performance of Magnificent Seven as tracked by Roundhill MAGS ETF over 1yr

Source: FE Analytics

“Last November, I was significantly wrong. I underestimated Nvidia’s surge and how it would drag the rest of the Magnificent Seven higher,” said De Lisle.

“They ran up to a high in July and beat the S&P 500, which was up 19%. They continue to be the only place to be and are even more dominant within the market than they were back then. We're in a very unusual situation.”

The VT De Lisle America fund invests in the opposite end of the US market (small manufacturing companies, community banks and industries benefitting from infrastructure spending), which admittedly, has “not been the place to be”.

The sector was particularly damaged by the August sell-off, a “good old-fashioned panic” that “took away all the year’s gains”. In this “superior crack”, the Russell 2000 lost 11%.

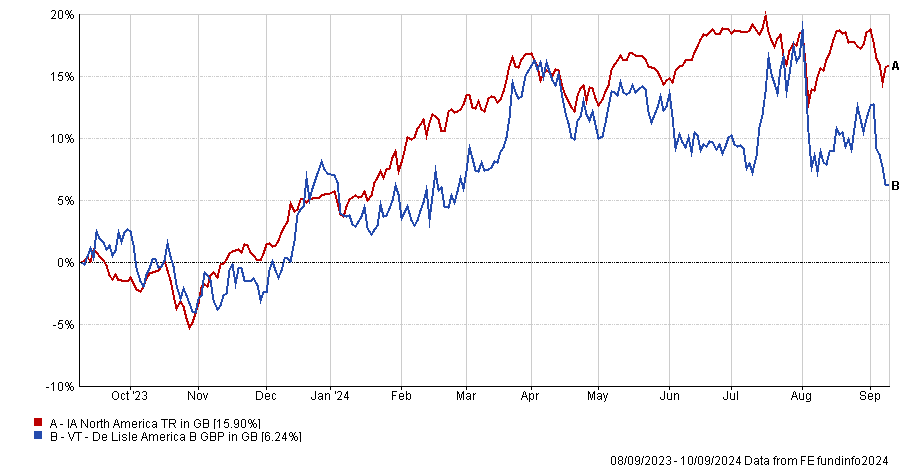

De Lisle America was “back to start-of-the-year levels” and over the past year, it significantly lagged the average peer, coming in in 234th position out of 244 funds in the IA North America sector.

Performance of fund against sector over 1yr

Source: FE Analytics

Another development that the manager couldn’t have predicted was that the Fed “really achieved what it wanted”, namely “to damp down spirits and stop people enthusiastically spending”.

“That was a surprise,” De Lisle said. “One year ago I couldn’t have predicted that consumer spending on durable items, such as boats, would be down 40% year-on-year. Most durable items are bought on finance, so people are just waiting for rates to come down.”

Consumer durables wasn’t the only depressed sector either. By splitting consumer cyclicals into retailers, house builders, consumer durables and financials, the manager was able to highlight different trends within the groups.

Retailers have been weak because consumers have run out of their surpluses, with credit defaults rising and retailers reporting bad earnings as a result.

Another value staple, commodities and energy, is “just too stuck” as a sector, and the manager is planning to cut his exposure by 2 or 3 percentage points from a starting point of 15%.

Among the doom and gloom there have been some flickers of hope for some value sectors. One was housing, which remained “relatively strong” and another financials, which is having “a bit of a stealth rally”, up approximately 19% year-to-date.

But the real sweet spot for De Lisle has been another. Almost 20% of the fund is invested in more growth-focused names beyond technology, whose earnings haven’t moved, and yet the stocks have doubled as their potentials were “suddenly recognised”.

Examples include heathcare company Pennant, retailer Build-A-Bear and gasoline stations and convenience stores Murphy USA.

A share in Pennant was priced at $13 at the end of last year and is now closer to $33, with earnings “not much better than we would have expected”. Build-A-Bear was up 45% over the year “for the simple reason that its earnings did not collapse” like other retailers’, although they stopped at “a little more than black”.

The manager said a 20% allocation to this area is “clearly not as much as we should have had”, but many of these names are suffering from the same ailment as the largest growth stocks: they are getting too expensive, so he is wary of adding more.

But neither would he cut down the rest of the portfolio to add more. On the contrary, it would be “risky” to sell value stocks now.

“The difference between the ratings of value stocks and the more expensive stocks is so large that it would be quite risky to sell value hard,” he said.

“Despite recession fears have grown since June, relative valuations have been pushed so hard that it would be difficult for value to continue to underperform.”