Growth stocks have had an enormously good run over the past decade of low interest rates, but sticking with them now would be akin to “picking up pennies in front of a bulldozer”, according to Simon Adler, manager of the Schroder Global Equity Income and Schroder Global Recovery funds.

He proclaimed: “Growth will never manage to make money from here on”, before adding “statistically”.

The data he used to support his statement is below. Since 1975, the average discount at which value shares have traded relative to growth shares has been 40%. At the peak of the dot.com boom, it went to just over 60%. Today, we are over 65%, meaning we are in a market that is “even more extreme” than during the tech bubble of 2000.

“People are underappreciating the extreme at which we are at”, said the manager, who noted that three years after the peak of the dot-com bubble, the MSCI World index was down 45%, meaning that investors lost almost half their money.

The most recent time when discounts were as wide as they are today was towards the end of 2020, which, as the manager recalled, led to “a very strong period” for value shares.

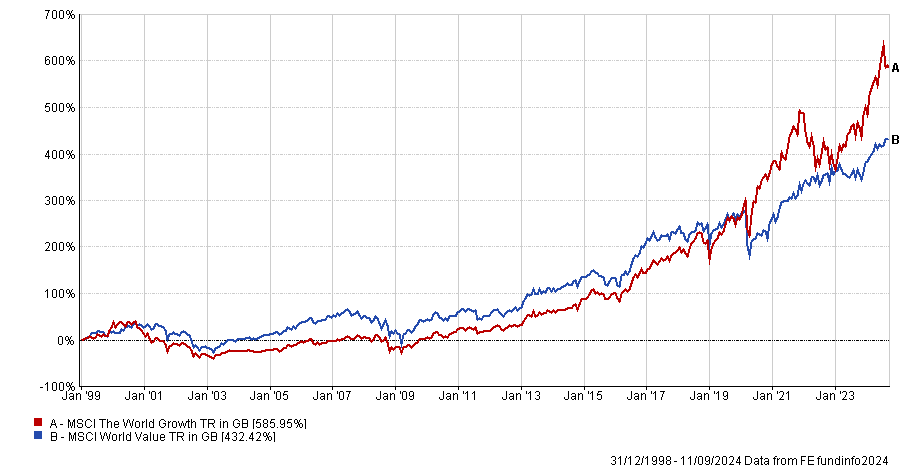

Performance of indices since 1999

Source: FE Analytics

Investors are suffering from recency bias, as Adler previously told Trustnet, which is human nature. At present, investors are focusing on short-term events such as the rise of artificial intelligence (AI), rather than looking at historical data, believing this time will be different.

It doesn’t help that bear markets in recent years have been short and sharp, rather than protracted, as they have been in the past. As such, growth stocks have rebounded strongly, giving investors confidence that they will do so every time.

The lack of prolonged downturns has built the market up to “a very dangerous place”, because “all bubbles burst eventually,” said Adler.

However, he admitted that the “bubble could go on and on” and could last “another week or another three years”. “But something one day will change and it will be very powerful in favour of value.”

Trying to identify why the growth bubble might burst would be “fruitless”. It could have to do with the economy, interest rates, regulation or a disappointment from the Magnificent Seven.

But this uncertainty is why people should have a good spread of investments, including “a decent allocation to value”, yet too few do.

One issue for value managers is that many only see the investment style outperforming based on economic outcomes. For example, a soft landing should benefit value, while higher for longer interest rates and a hard landing would favour growth.

Either this, or they restrict it to particular geographies or certain conditions, such as the traditional ‘value markets’ of the UK or Europe. Yet, in terms of geographies, the US market is particularly attractive right now for Adler. As he recently told Trustnet, this is an area where opportunities span across market capitalisations.

So strong is his belief that growth will falter and value will win out, he has put his entire family’s savings into funds with a contrarian edge. He admitted this has performed “okay but not terrifically” in the past few years.

In the Schroder Global Equity Income and Global Recovery funds, the manager only invests in the cheapest 20% of the market, so in a sense, the bubble is “irrelevant” to him, although it “certainly impacts our relative performance”.

Adler invests with a 10-year time horizon, “but what I don't know and never will know is which are the good years and which of the bad years within that 10 years”.

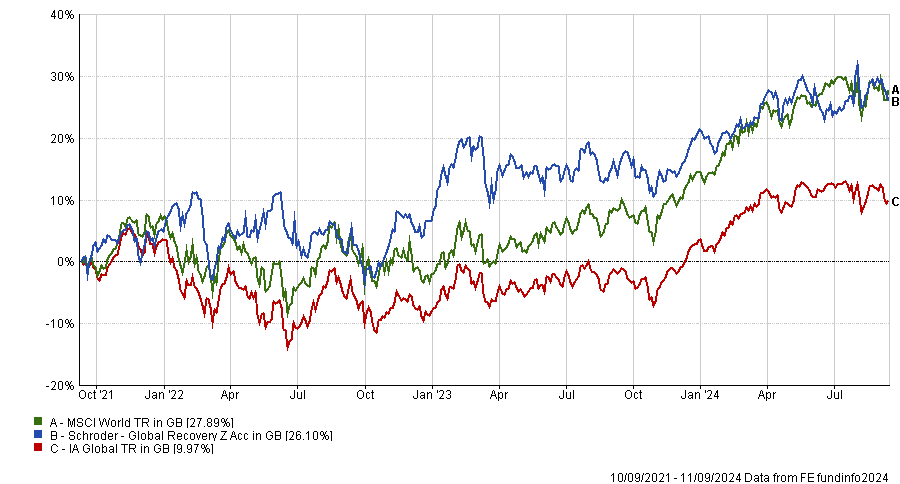

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Currently, the Global Recovery portfolio’s biggest exposure is to consumer products (34.2%). On the lower rankings, at half the percentage, are the telecom, media and technology, financials and healthcare sectors – all closely together at about 15%.