Fund managers have shifted into a cautiously optimistic stance but are best described as ‘nervous bulls’, the latest Bank of America Global Fund Manager Survey has found.

While fears of a hard landing have eased among investors, there remains a strong sense of uncertainty. The expectation of Federal Reserve rate cuts has driven this more hopeful outlook, but investors remain mindful of potential risks, especially with inflation and slow growth still on the horizon.

The survey highlights a significant shift in portfolio positioning, with fund managers rotating heavily into defensive sectors like utilities and out of commodities and other cyclical sectors, reflecting a desire to hedge against economic uncertainty. Despite the improved sentiment, many investors are still preparing for slower growth and volatile markets, balancing their optimism with caution.

Fund manager sentiment in Sep 2024

Source: Bank of America Global Fund Manager Survey – Sep 2024

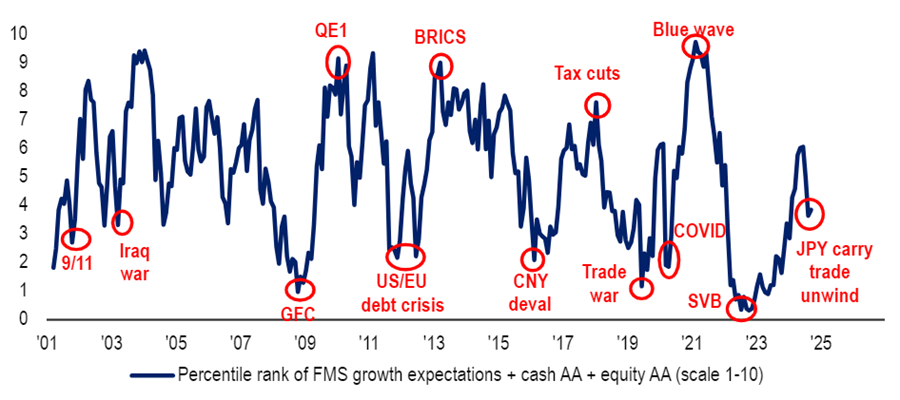

There has been a modest improvement in overall fund manager sentiment this month, with Bank of America’s broadest measure of this rising from 3.6 to 3.9.

This index, which combines growth expectations, cash levels and equity allocations, suggests that while there is still caution in the market, sentiment is slowly picking up. The increase reflects a gradual shift from the more extreme pessimism seen during the lows reached when Silicon Valley Bank collapsed.

Fund managers’ most likely outcome for the global economy in the next 12 months

Source: Bank of America Global Fund Manager Survey – Sep 2024

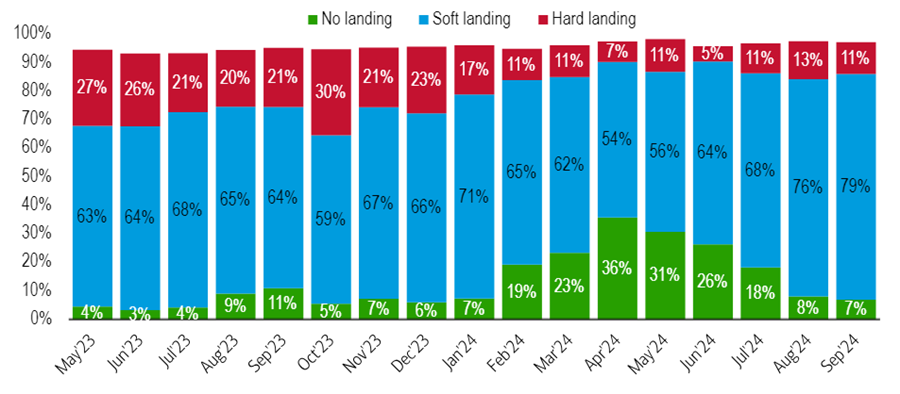

Bank of America said investor sentiment is evolving towards cautious optimism, with the majority of fund managers - 79% - now expecting a ‘soft landing’ (slower growth but no severe downturn) for the global economy in the next 12 months. This is an increase from 76% in the previous month.

The possibility of a ‘hard landing’, where a sharp recession occurs, has decreased slightly from 13% to 11%, while those expecting ‘no landing’, or continued growth without a significant slowdown, dropped from 8% to 7%.

That said, there are lingering concerns over global growth. Despite the improved outlook on recession risks, 42% of fund managers still expect the global economy to weaken over the next 12 months. While this remains a significant percentage, it’s a slight improvement from the more pessimistic figure of 47% recorded in August.

Fund managers’ expectations for the global economy over the next 12 months

Source: Bank of America Global Fund Manager Survey – Sep 2024

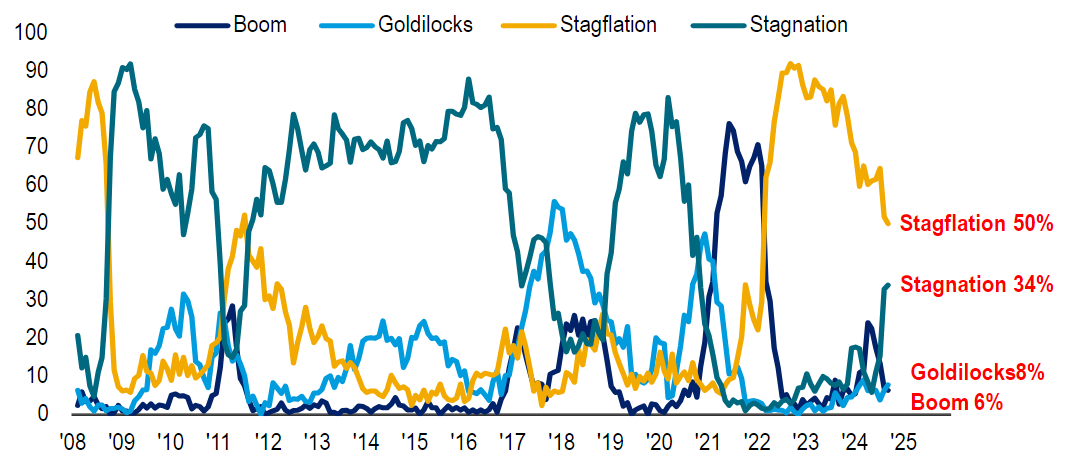

But the outlook for economy is hardly rosy. Half of fund managers now expect ‘stagflation’, or below-trend growth paired with above-trend inflation, over the next 12 months. While this remains the dominant outlook, it is the lowest reading since February 2022. This decline suggests a slight easing in inflation fears but reflects ongoing concerns that economic growth will remain sluggish despite improving inflation expectations.

At the same time, 34% of fund managers are anticipating ‘stagnation’ (below-trend growth and below-trend inflation). This is the highest level since October 2020 and shows a growing belief that the global economy may slow down without the added pressure of rising inflation.

Meanwhile, only 8% of investors foresee a ‘Goldilocks’ scenario of above-trend growth and below-trend inflation and just 6% expect a ‘boom’ with both growth and inflation above trend.

Fund manager’s biggest tail risks

Source: Bank of America Global Fund Manager Survey – Sep 2024

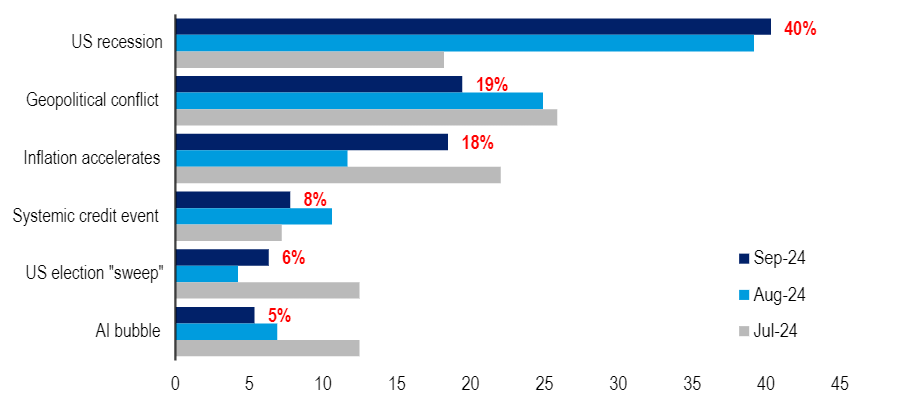

Some 40% of fund managers see a US recession as the biggest ‘tail risk’ in the market, indicating that while optimism around a soft landing has grown, recession fears are still top of mind. This concern has held steady, even as other risks like geopolitical conflict and an artificial intelligence bubble faded in importance.

When asked if they expect, rather than worry, about a US recession, 52% of asset allocators said they believe the US will avoid recession in the coming 18 months. Some 8% expect a recession in the second half of this year, 21% in the opening half of 2025 and 14% in the second half of next year.

Meanwhile, inflation is back on the radar, with 18% of fund managers citing accelerating inflation as a significant risk, up from 12% in the previous month.

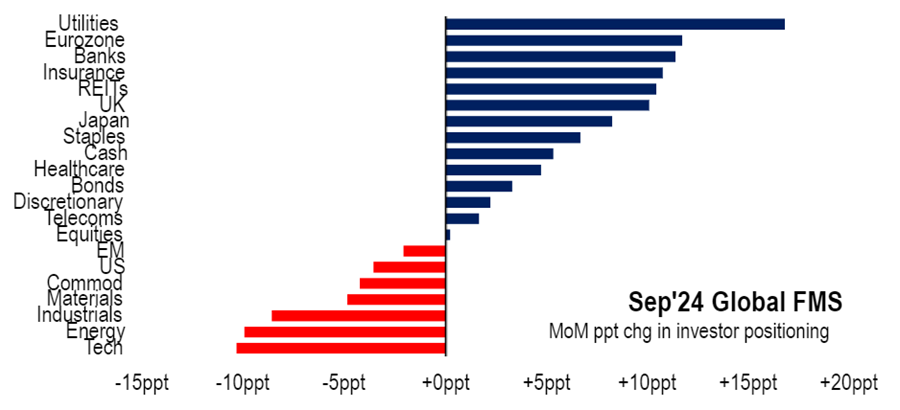

Month-on-month change in fund manager positioning

Source: Bank of America Global Fund Manager Survey – Sep 2024

Investors rotated heavily into defensive sectors like utilities and staples in September, along with financials such as banks and insurance. This move reflects growing caution as defensives are traditionally seen as safer during periods of uncertainty.

At the same time, the allocation to cyclical sectors like tech, industrials, resources and commodities has decreased. These areas typically perform well during economic expansion, but the reduction signals that investors are pulling back from more volatile sectors in favour of stability. This positioning reinforces the ‘nervous bull’ narrative, where fund managers are optimistic about avoiding a recession but still wary of market risks.

This means fund managers are currently taking their largest relative overweight position in defensives compared to cyclicals since May 2020. Utilities (at their highest overweight since May 2008) and consumer staples are now significantly favoured over sectors like energy, materials and industrials, which often suffer during downturns. This is coupled with the most underweight energy position since December 2020.